![]()

1, Inflation – price data for April showed headline prices stayed at 0.5% in June, this is one of the lowest readings since 2009. Although it is too early to assess the impact of the ECB’s recent actions on inflation, the fact that prices have been below 1% since September last year is still a major cause for concern. Although prices in Germany have picked up a notch, they are still only half of the ECB’s 2% target rate. Things across the periphery are even worse, in Italy, the third largest economy in the currency bloc; prices fell to 0.2% from 0.4% in June, and the lowest level since September 2009. The battle against deflation is far from over, and Draghi may have to keep the door open to further action at this week’s ECB press conference, to scare off the threat of deflation.

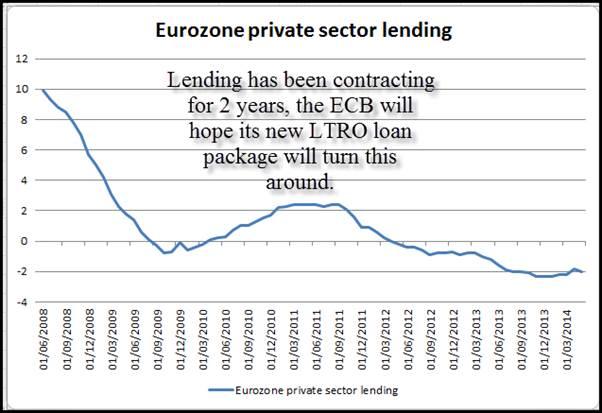

2, Lending: the latest money supply data from the currency bloc showed that private sector loans fell 2% on an annualised basis in May, down from -1.8% in April. The ECB will be hoping that their package of fresh LTRO funds can boost this number; however this data reinforces the uphill battle the Bank has to encourage demand for loans. Credit growth to the private sector has been contracting since April 2012, so the Bank may need more aggressive action down the line if it wants to bring this back into positive territory.

3, France: The second largest economy in the currency bloc is becoming a big problem, and it could make it on to the ECB’s agenda later this week. Its PMI data is lagging the periphery and earlier on Monday its statistics agency published its debt to GDP ratio for Q1, which rose to 93.4%, a record high. A country’s debt is considered a major problem if it gets above 100% of GDP, and if French debt accumulation carries on at its current pace, then we may reach 100% in the next 12 months. It appears that President Hollande’s 75% top rate of tax has had no impact on French debt levels, and today’s data may trigger more explicit wording in the ECB’s statement to get governments to do more to reduce debt loads. If the ECB sounds concerned about France then we could see the market panic.

It is also worth noting that as French debt-to-GDP has continued to jump, the opposite is true in Germany where the rate has fallen from a peak of 83.4% of GDP in 2010, to 79.9% in Q1 this year. Watch out for signs that Germany is getting annoyed with France’s inability to keep its borrowing under control. A spat between the two largest economies in the currency bloc could dent investor confidence and weigh on euro-based assets.

4, The EUR: Last but not least, the single currency hasn’t played ball since the last ECB meeting. It has risen for two consecutive weeks and is close to the high before the ECB meeting on 5th June at 1.3665. If Draghi and co. want to limit further upside for the single currency, and protect the recovery, it may need to keep the door open on Thursday to further policy action in the future.

The technical picture is fairly neutral for EURUSD. If it can break above 1.3670-80, the high from early June and also the 200-day sma, this would be a bullish development that could take us back to 1.3800 in the medium-term, however, the ECB may be hoping that it does not break this level, which could open the way to another leg lower.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The markets remain unconvinced that the Fed will pivot earlier than previously expected.

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

Gold looks to extend uptrend once it confirms $2,400 as support

Gold price continued to push higher last week and rose above $2,400 on Friday, gaining nearly 2% for the week. Investors will continue to scrutinize comments from Fed officials this week and look for fresh hints on the timing of the policy pivot in the minutes of the April 30-May 1 meeting.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.