![]()

The dollar may have had one of its sharpest sell-offs in years on Friday, but we continue to think that the buck is king in the FX world, and the shake out on Friday was more positioning rather than a change in trend.

As we start a new week EURUSD has given back some of Friday’s gains, but it is managing to hold on above 1.08 as we wait for a key meeting between Germany and Greece to discuss how to avoid a Greek default as early as next month.

So why did the Dollar fall so sharply on Friday?

The dollar had been moving in the same direction as stocks for some time, however, that relationship broke down last week. As global stocks rallied, and stock market volatility fell, the dollar turned lower. Thus, the dollar may struggle when stocks rally in the coming days.

The ultimate factor that weighed on the buck was the Fed. The market noticed hesitancy in the FOMC statement last Wednesday to commit to hiking rates, which led to a bout of dollar profit taking.

CFTC positioning data: short EUR positions turned lower again last week. When positioning is this extreme there is a risk that the market will take profit.

These are potent reasons why the dollar was the weakest performer in the G10 last week, falling sharply vs. the Kiwi, the Aussie, the Swiss franc and the EUR. However, at the start of a fresh week it has been able to pull back some recent losses against the GBP, CAD and franc, suggesting that the dollar sell off is not broad-based.

However, we think that dollar bulls need to show some discretion this week, as the dollar’s performance may not be consistent across the G10. Two pairs we will look at closely include:

1, EURUSD: This pair could be due a longer pullback/ period of consolidation after such a hefty fall in recent weeks. The biggest risk is the meeting between Germany and Greece on Monday. However, even if the meeting breaks down in disarray, this doesn’t mean that the EUR will fall off a cliff. The EUR actually rose during the last period of Greek-induced volatility during the general elections in January. Thus, we are wary of looking for the EUR to falter this week, especially as the market seems happy to take profit.

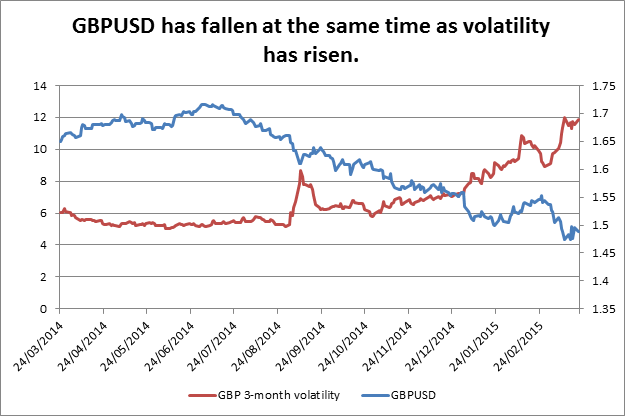

2, GBPUSD: this pair is much more at risk. Firstly, the pound is the weakest performer in the G10 vs. the USD so far on Monday. It has not been able to sustain Friday’s gains, suggesting that bearish GBP sentiment still has the upper hand. Last week’s weak UK wage data is causing the market to question whether the BOE will actually raise interest rates this year. One of the reasons why GBP is stalling on Monday is because it has lost some of its yield effect. The spread between UK and US 10-year bond yields is close to its lowest level since 2006.

Also worth noting if you are trading GBPUSD is 3-month volatility in this pair. Vol has spiked to its highest level since 2011, which is not surprising, with less than 2 months to go until the next general election. Political uncertainty is likely to continue to build in the coming weeks as the election campaign gets into over-drive. If that happens then we may continue to see GBP falter as volatility may continue to rise.

Takeaway:

The dollar sell-off on Friday was sharp; however, we don’t think that the bullish dollar trend is over.

Positioning data in the buck looked stretched, which supports this bout of profit taking.

However, dollar bulls may need to show more discretion in the coming weeks.

EUR could be more resilient compared to the pound in the next few weeks.

GBP has lost its yield effect, and is also suffering from increased political uncertainty as we lead up to the General Election on May 7th.

This is why GBPUSD is our one to watch at the start of a new week.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.