If the US doesn’t get the recovery spending money, the economy gets decelerating recovery

Outlook

We get a fair amount of fresh US data today, including the flash PMI and home sales, but

“It’s the virus, stupid.”

Grim warnings from Pres Biden that it’s going to get worse before it gets better are reverberating throughout financial markets. We were just starting to feel relief from universal PTSD when Honest Joe told the truth, dashing hopes of the recovery scenario. It’s not just the US. Japan may have to cancel the Summer Olympics. As reported above, Bloomberg reports PM Boris “signaled that the current lockdown in the country could last until the summer while officials there have suggested paying people who test positive for the virus to stay at home. German Chancellor Angela Merkel said it would be late September before everyone who wants to get vaccinated can get a shot.”

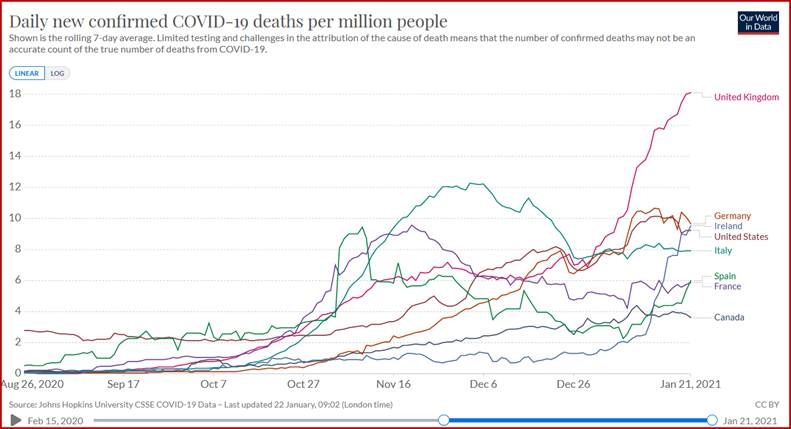

Germany is freaking out. The NYT reports total deaths are 50,000, of which 30,000 came after December 9th, or over 1000 per day. Yesterday brought 17,862 new cases, fewer than the week before but deaths lag cases. This seems like a smallish number, but see the chart—the German death toll is the highest of the big European countries and higher than in the US and second only to the UK. It’s higher even than Ireland.

Pity Ms. Lagarde, who only yesterday said the medium-term outlook is very positive: “Looking ahead, the roll-out of vaccines, which started in late December, allows for greater confidence in the resolution of the health crisis…The news about the prospects for the global economy, the agreement on future EU-UK relations and the start of vaccination campaigns is encouraging…”

That was yesterday. Then Pres Biden spoke, and sentiment turned on a dime. It doesn’t help that Congress seems to be girding its loins to contest Biden’s $1.9 trillion spending plan, among other obstructions. Perhaps politics has no place in financial discussions, but the sheer size of the spending plan overrides the conventional disregard for politics. If the US doesn’t get the recovery spending money, the economy gets decelerating recovery. Does this boost risk aversion? Yes, and at the same time, it dilutes that inflation/rising yields story. It also drags down other currencies, especially the pound.

There’s no easy way out. We still expect bad news to get discounted, especially in equities, as it was all along under the aegis of the previous administration. If and when equities recover from today’s Covid-driven freak-out, currencies can reconfigure themselves, likely back to where they were on Wednesday. But fingers crossed. Fear can morph into panic. We don’t expect it, but you never know.

Politics: Pres Biden is an Energizer Bunny, issuing new orders all over the place and on a wide array of subjects, starting with 10 initiatives to deal with Covid. The TV shows claiming to be about the news had plenty of coverage of plans and personalities occupying the White House, plus dire warnings about maverick Republicans still making trouble for no good reason. A group of Dem Senators are investigating the depth of involvement by two Republicans (the religion-addled Hawley and the hateful Ted Cruz) in the Jan 6 uprising.

But the “news” folks missed the financial market effect of the cold water Biden was pouring on the economic outlook and thus the financial market prices. It was there for all to see. The S&P put in a double bottom in the morning, then a dead cat bounce, and then a lasting downmove starting around 4 pm.

Fun tidbit: Today’s date is a palindrome with only a little tinkering—it reads the same way forward as backward—1 21 21 and 1 21 21.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat