Gold Price Weekly Forecast: XAU/USD needs pullback in yields to extend rebound

- Gold tested $1,900 before staging a rebound on Friday.

- XAU/USD recovery could gather momentum in case US yields turn south.

- Investors will pay close attention to US inflation data, Fedspeak next week.

Surging global yields continued to weigh on XAU/USD throughout the week, but gold buyers managed to defend $1,900. Friday's mixed job report helped the pair extend its recovery ahead of the weekend. June inflation data from the US could be the next significant catalyst due to its potential influence on the Federal Reserve's (Fed) rate outlook.

What happened last week?

Financial markets in the US operated half-day on Monday and remained closed on Tuesday in observance of the Independence Day holiday. Hence, trading action remained subdued at the beginning of the week. Nevertheless, the weaker-than-expected ISM Manufacturing PMI print for June helped XAU/USD inch higher on Monday.

As trading conditions started to normalize mid-week, safe-haven flows dominated the action amid escalating US-China tensions. China announced controls on exports of some important metals that are used in the production of electric vehicles and semiconductors, effective from August 1. The Wall Street Journal reported that the Biden administration could look to restrict Chinese companies' access to US cloud-computing services in retaliation. The US Dollar (USD) benefited from risk aversion and caused XAU/USD to push lower.

In the late American session on Wednesday, the minutes of the Federal Reserve's June policy meeting revealed that some policymakers favored a 25 basis points (bps) rate hike. The publication further reiterated that almost all participants pencilled in additional interest rate increases in 2023 in their projections.

Employment in the US private sector increased by 497,000 in June, the data published by Automatic Data Processing (ADP) showed on Thursday. This print came in much higher than the market expectation of 228,000 and provided a boost to the USD in the early American session. Moreover, the ISM Services PMI improved to 53.9 in June from 50.3 in May, with the Employment sub-index recovering to 53.1 from 49.2. As the benchmark 10-year US Treasury bond yield climbed above 4% for the first time since March after the upbeat US data, gold turned south and came in within a touching distance of $1,900.

In the second half of the American session, however, the USD lost its strength, allowing XAU/USD to stage a rebound. This action seems to be a product of investors showing interest in other major currencies, such as the Euro and Pound Sterling, on sharp upsurges witnessed in their respective bond yields. In fact, XAU/EUR and XAU/GBP pairs both lost around 0.5% on Thursday.

Nonfarm Payrolls (NFP) in the US rose 209,000 in June, the US Bureau of Labor Statistics reported on Friday. This reading came in below the market expectation of 225,000 and caused the USD to come under renewed selling pressure. Underlying details of the jobs report showed that the Unemployment Rate edged lower to 3.6% from 3.7%, and annual wage inflation held steady at 4.4%. The USD struggled to benefit from these prints and gold price rose toward $1,930 ahead of the weekend.

