Gold Price Forecast: XAU/USD poised to resume its advance

XAU/USD Current price: $2,332.56

- The Bank of England kept rates unchanged, downwardly reviewed inflation forecasts.

- Federal Reserve’s speakers will gather all the attention on Friday.

- XAU/USD may extend gains in the near term, needs to run above $2,340.

Gold price posted an interesting comeback on Thursday, as buyers continued to defend the $2,300 area. XAU/USD fell throughout the first half of the day as the US Dollar benefited from a poor market mood. The Greenback changed course ahead of Wall Street’s opening following the release of the United States (US) Initial Jobless Claims for the week ended May 3. The report showed seasonally adjusted initial claims jumped to 231,000, the highest level since August 2023. The figure revived markets optimism as it is a tepid sign of a loosening labor market. As a result, stock markets surged while the US Dollar fell.

The Bank of England (BoE) announced its decision on monetary policy but had no impact beyond that on the British Pound. The BoE left interest rates unchanged at 5.25% for the sixth consecutive meeting and hinted at soon-to-come rate cuts, as inflation is forecast to fall below target. Policymakers upwardly revised growth figures while noting they would like to see more evidence price pressures are receding before loosening the monetary policy.

On Friday, the US will publish the preliminary estimate of the May Michigan Consumer Sentiment Index, while multiple Federal Reserve (Fed) speakers will hit the wires.

XAU/USD short-term technical outlook

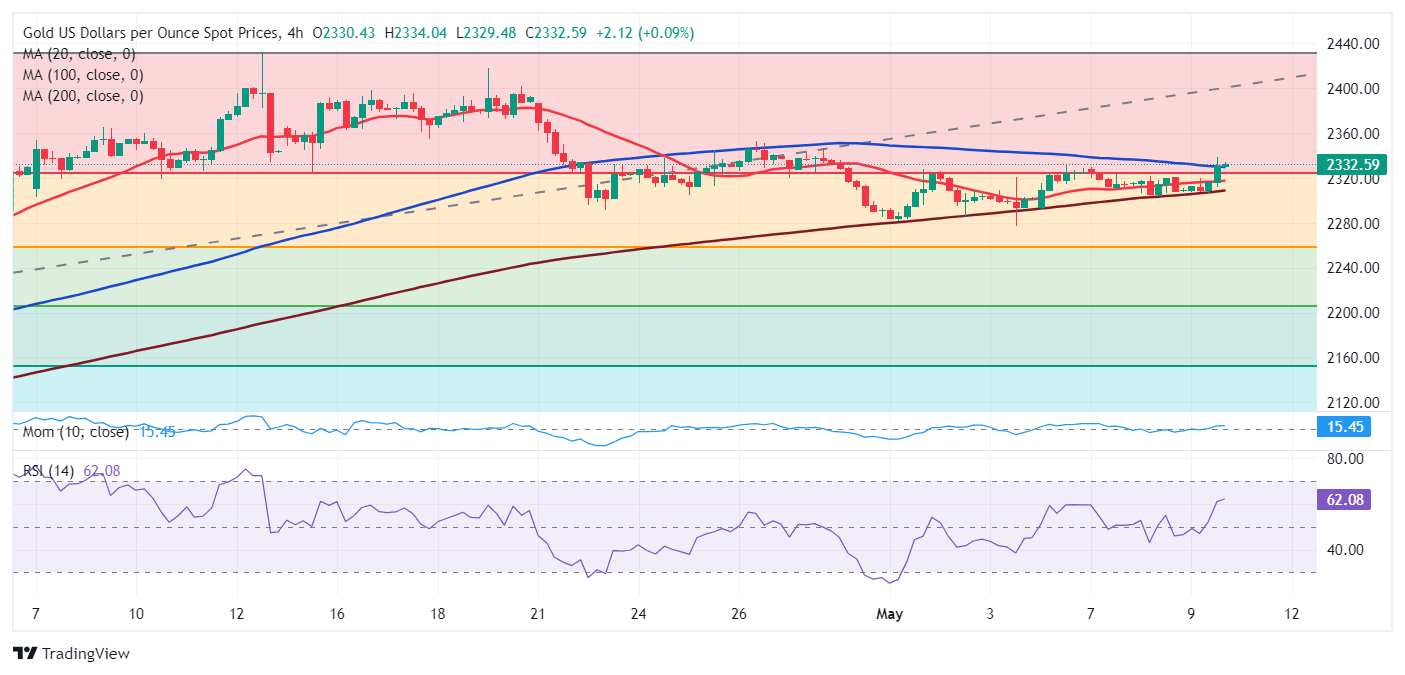

The daily chart for XAU/USD shows it stalled its recovery around a mildly bullish 20 Simple Moving Average (SMA), which stands at around $2,335. The longer moving averages maintain their upward slopes far below the current level, while technical indicators remain below their midlines without apparent directional strength. Overall, Gold extends its consolidative phase ahead of a relevant directional catalyst.

In the near term, and according to the 4-hour chart, XAU/USD is neutral. The pair met intraday buyers around a bullish 200 SMA but can’t extend gains beyond a mildly bearish 100 SMA. Finally, technical indicators stand flat within positive levels, suggesting bulls are more willing to jump in.

Support levels: 2,322.90 2,310.40 2,291.20

Resistance levels: 2,340.15 2,356.90 2,367.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.