![]()

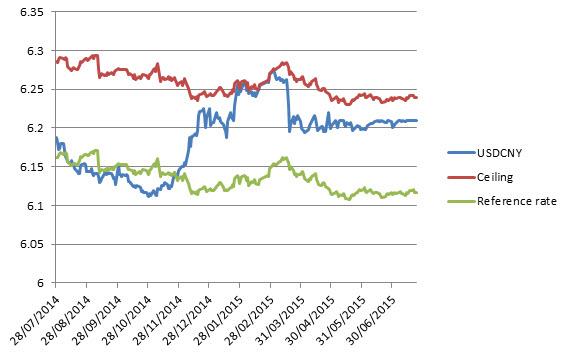

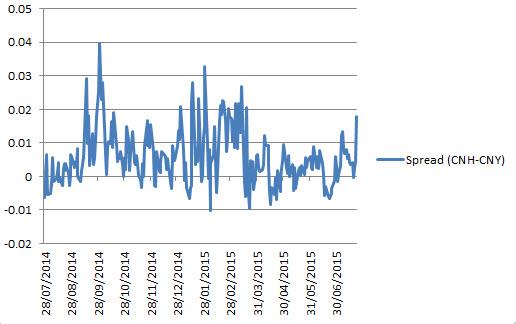

There’s some downward pressure building on the yuan ahead of this week’s meeting at the FOMC. USDCNY is hovering somewhat close to the ceiling set by the PBOC’s placement of the reference rate (see figure 1) and the spread between offshore and onshore yuan (see figure 2) is nearing levels last seen when the CNY was consistently testing the top of its trading range late in 2015/early 2015. This suggests that downward pressure on the Renminbi is building as investors prepare for the possibility of a more hawkish tone from the Fed this week.

Figure 1: USDCNY is consistently near the top of its trading band

Source: FOREX.com

Figure 2: CNY-CNH Spread

Source: FOREX.com

The downward pressure on USDCNY is understandable given a divergence of monetary policy expectations between China and the US. The former is expected to keep loosening policy as growth settles below 7% later this year and the latter is looking to raise short-term rates as the economy improves. It’s therefore not surprising that we’re seeing upward pressure build in offshore yuan, increasing the CNH-CNY spread (USDCNY gets progressively more and more illiquid near the edges of its trading range, thus it doesn’t have the same freedom to move higher even within its trading band).

There is some pressure from within Beijing to allow the yuan to depreciate by liberalising it further, as this would likely lend exporters a helping hand and help the RMB be added to the IMF’s basket of reserve currencies. However, it’s unlikely the PBOC will risk freeing CNY while it’s so freely playing with monetary policy in response to soft domestic demand and extreme volatility in the stock market.

Eyes on the FOMC

There’s a chance the market has underestimated the likelihood that the Fed will raise interest rates at its September meeting, and the bank may use this week’s meeting (a policy statement is due at 1800GMT on Wednesday) to prepare the market for such an event. During a recent speech Feb Chair Yellen seemed to be a little more hawkish than the market; a view supported by a general improvement in the economic outlook for the US. The economy is adding jobs at a healthy rate and core inflation is gaining pace (CPI excluding food and energy rose 1.8% y/y in June). Overall, we think the time is right for the Fed to prepare the market for the increased possibility of tighter monetary policy as soon as September, which could spark another significant rally in the US dollar.

Although, traders will also be close eyeing US advance GDP figures for Q2. The US economy is expected to have rebounded in Q2 after faltering in the first three months of the year. Annualised GDP is expected to jump to 2.5% q/q, with consumer spending anticipated to have increased 2.7%. The pace of growth of the US economy is a major factor in the setting of monetary policy, thus it’s very closely watched by policy makers and investors.

Recommended Content

Editors’ Picks

AUD/USD holds gains near 0.7000 amid PBOC's status-quo, Gold price surge

AUD/USD is clinging to mild gains near 0.7000 early Monday. The pair benefits from a risk-on market profile, China's steady policy rates and surging Gold and Copper prices. Focus now remains on Fedspeak for fresh impetus.

Gold price hits an all-time high to near $2,440

Gold price (XAU/USD) climbs to a new record high near $2,441 during the Asian trading hours on Monday. The bullish move of the precious metal is bolstered by the renewed hopes for interest rate cuts from the US Federal Reserve (Fed).

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.