Gold Price Forecast: XAU/USD keeps sight on $2,500 amid trade woes, Fed rate-cut bets

- Gold price bounces back toward all-time highs of $2,484 early Thursday.

- The US Dollar finds some solace from risk-aversion, US Treasury bond yields uptick.

- Gold price cheers potential US-China trade risks and increased Fed easing bets.

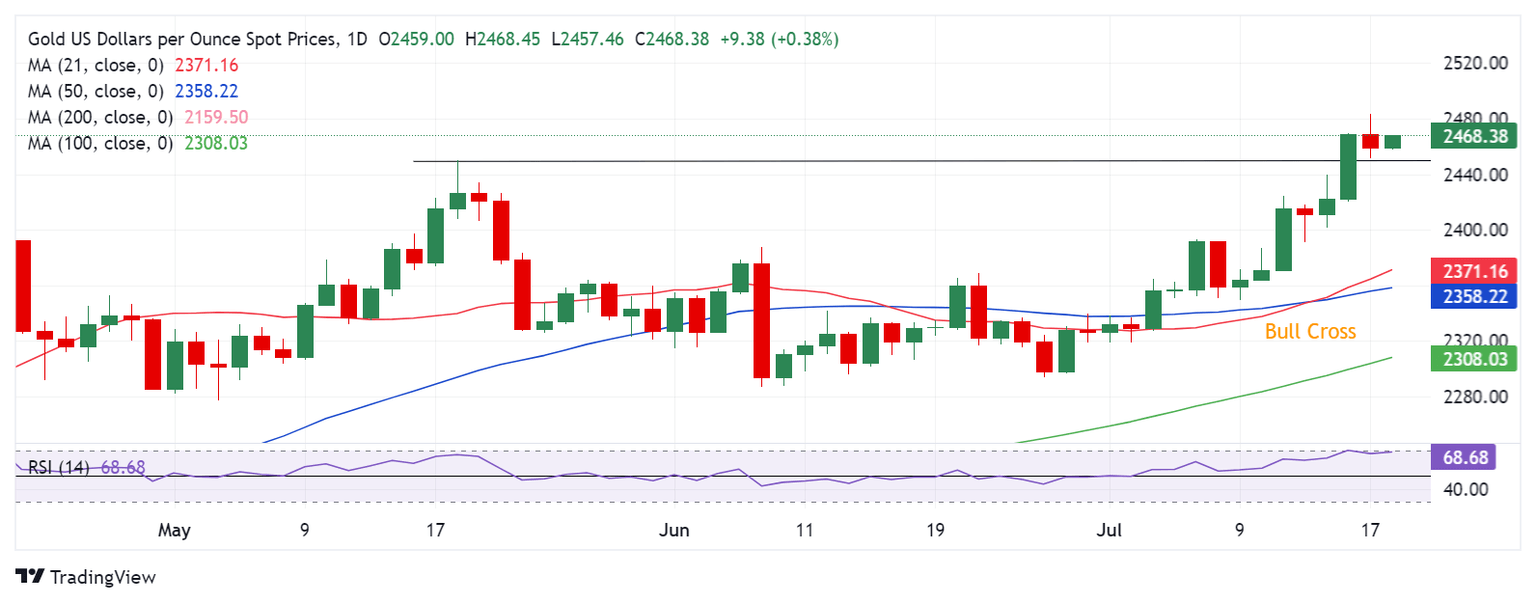

- The daily RSI is back below 70 while firm above 50, suggesting the upside is intact for Gold price.

Gold price has found fresh demand above $2,450 in early trading on Thursday, looking to regain upside momentum, following a brief correction from a new record high of $2,484 set on Wednesday.

Gold price remains poised to claim $2,500

Wednesday’s Gold price retracement could be attributed to profit-taking after the bright metal touched its highest level on record. In the early part of the day, Gold price rallied hard, courtesy of the recent dovish comments from US Federal Reserve (Fed) policymakers and mixed US Retail Sales, which cemented an interest-rate cut in September.

Markets are fully pricing in the September Fed rate cut while odds of another cut in December stand at above 60%, according to the CME Group’s FedWAtch Tool.

Additionally, robust physical Gold demand from India and the weekend’s assassination attempt on former US President Donald Trump also played a part in lifting the sentiment around Gold price.

However, the renewed strength in Gold price early Thursday is seen on the back of simmering tensions surrounding US-China trade, which could escalate on a likely Trump presidency. Following the Trump attack, markets are speculating Donald Trump will win the US Presidential election race.

A report that the US was considering tighter curbs on exports of advanced semiconductor technology to China sent chip stocks and the Nasdaq tumbling overnight, led by AI pioneer Nvidia and Apple, per Reuters.

The upside attempts in Gold price, however, could be capped if the US Dollar stages a decisive comeback on risk aversion. The modest rebound in the US Treasury bond yields could also act as a headwind to the Gold price advance.

On the other side, should the USD/JPY resume its downslide amid suspected Japanese forex market intervention, the US Dollar will likely follow suit, providing extra legs to the Gold price upswing.

Markets will also pay close attention to the mid-tier US Jobless Claims data and speeches from a few Fed policymakers for a fresh trading impetus in Gold price. These speeches will dictate the market expectations on the Fed interest rate outlook before the Fed’s ‘blackout period’ kicks in on Saturday.

The European Central Bank’s (ECB) policy announcements and President Christine Lagarde’s press conference will be scrutinized for the timings and scope of additional rate cuts, which could have some impact on the non-interest-bearing Gold price.

Gold price technical analysis: Daily chart

As noted before, the path of least resistance for Gold price remains to the upside, as the 14-day Relative Strength Index (RSI) has eased after prodding the overbought territory. The RSI indicator stays well above the 50 level, pointing to more upside in the offing.

The previous week’s 21-day and 50-day Simple Moving Averages (SMA) Bull Cross also continues to favor Gold buyers.

Gold price remains poised to capture the $2,500 level if the record high at $2,484 is taken out convincingly. The next resistance level is seen at the $2,550 psychological mark.

On the flip side, if Gold price resumes correction, the previous lifetime high at $2,450 will be put to the test again, below which the $2,400 figure will come into play.

The next relevant support levels are seen at the July 11 low of $2,371 and the $2,350 psychological levels.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.