Gold: The bulls have taken their foot off the gas, but they remain in the driving seat [Video]

![Gold: The bulls have taken their foot off the gas, but they remain in the driving seat [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/stacked-gold-bars-13094022_XtraLarge.jpg)

Gold

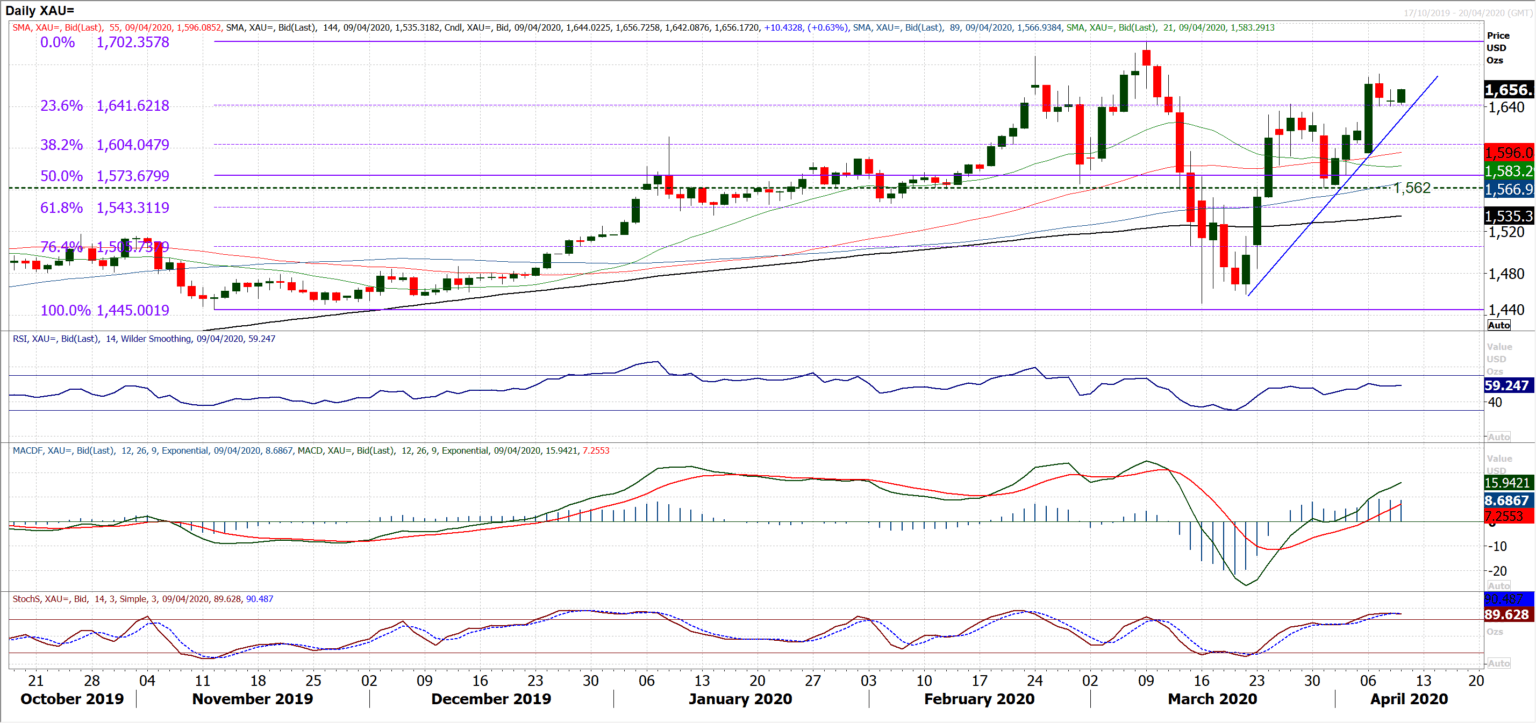

After the breakout of Monday, gold has spent the following time in consolidation around the breakout support at $1642. The bulls have taken their foot off the gas, but they remain in the driving seat. A strong, now three week uptrend comes in to support at $1629 and any retreat towards there will be seen as a chance to buy. They may have lost a certain degree of upside impetus, but momentum indicators remain positively configured and near term corrections are still a chance to buy. The hourly chart shows a band of underlying demand between $1625/$1642 is now a near term buy zone. Holding on to hourly RSI above 40 would help maintain a positive configuration that weakness remains a chance to buy. We favour pressure on $1671 (Tuesday’s high) and maintaining a position above the 23.6% Fibonacci retracement (of $1445/$1702) at $1642 maintains the bullish bias for a retest of the $1702 high in due course. On a near to medium term basis, we remain bullish whilst above $1562 and see near term weakness as a chance to buy.

Author

Richard Perry

Independent Analyst