![]()

It’s been a rather subdued start to this week’s trade, with most major global markets closed for Easter Monday. That said, we have seen the USD/JPY continue to rally, carrying over the some of the strength from last week. The catalyst for the yen weakness was a weaker-than-expected trade balance report from Japan, which showed a ¥1.45T deficit, larger than the ¥1.07T expected. Some of this increase was attributed to the April 1 sales tax hike in Japan, which contributed to an 18% surge in imports last month, but the sluggish growth in exports (only 1.8% y/y) is a particularly worrying sign for The Island Nation.

The other major fundamental driver of the USD/JPY has been US treasury yields. After dropping down to support near the 6-month lows at 2.60% early last week, yields spiked back up toward 2.75% by the close of the week. If rates manage to break above resistance at the 2.80% level this week, the USD/JPY could extend its recent gains and recover back toward the early April high above 104.00.

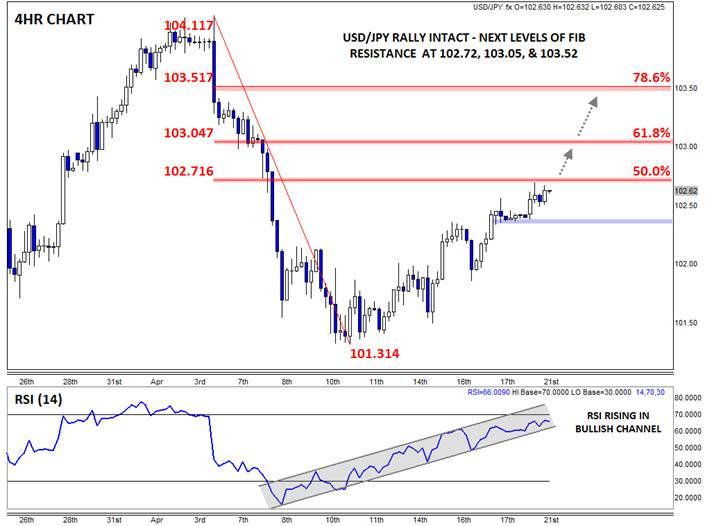

Looking to the chart, the USD/JPY remains within a short-term uptrend after bottoming near key support in the lower-101.00s two weeks ago. Though it’s difficult to fit a clean trend line to price itself, the RSI indicator has formed a clear channel over the last two weeks. Of course, the RSI indicator is bounded, so its uptrend cannot continue forever, but a break back into overbought territory (above 70) would suggest that rates may have further to run this week.

To the topside, bulls will be looking to target the near-term Fibonacci retracements at 102.72 (50%), 103.05 (61.8%), or even 103.52 (78.6%) next. On the other hand, a short-term drop below Friday’s low at 102.35 would shift the near-term bias back to neutral.

Key Economic Data / Events that May Impact USD/JPY This Week (all times GMT):

Tuesday: US Existing Home Sales (14:00)

Wednesday: US Markit Flash Manufacturing PMI (13:45), US New Home Sales (14:00)

Thursday: US Durable Goods Orders and Initial Unemployment Claims (12:30), JP National Core CPI (23:30)

Friday: JP All Industries Activity (4:30), US Markit Flash Services PMI (13:45)

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.