Gold Price Forecast: XAU/USD stabilizes around $2,735

XAU/USD Current price: $2,736.27

- Upbeat United States data helped the US Dollar after its early slide.

- US data stands out on an otherwise quiet Friday.

- XAU/USD turned neutral in the near term, sellers have no interest.

Gold price recovered some ground on Thursday, trading as high as $2,743.15 a troy ounce by the end of the European session. The bright metal shed some ground after the United States (US) unveiled upbeat macroeconomic data, albeit demand for the US Dollar remains subdued.

XAU/USD eased after the US reported that Initial Jobless Claims rose by 227K in the week ended October 18, much better than the 242K expected. Even further, The flash US S&P Global October Composite PMI rose to 54.3 after printing at 54.0 final in September. Manufacturing activity improved to 47.8 from 47.3 in September, beating the anticipated 47.5. The services index printed at 55.3, up from 55.2 in the previous month and above the 55 forecast.

Still, the US Dollar has been unable to fully recover its upward poise, under pressure since early Asia amid mounting concerns about the outcome of the US presidential election. Meanwhile, Wall Street trades mixed. The Dow Jones Industrial Average (DJIA) sheds roughly 0.45% for the day, while the S&P500 and the Nasdaq Composite trade in the green.

Partially explaining USD near-term weakness are Treasury yields, retreating just modestly after reaching fresh multi-week peaks earlier in the week. At the time of writing, the 10-year note offers 4.20%, while the 2-year note yields 4.05%.

The macroeconomic calendar will include on Friday, US September Durable Goods Orders and the October Michigan Consumer Sentiment Index. Upbeat figures will likely give the USD a boost ahead of the weekly close.

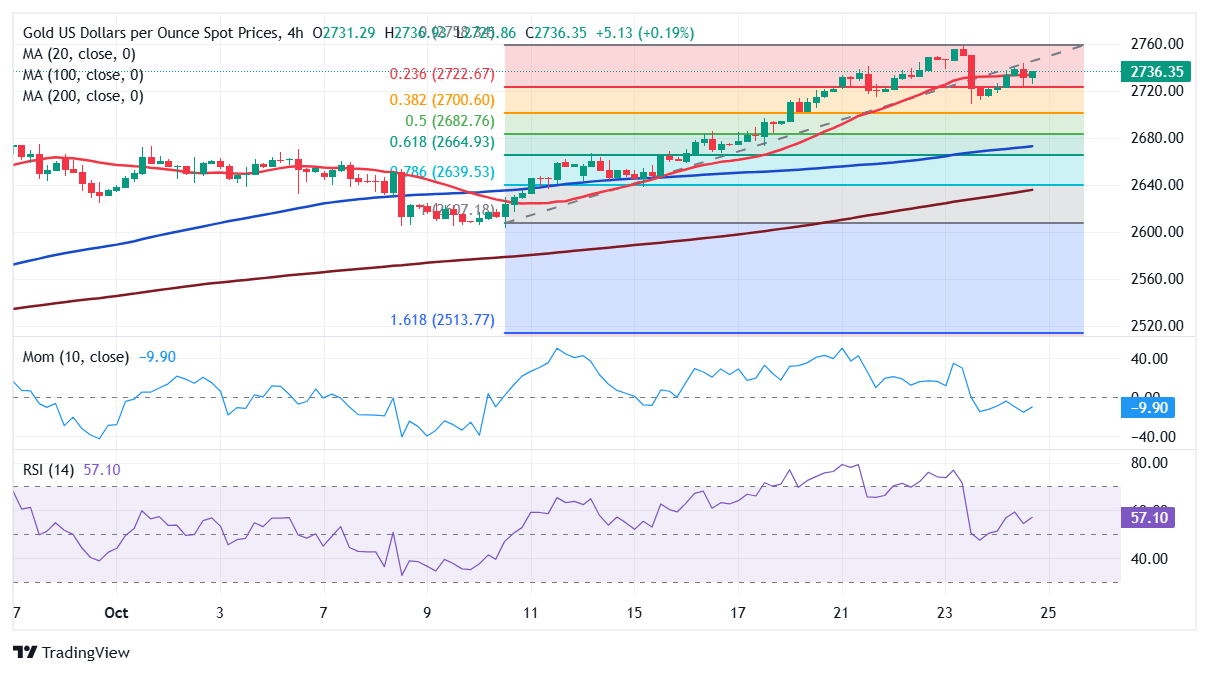

XAU/USD short-term technical outlook

The daily chart for the XAU/USD pair shows bulls retain control. Technical indicators resume their advances around weekly highs and after a modest downward correction, enough to erase overbought conditions. At the same time, the pair trades above bullish moving averages, with the 20 Simple Moving Average (SMA) currently hovering at around $2,670. At the same time, the pair found buyers around the 23.6% Fibonacci retracement of the $2,601.87/$2,756.36 rally at $2,721.20. The next relevant support level is 2,698.66, the 38.2% retracement of the same rally.

The 4-hour chart offers a neutral stance, although sellers are out of the picture. XAU/USD is hovering around a flat 20 SMA, but far above bullish 100 and 200 SMAs. The aforementioned 23.6% Fibonacci retracement provided near-term support during American trading hours, supporting additional gains ahead. Finally, technical indicators hover directionlessly around their midlines, not enough to define the next directional move.

Support levels: 2,721.20 2,708.50, 2,698.60

Resistance levels: 2,732.70 2,743.15 2,758.40

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.