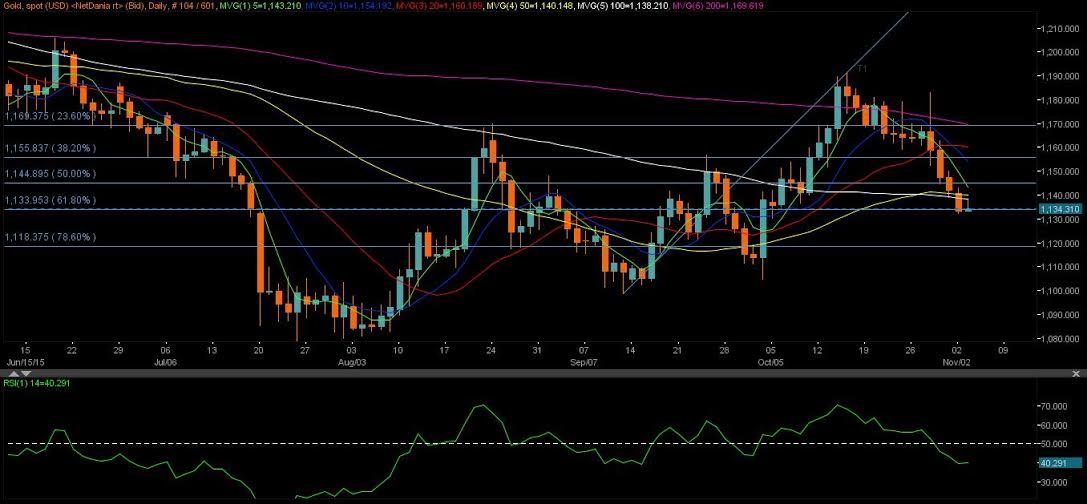

Gold prices in terms of the US dollar (XAU/USD) extended the downward spiral into a fourth day on Monday and remained submerged in the red at fresh monthly lows of 1132.40. On daily charts, the prices fell below most major moving averages and closed at 1133.33, below the key Fib 61.80% (retracement of Sept 11-Oct 15 rally) level located at 1133.95. The ongoing Dec Fed rate hike speculations were further boosted by the above estimates US manufacturing PMI reports from both Markit as well as ISM released in the US session. The ISM said its PMI booked 50.1 last month, from a reading of 50.2 in September. While the latest final PMI reading from Markit hit a 7-month high, coming in at 54.1 in Oct, versus 53.1 seen in September.

Currently, the yellow metal trades within a shouting distance of the monthly lows and remains weak after the US dollar halted its corrective slide and resumed the recent upbeat momentum. Gold prices remain undermined as the last week’s FOMC reinforced Dec Fed rate hike bets, with markets now eyeing Friday’s crucial NFP report to seal in a Dec Fed rate rise. Hence, gold bulls are expected to remain on the back foot with the looming Fed lift-off. Also, Wednesday’s Fed Chair Yellen’s testimony could also shed fresh light on the Fed interest rate outlook. The non-interest bearing gold suffers the most in high-interest-rates environment. Later in the day, US factory orders will be reported, with markets expecting the drop in the orders to ease in Oct (-0.8% exp.) against -1.7% booked previously.

Technicals – $ 1120 in sight on USD rebound

On daily charts, the prices remain capped below the crucial 100-DMA located at 1138.40 and continues to consolidate to downside, below most major moving averages. The pair is seen clinging to the aforesaid Fib 61.80% levels in last hours. The daily RSI around 40 has turned flat from the previous upward tick. Thus, indicating further room for declines.

To the downside, the prices could once again test the Fib 61.80% support, below which a renewed sell-off is likely to trigger driving the prices towards the next support in sight at 1121-1122 region (Sept 22 & 23 Low). A breach of the last, the prices could test the Fib 78.60% (of the same rally) located at 1118.37 levels. The scope for further upside remains bleak so long as the prices trade below 1138-1140 levels, the confluence zone of the 100 and 50-DMA.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.