Gold Price Weekly Forecast: $2,000 back in crosshairs amid market turmoil

- Gold price benefited from market jitters and climbed to fresh multi-month highs.

- Technical outlook suggests that there could be a correction before the next leg higher.

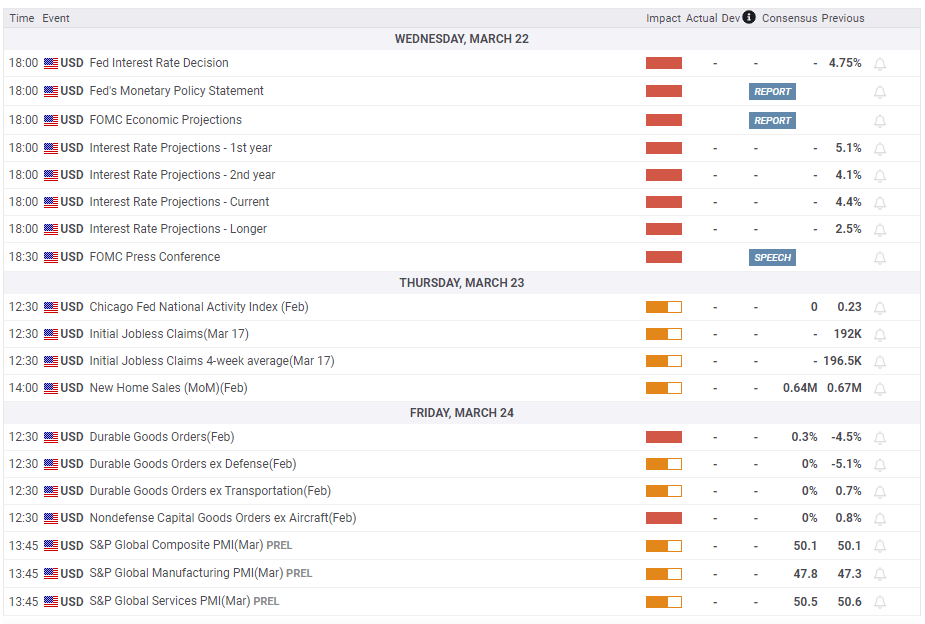

- Fed's policy announcements and dot plot will be next week's key risk event.

Gold price started the new week on a bullish note and gained more than 2% on Monday as investors reacted to the collapse of Silicon Valley Bank (SVB) and Signature Bank. Following a technical correction on Tuesday, XAU/USD regained its traction mid-week and climbed to its highest level since April, above $1,960, closing with a weekly gain of nearly 5%. The US Federal Reserve's (Fed) policy decision alongside the revised Summary of Projections (SEP) will drive the pair's action next week as investors will try to figure out how the Fed's policy will be shaped amid worrying signs of tightening in financial conditions.

What happened last week?

Market participants started to reassess the US Federal Reserve's (Fed) policy outlook on Monday as the negative impact of higher interest rates on financial conditions became apparent, with two medium-sized US banks collapsing. Goldman Sachs said that it was now forecasting the Fed to keep its policy rate unchanged in March to ease market fears. Meanwhile, the Fed introduced the Bank Term Funding Program (BTFP) to provide additional funding to depository institutions to help assure banks have "the ability to meet the needs of all their depositors." Nevertheless, the benchmark 10-year US Treasury bond yield fell nearly 4% and inversely-correlated XAU/USD surged higher.

As markets calmed down on hopes that the SVB crisis will remain contained and not spread to other financial institutions, US T-bond yields rebounded and XAU/USD erased a portion of Monday's impressive gains. Moreover, the data from the US revealed that the Core Consumer Price Index (CPI) rose 0.5% on a monthly basis in February, reminding markets of the stickiness of inflation. In turn, the US Dollar managed to stay resilient against its major rivals, with bets for a 25 basis points rate hike at next week's meeting gaining traction.

