![]()

One central bank ends QE, another increases it. This is not a trick but a treat for the markets. The global equity markets have surged higher after the Bank of Japan surprised the markets overnight by expanding its monetary easing programme to about 80 trillion yen a year, up from Y60tn-Y70tn previously. The BoJ will achieve this mainly by increasing its purchases of longer-term Japanese government bonds. The central bank is clearly worried about the impact of the April sales tax hike, the recent fall back in inflation and lower global oil prices. Indeed, the BoJ governor Haruhiko Kuroda himself thinks that the economy is at “a critical moment,” pointing out “there was a risk that despite having made steady progress, we could face a delay in eradicating the public’s deflation mindset.” That’s why they increased QE.

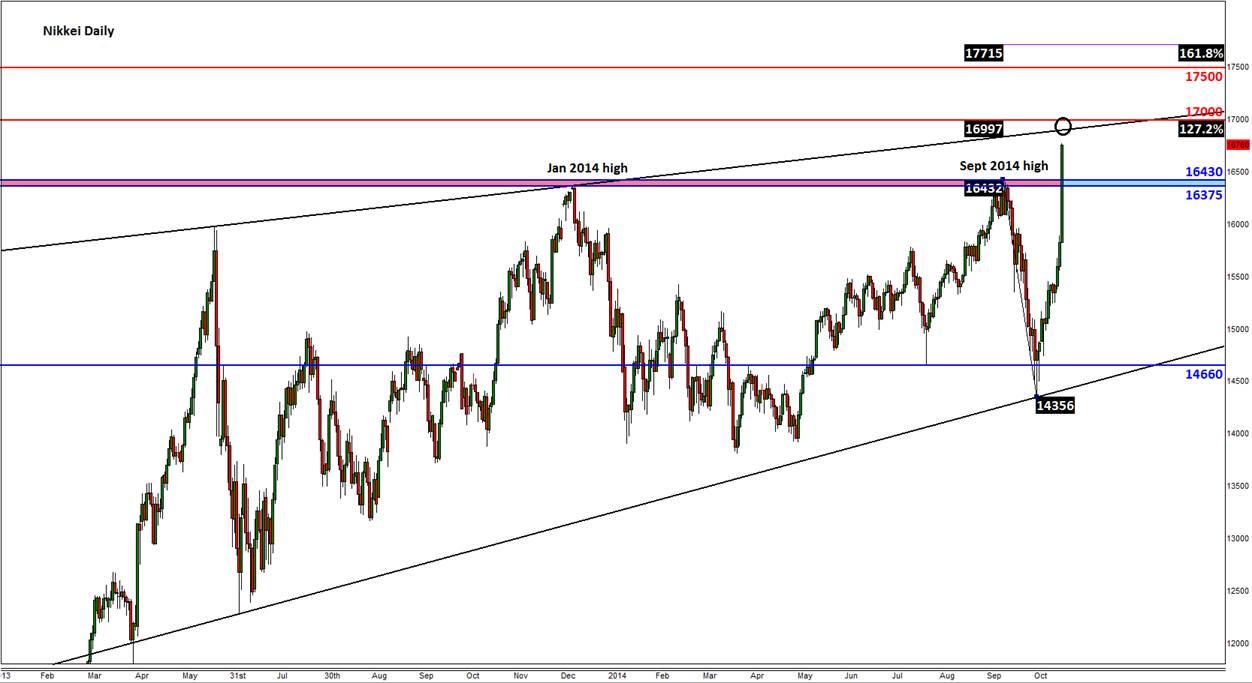

At the close of play on Friday, the Nikkei had already increased 4.8% to 16413. But in the index future has since gained further and at the time of writing it is hovering around 16760, representing a gain in excess of 2% from the official close. If the index future settles around the current levels, or better still, increase further during the New York session, then Monday could be another cheerful day for Japanese stocks.

The last time I covered the Nikkei index was at the end of September, when the index had just reached the previous 2014 high around 16375 but was struggling to hold above it. That led me to believe that a correction was imminent, which as it turned out was in fact the case. But like all the other major indices, the Nikkei has since bounced back very strongly and today it has decisively taken out the area around the previous 2014 highs, namely 16375 to 16430. This area is thus likely to turn into support if and when the index falls back. A potential break below this area would be very bearish. But the path of least resistance is clearly to the upside now, so let’s concentrate on finding potential resistance levels. The first such area is not too far off now: 16900-17000. This is where a resistance trend line meets the 127.2% Fibonacci extension level of the last correction. Not only is that, 17000 also a psychological level. Beyond there, 17500 could be the next target followed by the 161.8% Fibonacci extension at 17715.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.