Gold Price Forecast: XAU/USD now retargets the $2,700 region

- Gold prices extended their uptrend despite alleviating geopolitical jitters.

- The US Dollar regained composure and advanced to weekly tops.

- XAU/USD maintains the bullish note well north of $2,600/oz.

On Wednesday, Gold prices continued their ascent despite geopolitical tensions mitigated somewhat along with the appetite for safe-haven assets. Heightened anxiety over the Russia-Ukraine conflict, coupled with broader uncertainty in global markets, has been underpinning the strong weekly rebound in the precious metal for the time being.

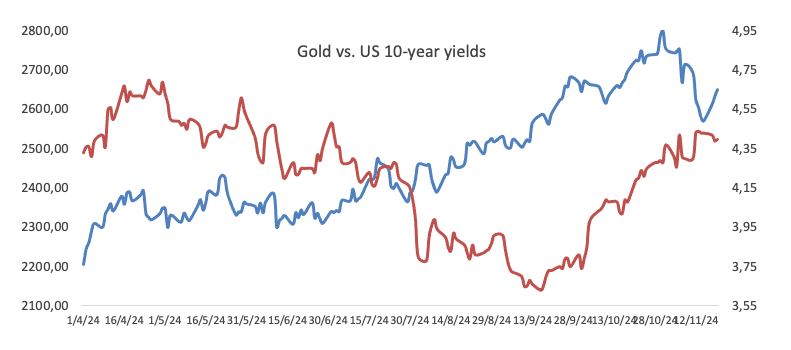

The yellow metal, however, is expected to remain under scrutiny in the next few weeks as recent US economic data, coupled with expectations that Republican policies could fuel inflation, have increased the likelihood of interest rates staying elevated for an extended period. While gold is traditionally viewed as a hedge against inflation, higher interest rates make the non-yielding metal less attractive to investors.

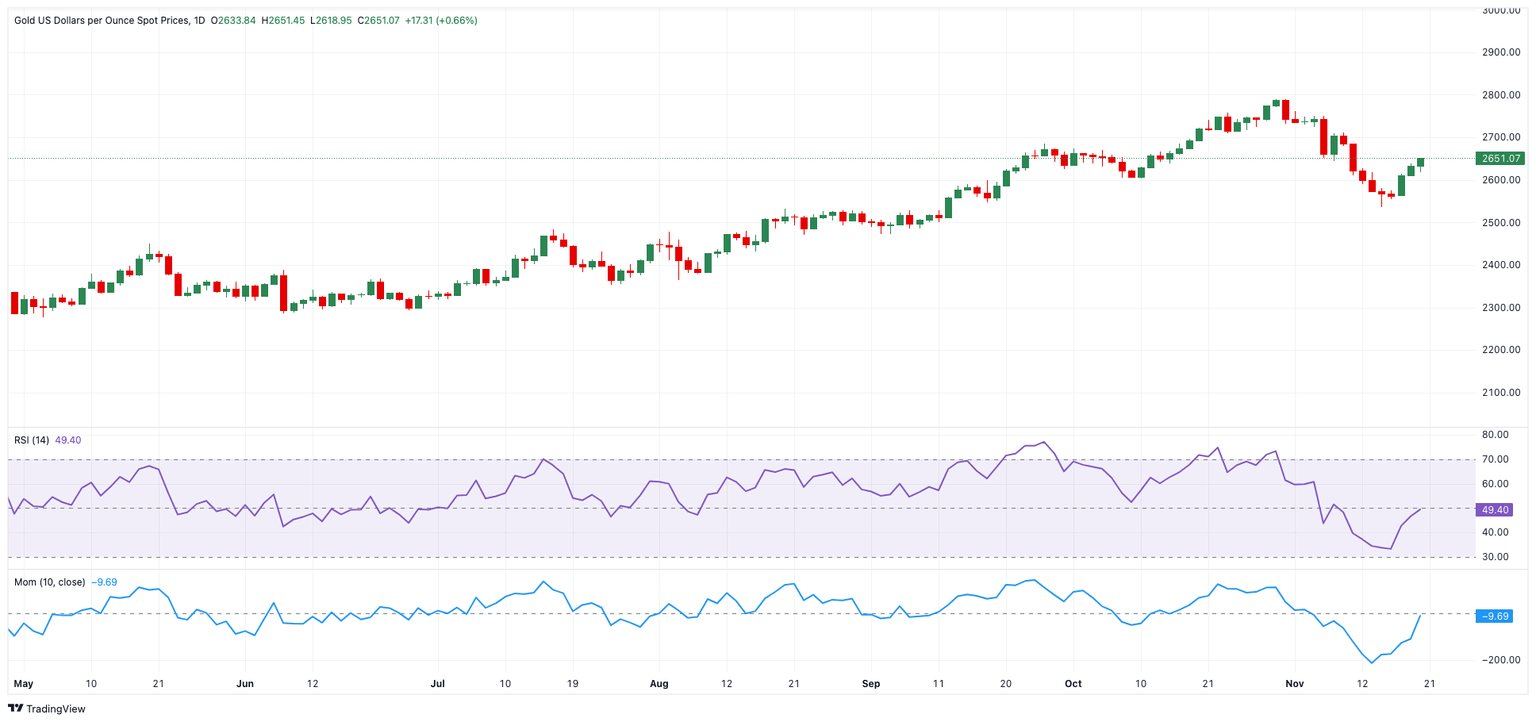

So far this week, Gold prices surged past the recently breached $2,600 mark per troy ounce, finding decent resistance around the 55-day Simple Moving Average (SMA) above $2,640, which emerges as a noticeable hurdle as it seeks to build on its recovery momentum.

The yellow metal's rebound was also supported by a softer US Dollar (USD), which has struggled to maintain the strength it gained during its Trump-trade rally. Adding to the bullish narrative, US Treasury yields have lost steam across multiple maturities, providing further breathing room for Gold prices.

Looking ahead, this week’s spotlight will turn to a series of key global economic data releases, with preliminary Purchasing Managers’ Indexes (PMIs) taking the lead. Market participants will also be tuning in to comments from central bank officials, particularly in the wake of Fed Chair Jerome Powell’s recent cautious stance. On this, let’s recall that Powell highlighted the resilience of the US economy but reiterated the need for prudence when considering future rate cuts.

From a positioning standpoint, speculative interest in gold has softened. Non-commercial traders reduced their net long positions to approximately 236.5K contracts as of November 12—the lowest level since early June, according to the latest CFTC report. This decline in long positions coincides with a second straight drop in open interest, which could prop up some loss of traction from the recent downtrend in gold prices.

XAU/USD short-term technical outlook

The daily chart of XAU/USD indicates a clear break above the bullish 100-day Simple Moving Average (SMA) above $2,550, which is close to the November low of $2,536. Further up comes the current weekly high of $2,650 (November 20) corresponds with the transitory 55-day SMA, confirming this first resistance zone. Up from here, the next minor objective is the $2,700 barrier, prior to the weekly top of $2,749 (November 5).

On the other side, a rapid breach of the temporary 100-day SMA at $2,554 should draw attention to the November low of $2,536 (November 14).

In the short term, the 4-hour chart indicates that the current recovery has more space to go. The Relative Strength Index (RSI) has recovered but confronts resistance at 65, while the Average Directional Index (ADX) near 34 suggests a lack of significant trend momentum for the time being.

On the upside, the next resistance level to monitor is $2,650, followed by the more important 200-SMA at $2,677. On the downside, support remains solid around $2,536, a critical level to monitor if prices reverse course.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.