Gold Price Forecast: XAU/USD surges on revival of reflation trades, bullish breakout imminent?

- Gold surges for the third straight session on Tuesday.

- Revival of reflation trades amid US stimulus hopes boosts gold.

- Bulls teasing a falling wedge breakout on the four-hour chart.

Gold (XAU/USD) extends its recovery from two-month lows of $1785 into the third straight session on Tuesday, backed by the revival of the reflation trades amid growing optimism on the passage of a $1.9 trillion stimulus package in the US Congress. The reflation trades boost the inflation-hedge while weighing down on the safe-haven US dollar. The greenback also suffers, as investors cast a doubt on the recent rally driven by the US economic optimism. The Bitcoin rally on Tesla’s $1.5 billion investment news also exacerbated the pain in the buck, offering extra wind to gold’s bullish reversal.

The prospects of a bigger US fiscal stimulus and the Fed’s continuation of the ultra-easy monetary policy will keep the gold bulls underpinned, as markets look forward to fresh updates on the stimulus front amid a lack of relevant US economic data slated for release on Tuesday. Although the surge in US Treasury yields amid increasing US inflation expectations could likely cap the advance in the yieldless gold.

Gold Price Chart - Technical outlook

Gold: Four-hour chart

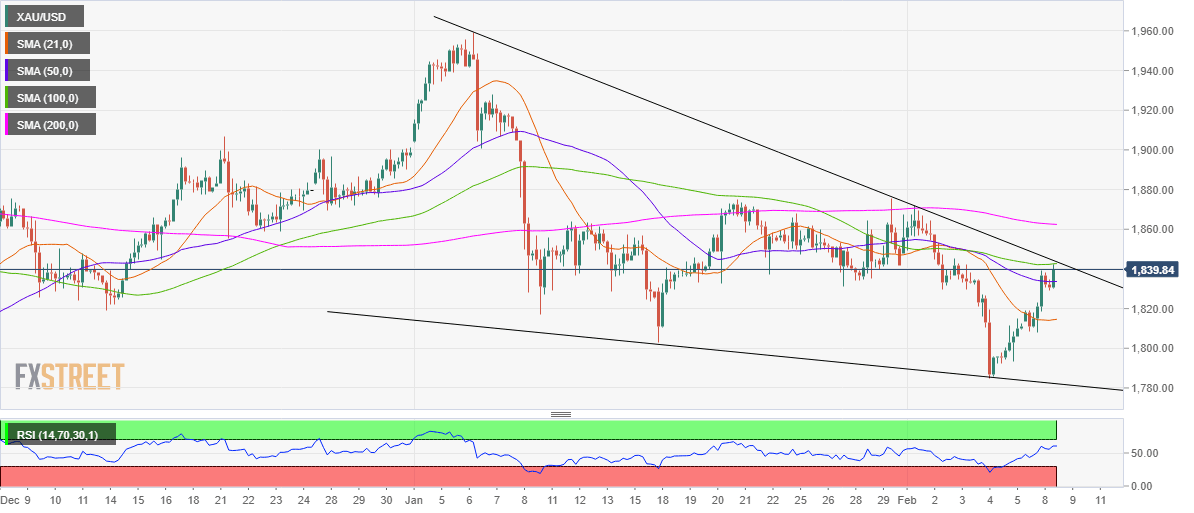

At the time of writing, gold is battling the bearish 100-simple moving average (SMA) at $1843 while wavering in a falling wedge formation on the four-hour chart.

Acceptance above the latter could expose the falling wedge resistance at $1844. A sustained move higher above that level would confirm the upside break, opening doors for a test of the horizontal 200-SMA barrier at $1863.

The Relative Strength Index (RSI) trades firmer above the midline, allowing room for more gains. The next relevant target for the buyers awaits at the January high of $1875.

On the flip side, the 50-SMA at $1834 could offer immediate support to the XAU bulls, below which the 21-SMA support at $1814 would be put to test.

Further south, Friday’s low of $1792 could be the last resort for the gold buyers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.