Gold Price Forecast: XAU/USD not out of the woods yet, focus on US PCE inflation

- Gold price makes another upside attempt amid risk-on mood.

- US dollar eases amid market optimism on US infrastructure stimulus.

- Higher T-yields, bearish technical set up caution bulls ahead of PCE inflation.

Gold price fell on Thursday after witnessing yet another day of choppy trading while maintaining familiar levels below the $1800 level. The up and down moves could be largely associated to the Fed’s expectations on the monetary policy amid mixed messages on interest rates and inflation from the officials at the world’s most powerful central bank. Meanwhile, the recent series of US economic data, including the New Home Sales, Markit Services PMI and Durable Goods continue to disappoint, pointing to a plateauing economic recovery. Gold’s downside, however, remained limited as US President Joe Biden’s $1.2 trillion infrastructure deal was finally reached with Bipartisan support. The US stimulus deal sent Wall Street indices to record high and dented the dollar’s safe-haven appeal. Although, the risk-on mood spurred a rise in the Treasury yields kept gold’s upside in check, as the price closed below the $1780 level.

This Friday, the final trading day of the week, nothing seems to have changed for gold – either fundamentally or technically. But gold bulls may be attempting their last dance before today’s US PCE inflation data reaffirms the FOMC’s hawkish turn, negating the recent dovish comments from several Fed’s policymakers. The US dollar, therefore, could snap its corrective downside and resume its uptrend, as gold bearish bias is likely to continue. In the meantime, US stimulus optimism-led risk tone and the dollar’s dynamics will likely play out.

Gold Price Chart - Technical outlook

Gold: Daily chart

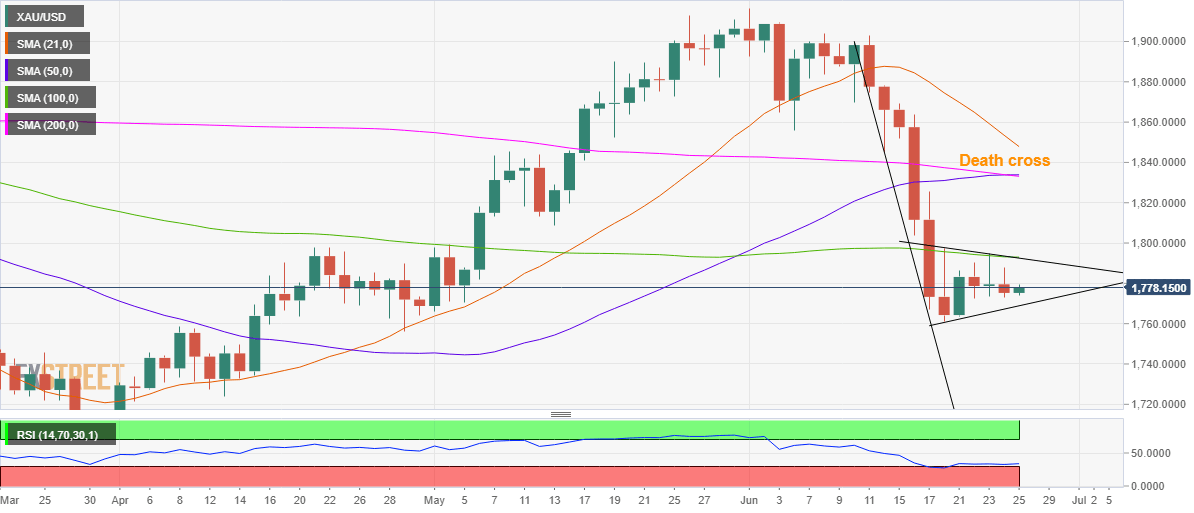

A downside breakout from the bear pennant formation on gold’s daily chart remains well on the cards, especially after the death cross got confirmed on Thursday.

A death cross generates a bearish signal when the 200-Daily Moving Average (DMA) cuts the 50-DMA from above. Also, the 14-day Relative Strength Index (RSI) remains listless below the midline, currently at 33.82, backing the bearish scenario.

A daily closing below the rising trendline support at $1769 will confirm a bear pennant, opening floors towards two-month lows of $1761, below which the $1750 psychological barrier will come into play. Further south, mid-April lows around $1725 could come to the rescue of gold bulls.

Alternatively, if the buyers manage to find a strong foothold above $1794, the confluence of the 100-DMA and falling trendline support, then the June 18 highs of $1797 will be next on the bulls’ radars. The psychological $1800 level will then challenge the bullish commitments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.