Gold Price Forecast: XAU/USD on its way to test record highs

XAU/USD Current price: $2,722.50

- Fresh hopes for a Federal Reserve rate cut in May put pressure on the US Dollar.

- China will release Q4 Gross Domestic Product figures early on Friday.

- XAU/USD maintains the bullish bias and looks to retest the $2,790 all-time high.

Spot Gold keeps advancing on Thursday, posting fresh highs above the $2,720.00 level in the mid-American session. The market mood soured ahead of the United States (US) opening, as macroeconomic data was tepid while Federal Reserve (Fed) Governor Christopher Waller said that interest rate cuts could come sooner and faster than expected if the disinflation trend holds up. As a result, investors lifted bets for an interest rate cut in May.

Earlier in the day, the United States reported that Retail Sales rose a modest 0.4% in December, below the 0.6% expected and the previously revised 0.8%. At the same time, Initial Jobless Claims for the week ended January 10 increased by 217K, worse than the 210K expected. The US Dollar (USD) lost ground with the news, as Wall Street struggles to post gains.

Market players will now shift the focus to China, as the country will publish early in Asia Q4 Gross Domestic Product (GDP) figures. Additionally, China will release December Industrial Production and Retail Sales.

XAU/USD short-term technical outlook

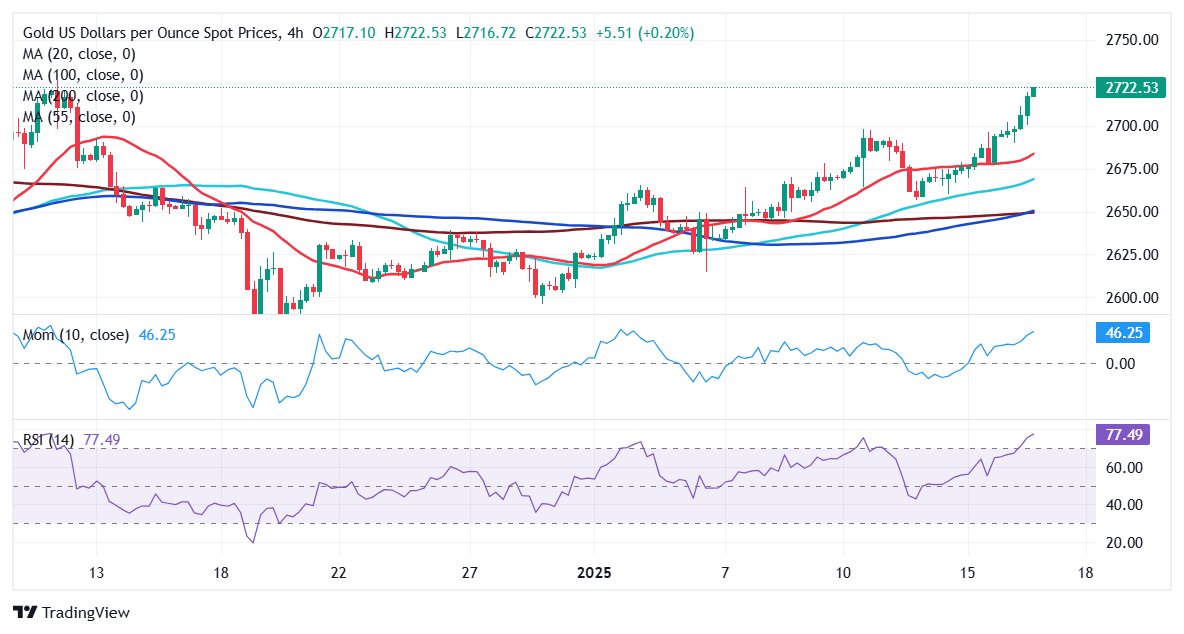

Technical readings in the daily chart support additional XAU/USD gains. The pair extends gains above its moving averages, with bullish 20 and 100 Simple Moving Averages (SMA) converging at around $2,643, both gaining upward traction. At the same time, technical indicators extended their advances within positive levels, with room to extend their advance in the upcoming sessions.

In the near term, and according to the 4-hour chart, Gold is overbought yet there are no signs of upward exhaustion. The 20 SMA accelerated its advance far below the current level, while the 100 SMA is about to cross above the 200 SMA, both far below the shorter one. Finally, technical indicators have partially lost their positive momentum but keep heading north despite developing at extreme levels. A relevant resistance comes at around $2,725, with gains beyond it exposing the all-time high in the $2,790 region.

Support levels: 2,712.90 2,700.00 2,685.05

Resistance levels: 2,725.00 2,738.15 2,751.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.