Gold Price Forecast: XAU/USD declines to $2,720 corrective decline may continue

XAU/USD Current price: $2,719.65

- Rising US Treasury yields amid looming US elections back the US Dollar.

- Polls show a tight intention vote between Vice President Harris and former President Trump.

- XAU/USD aims to extend its corrective advance, could pierce the $2,700 level.

Spot Gold reached yet another record high on Wednesday, trading as high as $2,758.36 before turning south. The bright metal retreated from such a high and trades at around $2,720 as the US Dollar maintained its positive momentum across the FX board. Financial markets are in risk-averse mode, with global stocks under pressure. Tech shares led the slide, albeit speculative interest is also looking at government bond yields, which jumped this week in anticipation of the United States (US) presidential election.

The world’s largest economy heads into the polls in little over two weeks, with no clear winner ahead of the event. It seems Vice President Kamala Harris is leading and has a roughly 2% lead over former President Donald Trump, yet the difference is barely significant.

Meanwhile, Treasury yields extended their weekly advance. The 10-year note currently offers 4.26%, while the 2-year note yields 4.06%, levels not seen since early in July.

XAU/USD short-term technical outlook

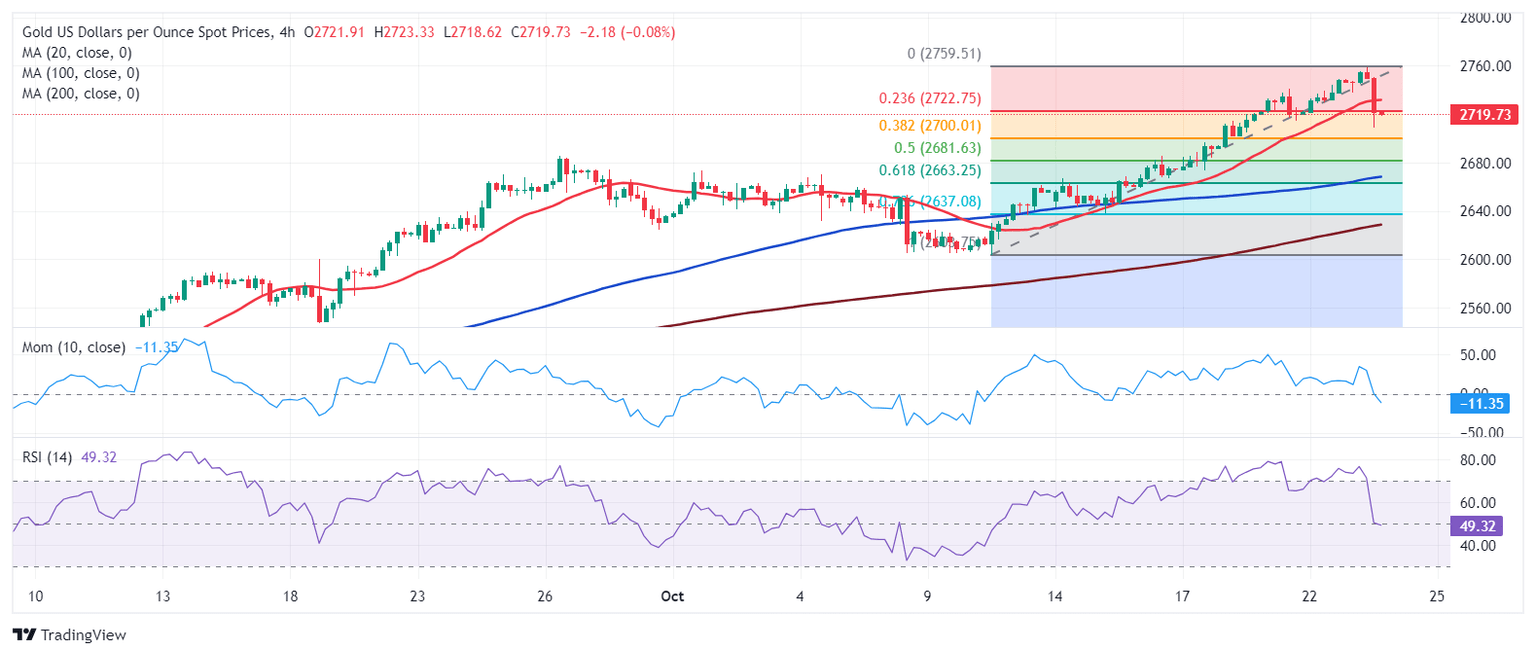

The XAU/USD pair is currently stuck at around the 23.6% Fibonacci retracement of the $2,601.87/$2,756.36 rally at $2,721.20. The decline seems corrective, although it may continue towards $2,698.66, the 38.2% retracement of the same rally.

In the daily chart, technical indicators turned south, with the Relative Strength Index (RSI) indicator correcting overbought conditions and the Momentum easing from October highs. Both indicators support another leg lower, yet a break through the daily low at $2,708.57 will help confirm the slide. Additionally, it is worth mentioning moving averages maintain their firm upward slopes far below the current level, keeping the long-term bullish trend alive.

The 4-hour chart shows a near-term downward continuation is likely. Technical indicators head south almost vertically, crossing their midlines into the negative territory. At the same time, XAU/USD lost its bullish strength and turned flat, now providing dynamic resistance at around $2,732.70. Nevertheless, the 100 and 200 SMAs keep advancing far below the current level, limiting the downward potential of the pair.

Support levels: 2,708.50, 2,698.60, 2,680.10

Resistance levels: 2,732.70, 2,744.10 2,758.40

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.