Next week

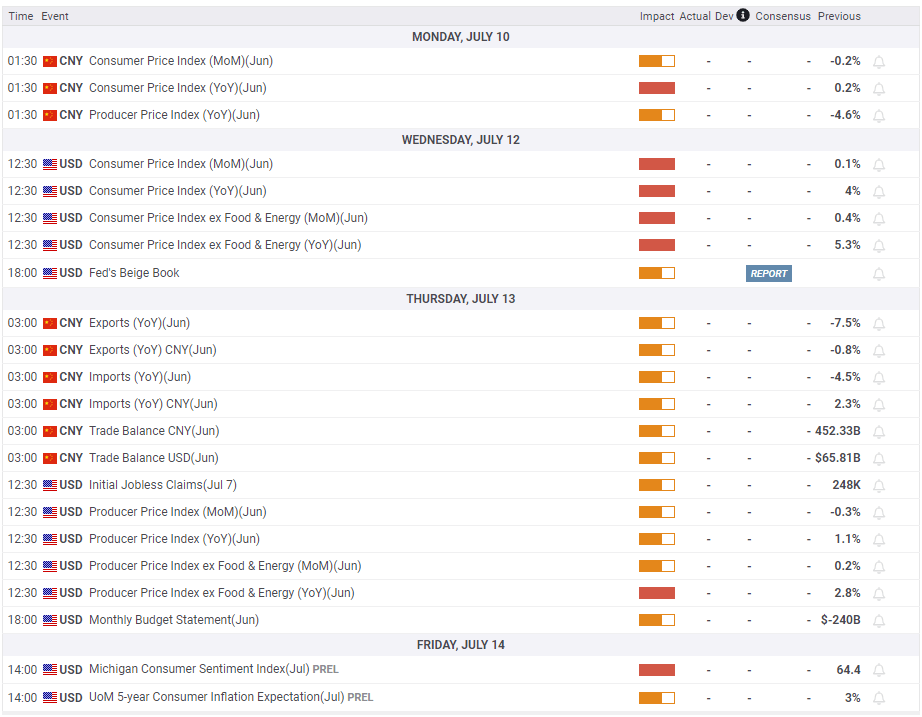

The next potential catalyst for XAU/USD will be the US June inflation data on Wednesday. Markets expect the annual Consumer Price Index (CPI), the so-called headline inflation, to rise less than 3.5% on a yearly basis in June, down from the 4% increase recorded in May. Monthly Core CPI, which excludes volatile food and energy prices, is forecast to increase by 0.3%. A reading of 0.1% or lower is likely to weigh heavily on the USD, as it would go against the Fed's view of core inflation remaining sticky. Even if the headline inflation softens as anticipated, a monthly Core CPI of 0.4% or higher could support the USD and make it difficult for XAU/USD to gain traction.

In the Asian session on Thursday, Trade Balance data from China will be watched closely. China's Exports declined 7.5% on a yearly basis in May, and the trade surplus stood at $65.81 billion. A further contraction in exports and a narrowing of the trade surplus could revive concerns over China's economic outlook and its potential negative impact on future gold demand. Later in the day, the US Bureau of Labor Statistics will publish the Producer Price Index (PPI) figures for June.

Market participants will continue to scrutinize comments from Fed officials. Ahead of the July 25-26 policy meeting, the Fed will go into the blackout period on July 15. Next week will be the policymakers' window to steer market expectations. In case dovish comments cause the 10-year US yield to the 3.75% consolidation area, XAU/USD could gather bullish momentum. On the other hand, the pair's recovery attempts are likely to remain limited if 10-year yield stabilizes above 4%.

