![]()

This pair broke key resistance during the Asian session rising to a high of 109.75 – the highest level since September 2008. The break above 109.49 – the recent high – was significant, and opens the way to test 110.67 – the high from August 2008.

Prime Minister Abe helped to give USDJPY a boost earlier, after announcing a strategy for his key economic reforms; this includes a review of the crippling seniority-based pay system in Japan. Typically, when the Japanese government announce key economic statements it can weaken the yen, which tends to move inversely to positive domestic economic news. However, there are a couple of things that make us a little nervous about the future of USDJPY:

Although USDJPY managed to break another record high overnight, the weakness in the yen has not been broad-based, for example, EURJPY is close to a 2-week low, and its push higher overnight was fairly lacklustre. If the yen is not weak across the board, it could be tough for USDJPY to break fresh highs, as it is starting to look stretched to the upside.

The pro-Democracy protests in Hong Kong escalated over the weekend, and they show no signs of stopping any time soon. This weighed heavily on the Hang Seng index overnight, and if the protests continue then we could see safe haven flow into the yen, which may make USDJPY vulnerable.

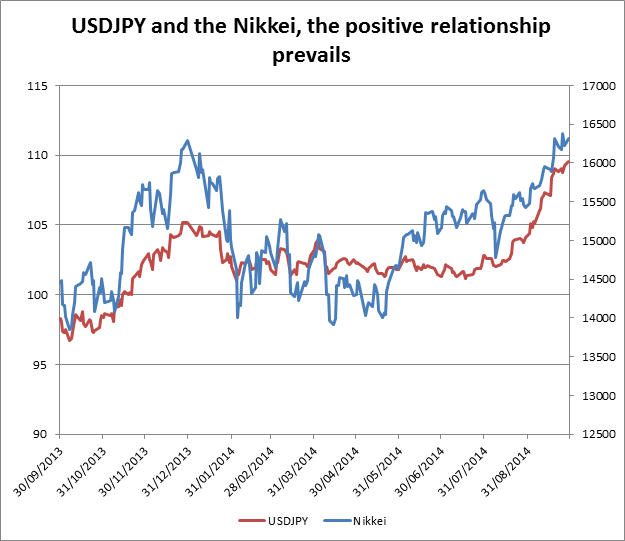

USDJPY and the Nikkei

Interestingly, the Nikkei was able to buck the trend of weaker Asian equities and actually managed to eke out a gain. This helped to protect USDJPY; these two tend to have a fairly close, positive relationship. The Nikkei may have attracted some interest as investors diversified away from Hong Kong, but how long can this continue?

The Nikkei is close to its highest level since 2009, if anti-China protests in Hong Kong continue, could negative sentiment to Asia dent the attractiveness of the Nikkei? If it does then there could be a knock-on effect for USDJPY.

The technical view:

While the technical picture remains strong, we could expect some choppy trading conditions as protests in Hong Kong threaten to drive safe haven flows into the yen. Critical resistance is at 110.66, the August 2008 high. If the protests die down and the Nikkei can make fresh multi-year highs, then we expect the positive momentum to prevail and for USDJPY to meet this milestone. However, if you start to see weakness in the Nikkei, then watch USDJPY, which could come under pressure. Key support lies at 108.26 initially, last week’s low, then 106.81, the low from September 16.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.