Gold Weekly Forecast: Focus shifts to Trump 2.0

- Gold advanced for the third week in a row, hitting multi-week highs above $2,720.

- The US Dollar’s drop and investors’ repricing of rate cuts helped the metal.

- The yellow metal is expected to closely follow Trump’s Inauguration Day.

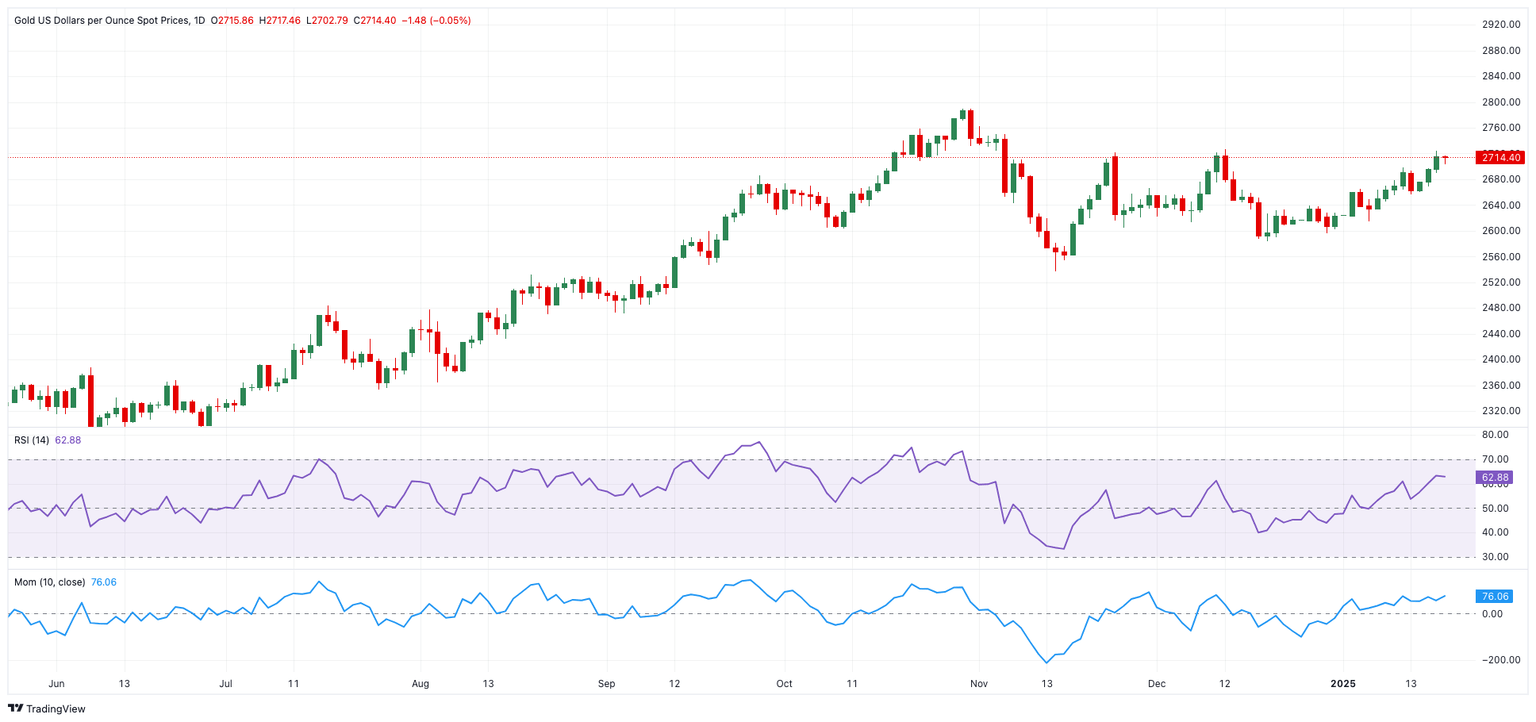

The corrective move in Gold (XAU/USD) remained well in place for yet another week, this time surpassing the $2,720 mark per troy ounce for the first time since mid-December, where an initial resistance zone appears to have emerged.

In fact, the bid bias in the precious metal has persisted since the beginning of the new year and gained additional momentum this week due to the corrective decline in the US Dollar (USD).

It is worth recalling that the yellow metal advanced more than 27% last year.

All eyes on Inauguration Day

The weekly positive performance of Gold prices coincided with the corrective retracement in the US Dollar, which saw the US Dollar Index (DXY) retreat for the first time after six consecutive weeks despite hitting new cycle highs earlier in the week.

Disappointing data releases in the US, particularly from the Consumer Price Index (CPI), helped reignite investor hopes that the Federal Reserve (Fed) might continue trimming interest rates this year.

This renewed speculation also supported a fresh decline in US yields across the curve, which in turn weighed on the Greenback and bolstered the bullish outlook for Gold.

Trump: Will he? Won’t he?

Key concerns impacting the non-yielding metal include the potential implementation of tariffs on European and Chinese imports by the Trump administration, coupled with looser corporate regulations and fiscal policies.

These measures could permeate through the economy via inflationary pressure and, more likely than not, prompt the Fed to adjust its ongoing easing cycle. Accelerated consumer price increases could even reignite the possibility of tightening measures by the central bank.

In summary, the likelihood of resurgent inflation in the US economy and its potential influence on the Fed’s strategy should keep Gold prices supported. Should looser fiscal policies and tariffs come into effect, it will be time to assess the scope and duration of these measures, which may allow Gold to recover part of its lost luster.

Gold technical outlook

Gold is en route to potentially revisit its all-time high of $2,790 set at the end of October 2024. Further upward momentum could target Fibonacci extensions of the 2024 climb at $3,009, $3,123 and $3,288.

On the other hand, interim support comes at the 55-day and 100-day Simple Moving Averages (SMAs) of $2,652 and $2,640, respectively, prior to the December 2024 low of $2,583 (December 18) and the November 2024 low of $2,536 (November 14).

If prices dip further, the next targets could include the critical 200-day SMA) at $2,510, ahead of the September low of $2,471. A failure to hold this zone could open the door to additional downside levels, such as the $2,353 mark (July 2024 low), the June low of $2,286, and May’s low of $2,277.

Gold daily chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.