![]()

Are you following the FOREX.com Research Team on Twitter? If not, you are missing up to the minute updates about market moves, insight in to what, when, why, and where of market moves, as well as links to easily accessible published material as soon as it is finished. Just in case you missed some of our most popular tweets of the week, here’s a Top 5 countdown to catch you up to speed.

5. (tie) 9 RETWEETS AND 5 FAVORITES = 14 ACTIONS

https://twitter.com/FOREXcom/status/579985215726194688

Source: www.twitter.com/FOREXcom

Fawad correctly foresaw that the IBEX was heading higher after it cleared its “major hurdle,” but it didn’t quite get all the way up to 11750 (yet) as it paused near 11625 before retracing back down to 11300.

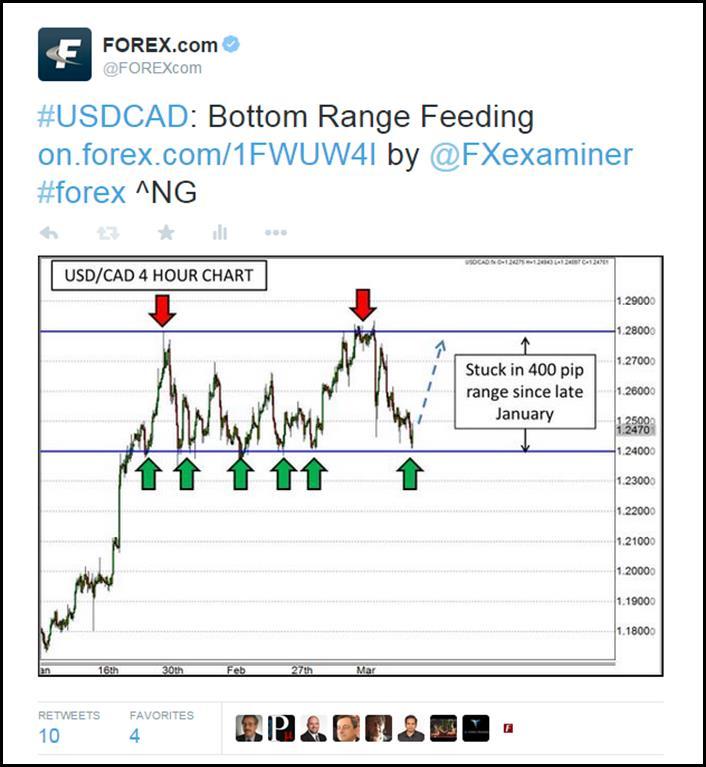

5. (tie) 10 RETWEETS AND 4 FAVORITES = 14 ACTIONS

https://twitter.com/FOREXcom/status/581121068485738497

Source: www.twitter.com/FOREXcom

The USD/CAD has been one of the strongest performers in terms of USD strength as we end the week. The range that I pointed out in this article held firm and this pair has already rallied back up to 1.26 in the process.

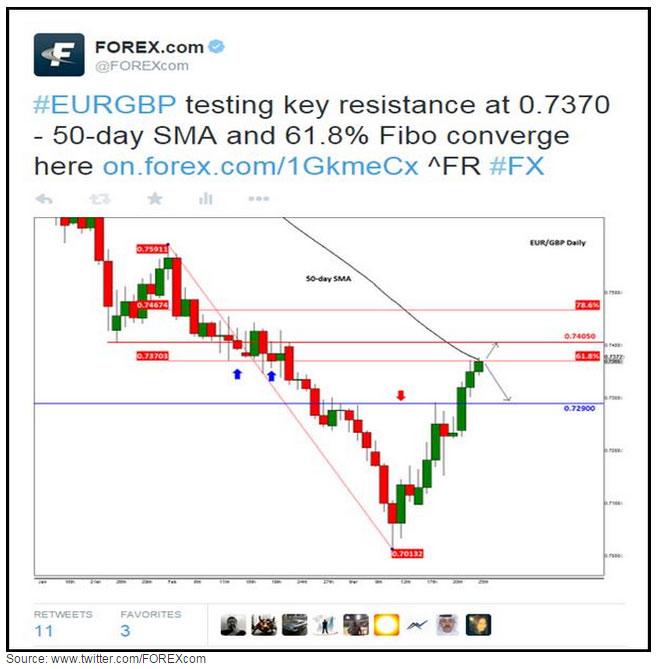

4. 11 RETWEETS AND 3 FAVORITES = 14 ACTIONS

https://twitter.com/FOREXcom/status/580692163295612928

Once again Fawad nailed his analysis, but this time it was on the EUR/GBP. The 0.7370/80 level was too resistant to the pair as it fell all the way down to 0.7265 after being rejected.

