Gold Price Forecast: XAU/USD extends consolidative phase as US election result looms

XAU/USD Current price: $2,741.03

- The United States presidential election dominates news feeds, US Dollar under pressure.

- The Federal Reserve is expected to trim interest rates by 25 basis points on Thursday.

- XAU/USD holds within range for a third consecutive day, sellers dominate in the near term.

Spot Gold found modest strength on Tuesday as market participants dumped the US Dollar. The better tone of global equities and the United States (US) going to the polls weigh on the USD. The US election is taking place today, and the tight race between Democrat Vice-President Kamala Harris and Republican former President Donald Trump is lasting until the last minute, with no candidate having a clear advantage.

Polls will start closing at 19:00 EST or 00:00 GMT, and the excitement on exit polls will likely move markets, although the final result could take a couple of days. The focus will be on the seven key swing states, with Georgia, North Carolina and Pennsylvania among the first to report.

Other than that, the Federal Reserve (Fed) will announce its decision on Thursday. Market participants have widely anticipated a 25 basis points (bps) interest rate cut and, hopefully, hints towards a similar move in December. However, the outcome of the US election may well change the Fed’s path. Speculative interest fears a Trump victory could revive inflationary pressures and, hence, force the Fed to interrupt monetary loosening. Even further, some speculate the central bank may have to hike interest rates again.

Anyway, uncertainty will be cleared in the next couple of days, not only with the election result but also with Fed Chairman Jerome Powell’s press conference after the rate announcement.

XAU/USD short-term technical outlook

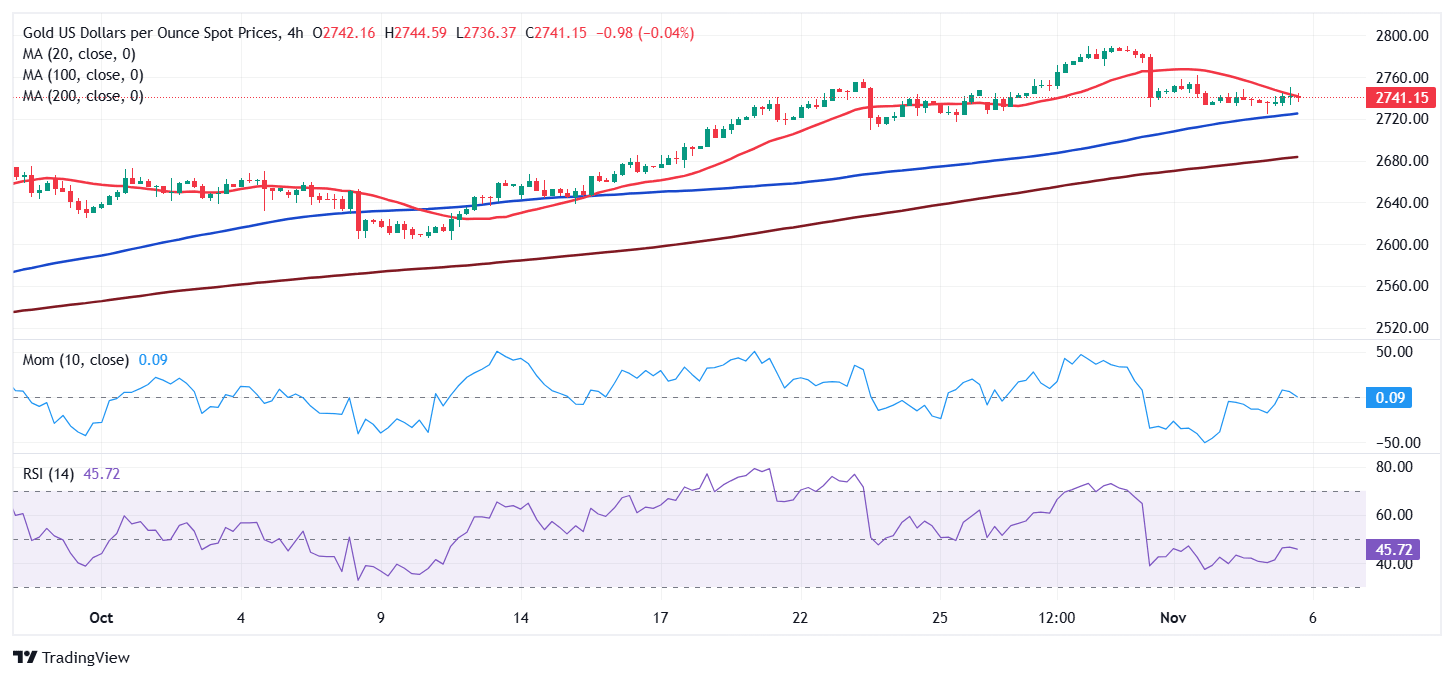

Ahead of critical events, the XAU/USD pair holds within familiar levels, consolidating around the $2,740 mark. The daily chart shows the pair has lacked directional strength for three days in a row. Also, the bright metal keeps developing above all its moving average, with a bullish 20 Simple Moving Average (SMA) providing dynamic support at around $2,710. The 100 and 200 SMAs also head north, although far below the shorter one. Technical indicators, in the meantime, remain within positive levels, with modest downward slopes, not enough to confirm another leg lower.

In the near term and according to the 4-hour chart, the risk skews to the downside. XAU/USD develops below a bearish 20 SMA, while a bullish 100 SMA provides intraday support at $2,724. Finally, technical indicators turned marginally lower below their midlines, suggesting sellers are in control of XAU/USD.

Support levels: 2,724.00 2,710.00 2,698.20

Resistance levels: 2,747.75 2,760.40 2,772.50

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.