Gold technical outlook

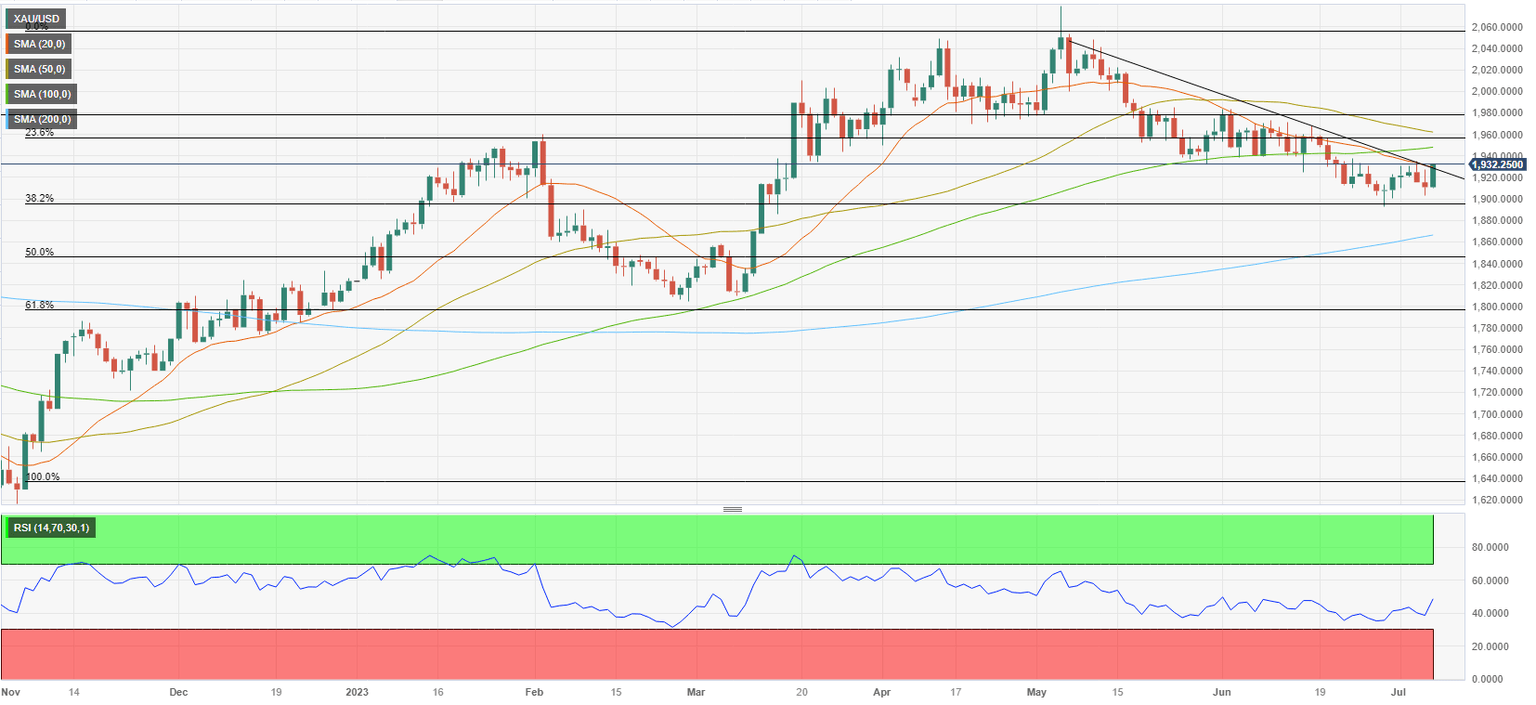

The Relative Strength Index (RSI) indicator on the daily chart recovered to 50 on Friday, reflecting the lack of seller interest. Once XAU/USD stabilizes above $1,930 (20-day Simple Moving Average (SMA), descending trend line), it could target $1,950 (100-day SMA), $1,960 (Fibonacci 23.6% retracement of the latest uptrend, 50-day SMA) and $1,980 (static level).

On the downside, $1,900 (Fibonacci 38.2% retracement, psychological level) stays intact as strong support. A daily close below this level could attract sellers and open the door for an extended slide toward $1,870 (200-day SMA), and $1,845 (Fibonacci 50% retracement) could be seen as the next targets on the downside.

Gold forecast poll

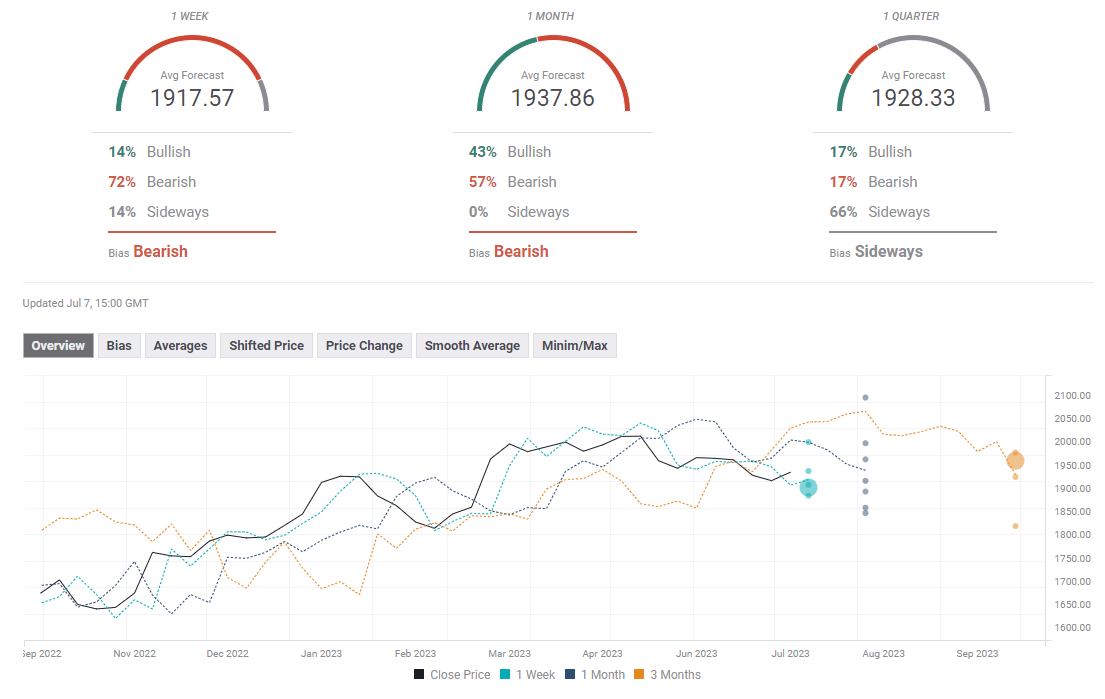

Despite Friday's rebound, FXStreet Forecast Poll suggests that the bearish bias is expected to stay intact in the near term. The one-week average target aligns at $1,917. The one-month outlook remains mixed, with an average target of $1,937.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.