Gold Price Forecast: XAU/USD approaches recent lows around $2,580

XAU/USD Current price: $2,590.05

- The Bank of Japan and the Bank of England kept rates on hold in their December meetings.

- The United States upwardly revised Q3 Gross Domestic Product figures.

- XAU/USD resumed its slide and aims for lower lows below $2,580.

Spot Gold came under selling pressure early in the American session after peaking at $2,626.31 during European trading hours. The US Dollar (USD) shed some ground throughout the first half of the day after reaching extreme overbought conditions in the Federal Reserve’s (Fed) aftermath. The United States (US) central bank delivered a hawkish cut, trimming the benchmark interest rate by 25 basis points (bps), while scaling back policymakers’ perspective on potential cuts in the upcoming years.

Global stock markets felt the heat, as most Asian and European indexes settled in the red on Thursday, following Wall Street’s slump post-Fed. US indexes kick-started the new day, trimming part of their Wednesday’s losses, but remain under strong selling pressure, helping the USD resume its advance.

Also backing the Greenback, US data was upbeat. The country published the final estimate of the Q3 Gross Domestic Product (GDP), which showed that annualized growth was higher than previously estimated, confirmed at 3.1% vs. the previous 2.8%. Initial Jobless Claims for the week ended December 13 declined to 220K from 242K in the previous week, also beating the expected 230K.

Also worth noting is that the Bank of Japan (BoJ) and the Bank of England (BoE) announced their decisions on monetary policy. The BoJ kept the short-term rate target unchanged in the range of 0.15%-0.25%, and give no clues on what’s next for monetary policy. The Bank of England also kept the benchmark interest rate on hold at 4.75%, albeit MPC members delivered a dovish message, reiterating a gradual approach to rate cuts coming up next.

XAU/USD short-term technical outlook

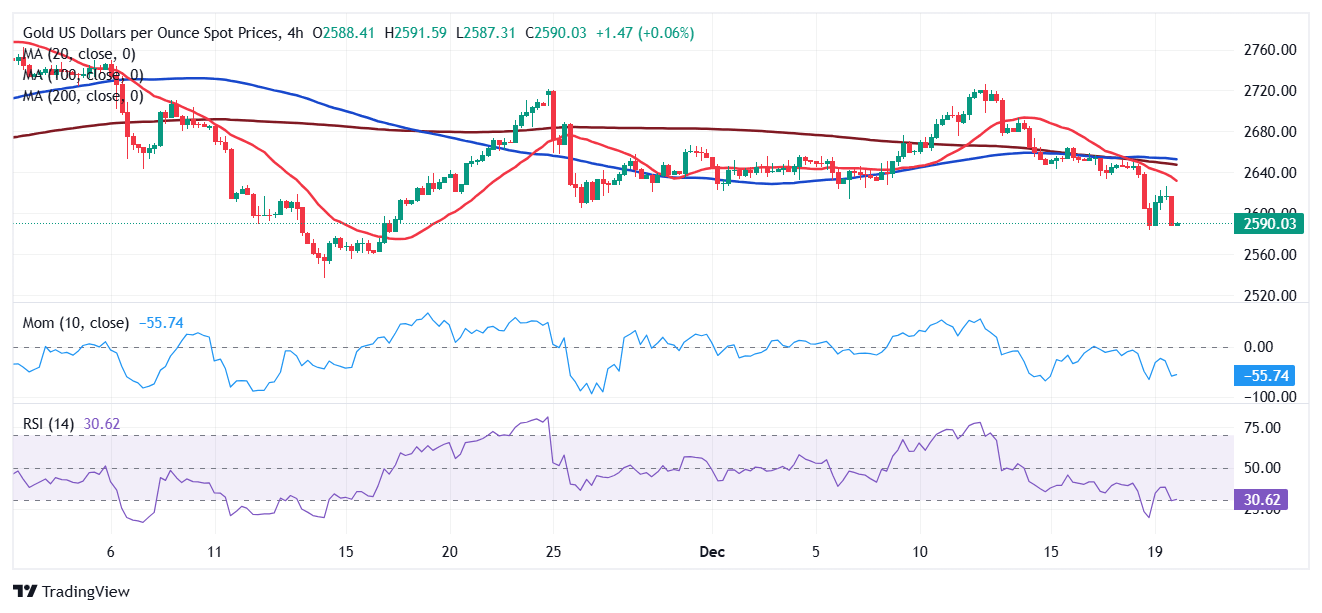

From a technical point of view, the XAU/USD is at risk of falling below its recent multi-week low at $2,582.93. The daily chart shows the pair trimmed almost all its intraday gains. Gold is currently below its 20 and 100 Simple Moving Averages (SMAs), below the longer one for the first time since October 2023. The 200 SMA, in the meantime, maintains its bullish slope around the $2,470 level. Finally, technical indicators offer neutral-to-bearish slopes well into negative territory, far from suggesting the pair may recover again.

In the near term, and according to the 4-hour chart, XAU/USD seems to have completed its corrective advance and is ready to reach fresh lows. The bright metal is developing below all its moving averages, with the 20 Simple Moving Average heading firmly south below the longer ones, reflecting sellers’ strength. Technical indicators, in the meantime, have retreated from their intraday peaks, anyway, set below their midlines.

Support levels: 2,582.90 2,568.80 2,554.10

Resistance levels: 2,603.20 2,617.55 2,632.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.