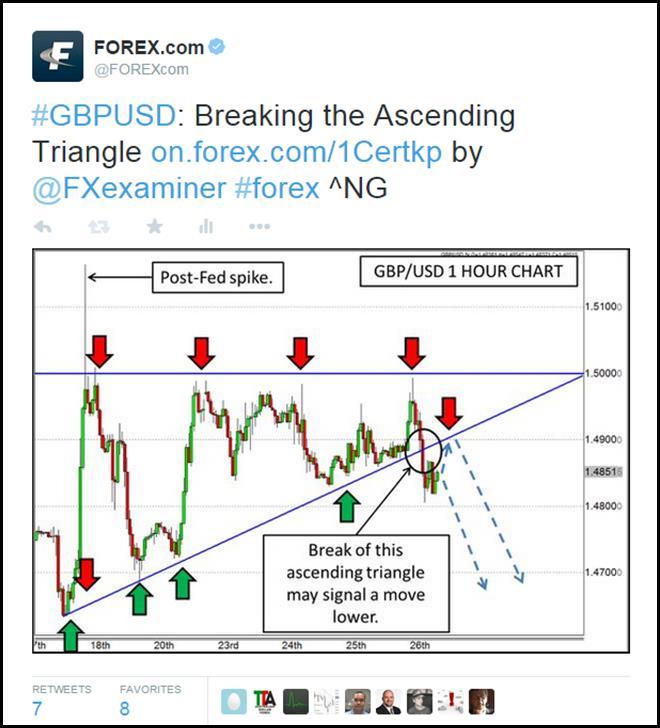

3. 7 RETWEETS AND 8 FAVORITES = 15 ACTIONS

https://twitter.com/FOREXcom/status/581183117773443072

Source: www.twitter.com/FOREXcom

The thought that the GBP/USD could rally back up to 1.49 and be rejected off former support turned resistance due to the break of an Ascending Triangle pattern has come to fruition as we take a pause for the weekend. We’ll have to keep our victory cigars holstered for the time being though as this move is still in its infancy.

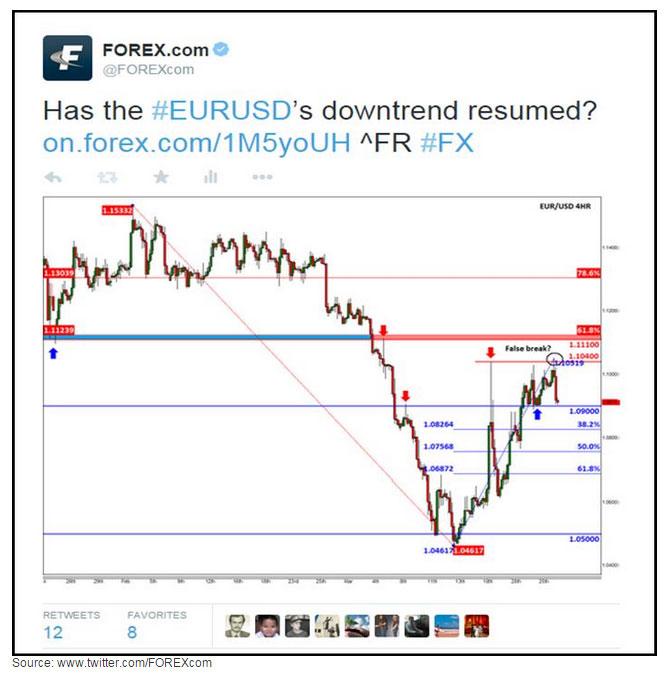

2. 12 RETWEETS AND 8 FAVORITES = 20 ACTIONS

https://twitter.com/FOREXcom/status/581147638571098112

The EUR/USD was a popular subject to tweet about this past week due to its unexpected strength in the face of relentless Quantitative Easing from the European Central Bank. The run back up to 1.10 has given many prognosticators pause as to the likelihood of parity in the near future, but there are even more hurdles remaining for this pair to the topside as Fawad eloquently points out in this article.

1. 20 RETWEETS AND 9 FAVORITES = 29 ACTIONS

https://twitter.com/FOREXcom/status/580094433376526336

Source: www.twitter.com/FOREXcom

In what was easily the most popular tweet of the week for us was this one in which I pointed out that the EUR/USD was in an area where a strong move was destined to take place. If it broke though this resistance level with force, the next level of resistance was near 1.12, but if it was rejected once again, 1.07 looked like the destination. As we end the week, this decision is still being made as neither a significant break higher nor lower has materialized, but 1.10 still looms as major resistance.

Did one of your favorite Tweets or Tweeters not make the cut this week? You can have an influence by making it a FAVORITE or RETWEETING it and sharing it with the world. Every little bit counts, and maybe you will be the difference maker in next week’s results!

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.