Gold Price Forecast: XAU/USD set for more pain on a daily close below $1,993

- Gold price licks wounds as US inflation data pares Fed easing expectations.

- US Dollar pauses before the next push higher; focus shifts to Fedspeak.

- Gold price appears ‘sell the bounce’ trade amid bearish technicals.

Gold price is flirting with the lowest level in two months near $1,990 early Wednesday, consolidating the previous day’s steep sell-off. The US Dollar (USD) rally has taken a breather alongside the US Treasury bond yields, allowing Gold price a temporary relief.

Hot US CPI data reinforces Gold sellers

Having briefly extended Tuesday’s slide in Asian trading on Wednesday, Gold price is nursing losses, as markets resort to profit-taking on the US Dollar upsurge that followed the hotter-than-expected US Consumer Price Index (CPI) inflation data.

The annual CPI inflation in the US fell to 3.1% in January following a brief increase to 3.4% in December but outpaced forecasts of 2.9%. The US CPI edged up 0.3% MoM, the most in four months, and above forecasts of 0.2%. Further, annual core CPI rose 3.9%, compared to expectations of a 3.7% growth. The monthly inflation rate edged up to 0.4%.

Hot US inflation report reinforced the US Federal Reserve’s (Fed) pushback against early and aggressive interest rate cut expectations, triggering a fresh rally in the US Treasury bond yields and the US Dollar. The benchmark 10-year US Treasury bond yields hit fresh three-month highs of 4.33%, where it now wavers. The US Dollar Index tested 105.00, a new three-month top.

Asian traders hit their desks early Wednesday and reacted to the US CPI data, keeping Gold price under pressure. Markets now price out a March Fed rate cut while chances of a May easing are seen around 65%.

Looking ahead, the US Dollar could resume its uptrend if risk aversion intensifies and the Fed policymakers back the hawkish interest rate outlook. Global markets are in a downward spiral following the hot US CPI data. In such a scenario, Gold price is likely to continue its bearish momentum. A potential rebound in Gold price, however, cannot be ruled out should investors take profits off the table.

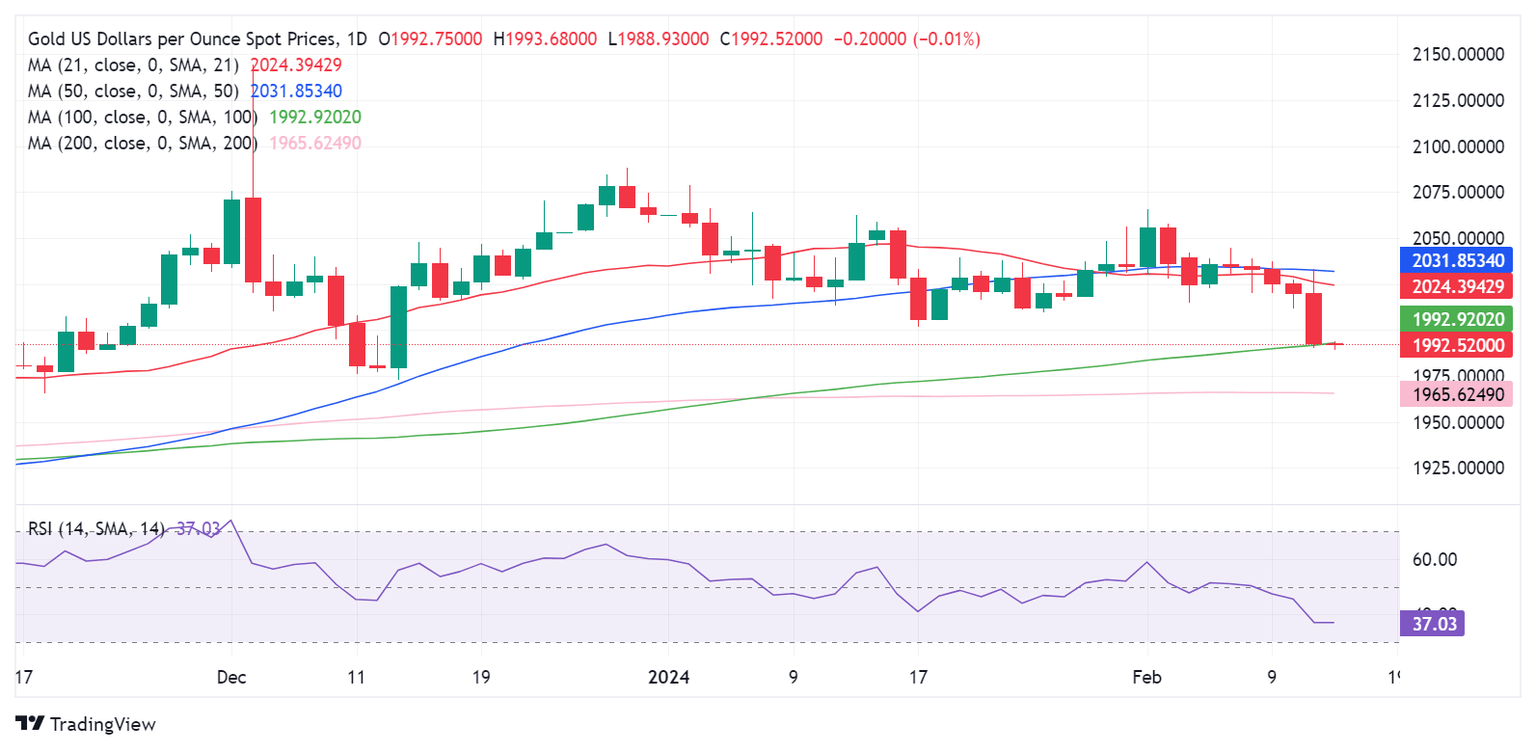

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price managed to close Tuesday above the 100-day Simple Moving Average (SMA) at $1,993.

However, it opened Wednesday below that level, keeping sellers hopeful.

The 14-day Relative Strength Index (RSI) is trading well below the 50 level, suggesting that there is more pain in store for Gold buyers.

Meanwhile, the 21-day and 50-day SMAs Bear Cross, confirmed last week, also remains in play.

Therefore, any corrective upside in Gold price could be seen as a good selling opportunity for Gold sellers in the near term.

Key support levels are now seen at the December 13 low of $1,973 and the horizontal 200-day SMA at $1,966. A sustained move below the latter will put the $1,950 psychological level at risk.

On the contrary, if Gold price manages to recapture the 100-day SMA support-turned-resistance at $1,993 on a daily closing basis, a fresh recovery toward the 21-day SMA of $2,024 cannot be ruled out.

Gold price needs to find a strong foothold above the $2,000 barrier once again, at first.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.