Gold Price Forecast: XAU/USD battles to regain the $2,500 mark

XAU/USD Current price: $2,496.69

- Weaker-than-anticipated United States employment data boosted the mood.

- The US Treasury yield curve turned flat, signalling decreased recession fears.

- XAU/USD bounced from a fresh weekly low, bears still have a chance.

Spot Gold trades just below the $2,500 level, recovering from a fresh weekly low of $2,472.40 posted during London trading hours. XAU/USD remained on the back foot throughout the first half of the day but changed course with the release of United States (US) data.

The number of job openings on the last business day of July stood at 7.67 million, according to the JOLTS Job Openings report released by the US Bureau of Labor Statistics (BLS). The reading was well below the 8.1 million expected, putting pressure on the US Dollar. The figures, showing a weaker labor market, fueled speculation that the Federal Reserve (Fed) is now more likely to trim interest rates by 50 basis points (bps) when it meets in a couple of weeks.

Enthusiasm about lower borrowing costs also helped equities. Wall Street shrugged off the negative note of its overseas counterparts and posts modest gains mid-session, further weighing on the American currency.

The report was the first of a series that will end on Friday with the Nonfarm Payrolls (NFP) report. On Thursday, the focus will be on the ADP Employment Change figure, which indicates new job positions added on a monthly basis by the private sector. Market participants anticipate it would hit 145K in August after printing at 122K in July.

In the meantime, the US Treasury yield curve has turned flat. Both the 10-year note and the 2-year note are yielding roughly 3.79%. Generally speaking, the longer-term bond tends to offer a higher return. The inverted scenario, which has been in place for a couple of years now, is usually seen as a sign of an upcoming recession. Sure enough, a return to normal in the yield curve should back a firmer recovery among high-yielding assets and limit Gold gains.

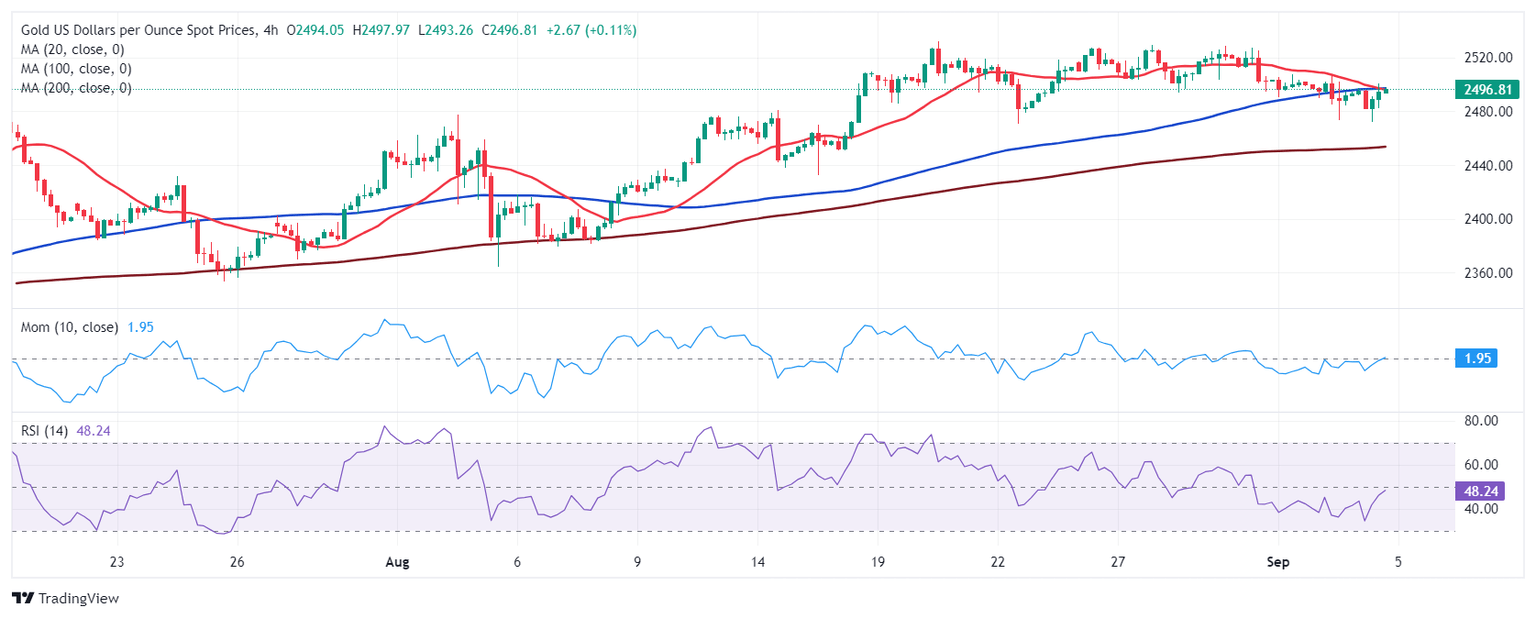

XAU/USD short-term technical outlook

The daily chart for XAU/USD suggests that buyers are adding on dips. The pair fell below a bullish 20 Simple Moving Average (SMA) but quickly recovered above it for a second consecutive day. At the same time, technical indicators have lost their downward slope and are currently consolidating within positive levels. Finally, the 100 and 200 SMAs maintain their upward slopes far below the shorter one, reflecting sustained aims to push it higher.

In the near term, and according to the 4-hour chart, XAU/USD is neutral. The price converges with the 20 and 100 SMAs, with the shorter one about to cross below the longer one, usually a sign of an upcoming slide. At the same time, technical indicators recovered from their intraday lows and turned flat at around their midlines. Should the pair fail to reconquer the $2,500 mark, there is a chance the aforementioned low gets retested in the near term.

Support levels: 2,489.60, 2,475.70 2,463.40

Resistance levels: 2,507.40 2,519.75 2,531.60

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.