Gold Price Forecast: XAU/USD holds on to modest gains around $2,650

XAU/USD Current price: $2,655.15

- Central banks’ leaders and US macroeconomic data set the market’s tone.

- The US Dollar seesaws between gains and losses ahead of Fed Powell’s words.

- XAU/USD extends its consolidative phase with no directional strength in sight.

Back and forth among financial markets did not impact Gold price on Wednesday, with the bright metal stuck around $2,650 a troy ounce. The US Dollar seesawed between gains and losses, on the one hand, backed by political jitters weighing on the mood, and on the other hand, losing ground on the back of tepid United States (US) data.

Also, central banks’ chiefs affected markets. Bank of England (BoE) Governor Andrew Bailey was the first to publicly appear, saying markets should expect the United Kingdom (UK) to keep cutting rates gradually next year as inflation eases. He added that the disinflation process is well embedded but that there’s more to do.

Next was European Central Bank (ECB) President Christine Lagarde, who testified before the European Parliament's Committee on Economic and Monetary Affairs. Lagarde said that the economic growth in the EU will be weaker in the near term, adding the recovery should start to gather “some steam.” She added inflation is expected to temporarily increase in the last quarter of the year, and decline to target in the course of the next one.

Data-wise, the US released the ADP Employment Change report, showing the private sector added 146,000 new positions in November, below the 150,000 expected. Additionally, the ISM Services Purchasing Managers Index (PMI), which unexpectedly fell to 52.1 in November from 56 in the previous month, also missed the expected 55.5.

Still pending is a speech from Federal Reserve’s (Fed) Chairman Jerome Powell, due to participate in a moderated discussion at the New York Times DealBook Summit. The next first tier-event will take place on Friday, when the US will release the November Nonfarm Payrolls (NFP) report.

XAU/USD short-term technical outlook

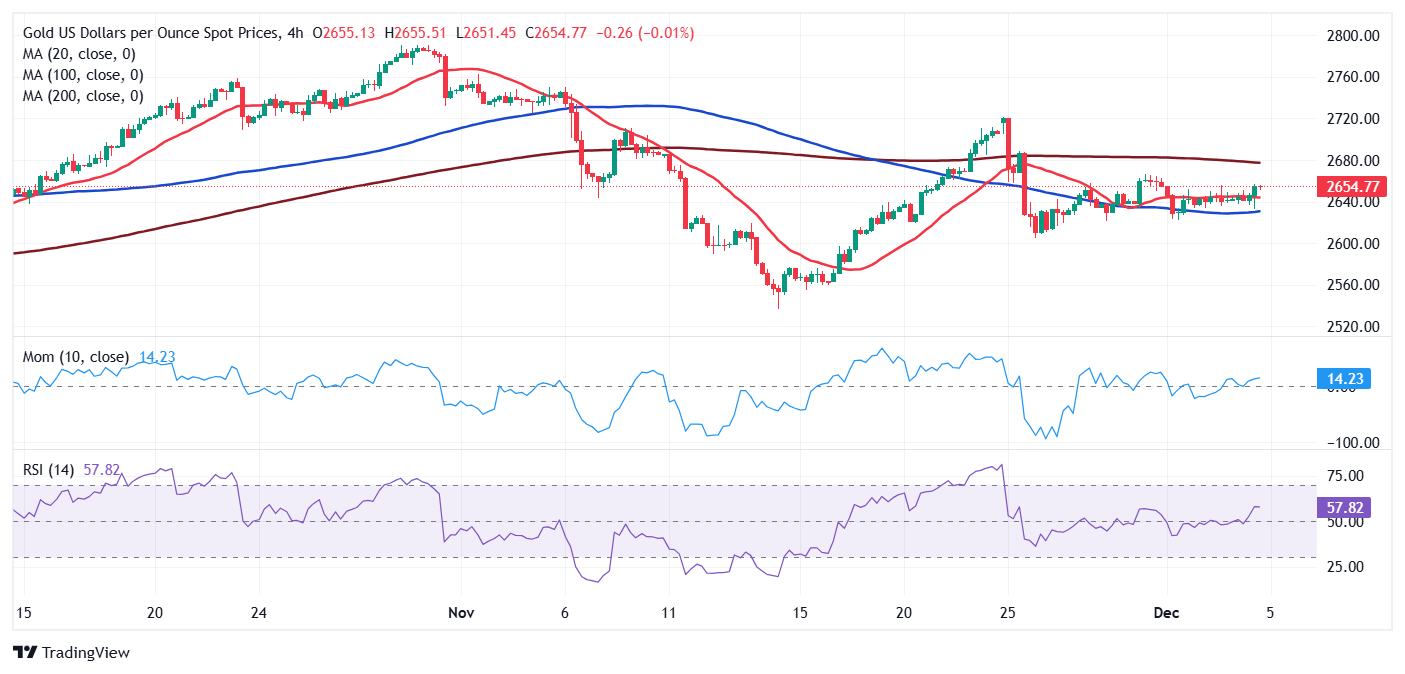

From a technical point of view, XAU/USD has made no progress. The daily chart shows it has held within familiar levels for a seventh consecutive trading day, albeit finding intraday support around a now flat 20 Simple Moving Average (SMA). The 100 and 200 SMAs advance below the current level but lose their upward strength. Finally, technical indicators remain within positive levels, with uneven upward strength, not enough to confirm a bullish extension.

In the near term, and according to the 4-hour chart, XAU/USD is neutral. All moving averages are flat, with the 200 SMA at around $2,678.35 and the shorter ones below the current level. Technical indicators stand above their midlines but lack directional strength. Gold may keep consolidating ahead of upcoming central banks’ meetings scheduled throughout the upcoming two weeks.

Support levels: 2,626.70 2,611.35 2,598.70

Resistance levels: 2,671.55 2,688.65 2,700.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.