![]()

Yesterday we noted how treasury yields declined on the back of poor US April Retail Sales, which saw the ‘control’ reading drop to -0.1% vs. expectations of a build by +0.5% MoM. As a result with this as a key input that most economists use to come up with their consumption estimates and consumption making up a large share of US economic growth, this has led to revisions lower for US 2Q GDP. Additionally, later in the session we noted the continued decline on Twitter as well as the potential bearish implications this could have over the ensuing sessions:

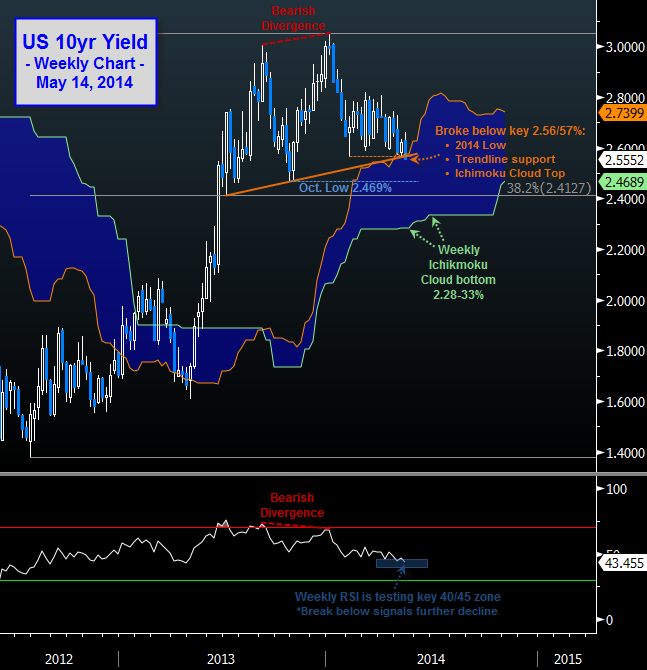

Sure enough this bearish momentum carried over today, despite higher than expected April PPI (+0.6% vs con. +0.2% m/m), and the US 10-year yield broke below a key level of support at 2.56/57% which saw a convergence of the 2014 low, trendline support (drawn from the July low) and the weekly Ichimoku Cloud top. As we noted two weeks ago, “should the US 10-year yield 2014 low at 2.568% give way over the coming sessions, next levels to watch: 2.50% (psychological & barrier/option related), 2.469% (Oct. 2013 Low), 2.413% (38.2% retracement), 2.40/41% (H&S measured move objective)” and finally 2.33% (weekly Ichimoku Cloud bottom). Additionally it may be prudent to keep an eye on weekly RSI as it is currently testing the key 40/45 zone, which is often characteristic of where bulls may look to reenter the market, however a break below this level would potentially signal a further retrenchment in yields over the coming weeks/months.

Chart Source: Bloomberg, FOREX.com

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.