Safe-haven flows returned to markets on Wednesday as Credit Suisse shares tanked after the bank's biggest investor, Saudi National Bank, said that it will not be providing any additional financial support because of regulatory restrictions. Global stock indices suffered heavy losses and global yields plunged mid-week, allowing Gold to capture the capital outflows. The 10-year US Treasury bond yield lost nearly 8% mid-week and touched its lowest level in over a month, below 3.5%, while XAU/USD added more than 1% on a daily basis and reclaimed $1,920. However, in the late American session, the Swiss National Bank (SNB) and the Swiss Financial Market Supervisory Authority (FINMA) released a statement noting that Credit Suisse met the capital requirements to be eligible for additional liquidity if necessary.

Markets made a U-turn at the European opening on Thursday and XAU/USD struggled to build on Wednesday's gains. As expected, the European Central Bank (ECB) hiked its key rates by 50 basis points (bps). In its policy statement, "elevated level of uncertainty reinforces the importance of a data-dependent approach to ECB's policy rate decisions," the bank said. During the press conference, ECB President Christine Lagarde and Vice President Luis de Guindos noted that banks in the Eurozone were resilient with a strong liquidity position. Lagarde, however, refrained from committing to future policy action. In the meantime, Reuters reported that ECB policymakers agreed to go ahead with the planned 50 bps hike after the SNB "threw a lifeline" to Credit Suisse. Citing three sources, Reuters said the other option was for the ECB to keep its policy rate unchanged. This development helped risk flows to continue to dominate the action as it suggested that major central banks could turn dovish to address the liquidity issues.

On Friday, the University of Michigan's Consumer Sentiment Survey revealed that year-ahead inflation expectations receded to 3.8% in March, the lowest reading in nearly two years, from 4.1% in February. As the US T-bond yields continued to decline after this data, XAU/USD preserved its bullish momentum and climbed above $1,960 for the first time since April.

Next week

XAU/USD is likely to have a difficult time making a decisive move in either direction at the beginning of next week, with investors moving to the sidelines ahead of the Federal Reserve's highly-anticipated policy announcements.

Markets were pricing in a very strong probability of a 50 bps March rate hike just last week after FOMC Chairman Jerome Powell told Congress that they were prepared to increase the pace of rate hikes if data warranted it. At the beginning of this week, the market positioning changed in a dramatic way, with the probability of a no-change in rates rising above 50%. By mid-week, the odds of a 25 bps hike reached 90%.

At this point, it looks very unlikely the Fed will opt for a 50 bps rate hike. If that were to be the case, the initial reaction could provide a boost to the USD and weigh on XAU/USD. However, such a decision could also revive fears over a deepening financial crisis and trigger a fresh bout of flight to safe-haven bonds, causing US T-bond yields to fall sharply and opening the door for a leg higher in Gold price.

At the other extreme, markets are likely to go back into panic mode even if the Fed were to leave its policy rate unchanged to address the tightening of financial conditions. Investors could assess such a decision as the situation in the banking sector being much worse than what they were led to believe.

Having said that, the most probable outcome seems to be a 25 bps hike. In fact, 76 of 82 economists that took part in a recently conducted Reuters poll said that they expect the Fed to raise its policy rate by 25 basis points to the range of 4.75-5%. In that scenario, the Fed's language and Chairman Powell's comments on the policy outlook and the banking sector will be key. If Powell downplays what happened with SVB and says that they will continue to take the necessary policy steps to tame inflation while monitoring the situation, the USD could regather its strength and weigh on XAU/USD. On the flip side, Gold price should turn north in case the chairman adopts a concerned tone and reiterates the Bank's willingness to take action in case they see additional signs of financial stress.

Alongside the policy statement, the Fed will release the revised Summary of Economic Projections (SEP), the so-called dot plot. In December's SEP, the median view of the policy rate at end-2023 stood at 5.1%. Following January's impressive jobs report and hot inflation data, there was market talk that the terminal rate projection could rise all the way toward 6%. Policymakers are unlikely to forecast a terminal rate that high in the SVB aftermath. Nevertheless, a terminal rate forecast at or above 5.5% should be seen as a hawkish outlook, while a reading below 5.5% should suggest that the Fed is getting closer to a pause in the tightening cycle. Additionally, risk sentiment could improve if the dot plot shows that some policymakers now expect a rate cut before the end of the year.

