Gold Price Forecast: XAU/USD stuck around $2,300 as market players lack directional conviction

XAU/USD Current price: $2,302.95

- The Federal Reserve failed to deliver a clear message on future rate moves.

- Market players await the April US Nonfarm Payrolls report.

- XAU/USD is neutral-to-bearish in the near-term, strong selling interest around $2,336.50.

Financial markets struggle for direction on Thursday, with XAU/USD hovering around the $2,300 mark. The US Dollar traded throughout the day on sentiment, advancing with optimism while falling when things soured. In a broader view, however, little has changed across the board throughout the week, as the Federal Reserve (Fed) failed to deliver a clear message. The central bank announced on Wednesday that it would slow the pace of decline in its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion starting in June. Interest rates have been left unchanged, as expected.

The Fed was hawkish but not as hawkish as feared. Indeed, Chairman Jerome Powell dropped some dovish comments in the middle of his press conference. Inflation is still the main issue, but not the only one. Price pressures intensified in the first quarter of the year, while other macroeconomic data indicated economic progress slowed. Still, Powell repeated that decisions will be made meeting by meeting and clarified that it is unlikely the next policy move will be a hike. He added that cutting rates is an option if inflation resumes its fall but also if there is weakness in the labor market, uplifting the relevance of employment-related figures ahead of the next Fed decision.

Data released these days showed the labor market remains tight. The ADP survey indicated that the private sector added 192K new positions in April while the number of job openings remained little changed at 8.5 million on the last business day of March, according to the JOLTS Job Openings report. Furthermore, the US reported Unit Labor Costs in the first quarter of the year rose 4.7%, implying an upward risk to inflaiton, while Nonfarm Productivity in the same quarter advanced a measly 0.3%.

Another indicator of labor sector performance will be the April Nonfarm Payrolls report, which will be out on Friday. The US is expected to have added 243K, while the Unemployment Rate is foreseen steady at 3.8%. The report includes an update on wages, while separately, the US will release the April ISM Services PMI, an indicator of economic health.

XAU/USD short-term technical outlook

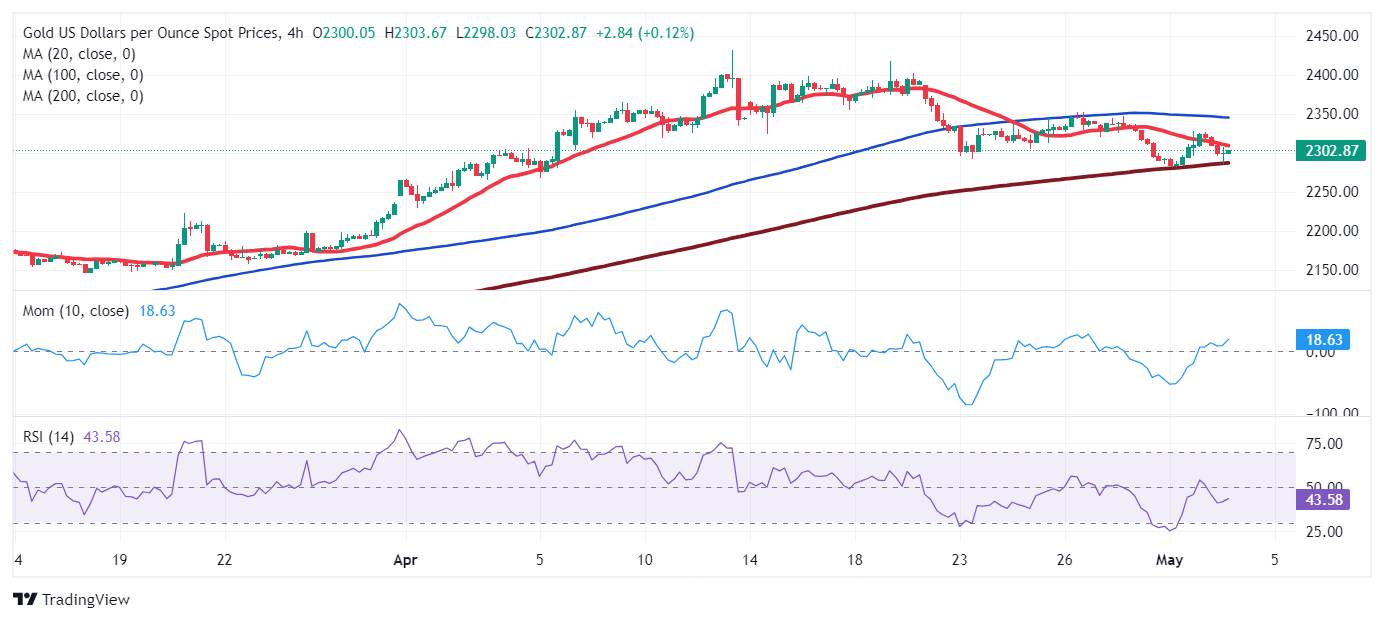

From a technical perspective, the daily chart shows sellers rejected advances for a second consecutive day around $2,326.50, the 23.6% Fibonacci retracement of the $1,996.06/$2,431.43 rally. The same chart shows the 20 Simple Moving Average (SMA) remains flat just above the mentioned level, while the longer ones maintain their upward slopes well below the current price. Finally, technical indicators held within negative levels with uneven strength, skewing the risk to the downside.

The 4-hour chart shows the pair is currently developing below bearish 20 and 100 SMAs, although a modestly bullish 200 SMA. Technical indicators recovered from their early lows but remain below their midlines and are losing their upward strength, suggesting buyers are not interested at the time being.

Support levels: 2,291.20 2,276.50 2,260.30

Resistance levels: 2,310.50 2,326.50 2,341.05

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.