To summarize, the rate decision itself will not be able to help investors figure out how the Fed's policy will look after the latest turmoil. Powell's comments, the revised SEP will cause market volatility to increase mid-week before the dust settles. Hence, it might be risky to bet on a certain XAU/USD direction during the Fed event. The action in the US T-bond yields and global stock indices should help the fog clear.

On Friday, S&P Global will publish the preliminary Manufacturing and Services PMI surveys for March, but it's difficult to make a prediction on a possible market reaction without knowing what the Fed does.

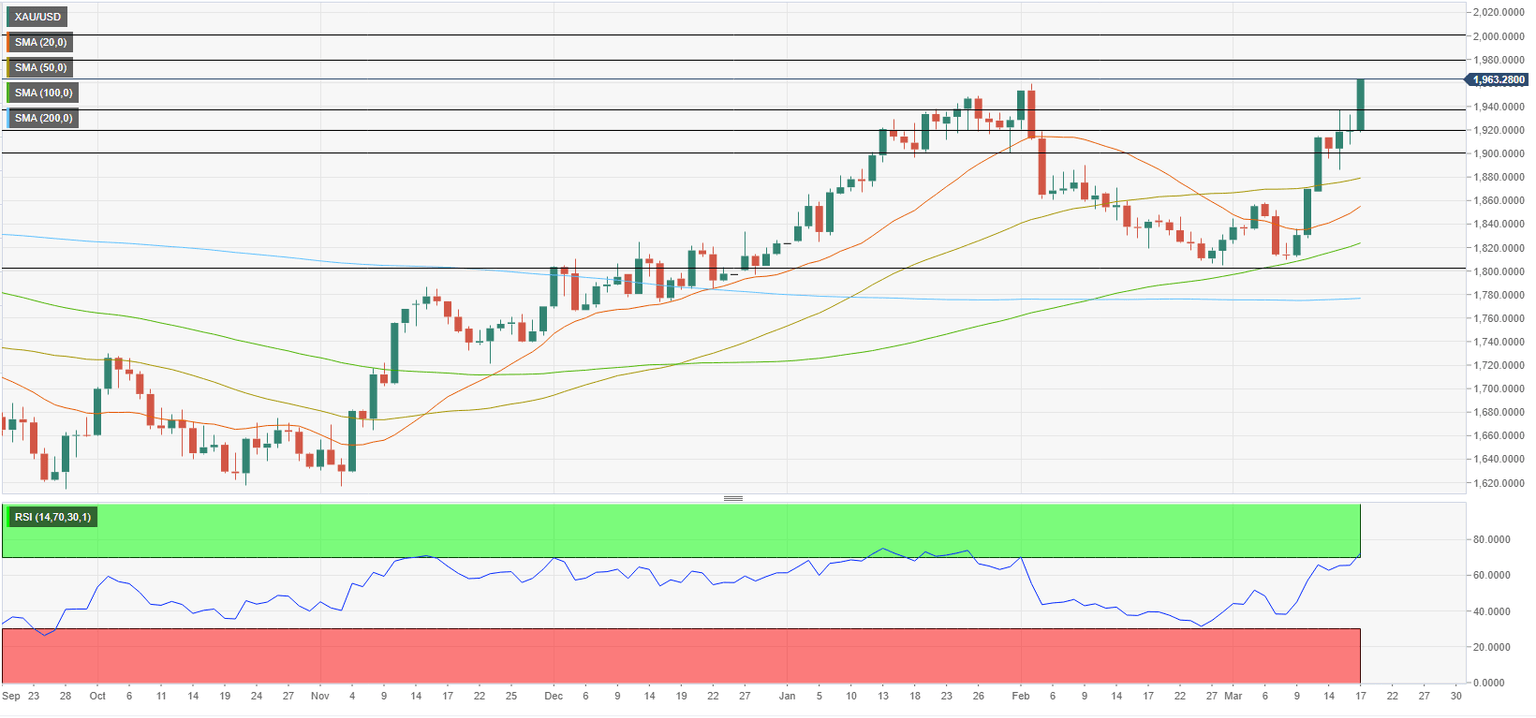

Gold price technical outlook

In case markets go into a consolidation phase while getting ready for the Fed event early next week, XAU/USD could stage a correction with the Relative Strength Index (RSI) indicator on the daily chart staying in overbought territory above 70. In that scenario, $1,940 and $1,920 align as static supports ahead of $1,900 (psychological level, static level).

On the upside, $1,980 (static level from April) aligns as the next bullish target before $2,000 (psychological level, static level).

It needs to be mentioned that investors could ignore XAU/USD's overbought conditions in case US T-bond yields continue to push lower.

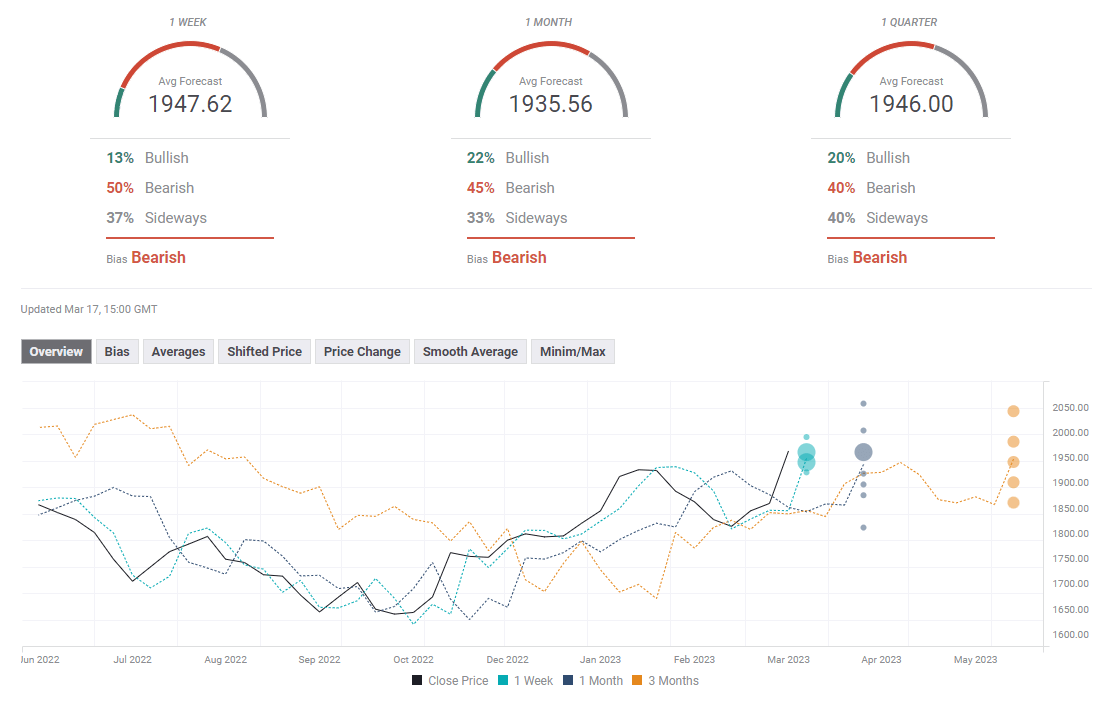

Gold price forecast poll

FXStreet Forecast Poll shows that some experts don't expect Gold price to continue to push higher in the short term. The one-week average target aligns slightly below $1,950. The one-month outlook seems to have turned bearish, while the one-quarter outlook remains neutral with a slightly bearish bias.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.