The XAU/USD pair (gold prices in terms of the US dollar) was relentlessly offered on Wednesday and cracked through the key Fib 61.80% support (Sept rally) located 1120.65, triggering a renewed sell-off. The prices accelerated the drop to $ 1111.60 levels, just ahead the next Fib 78.60% Fib retracement of the same rally located at 1110.60. The move was well anticipated as the greenback was bolstered after the US private-sector employment data released by ADP showed 200k jobs added in September, beating expectations for a 190k increase. While markets ignore dismal Chicago PPMI report. The pair remained pressured even though the Fed Chair Yellen spoke nothing on the monetary policy outlook, as the main focus now remains Friday’s NFP.

As for today’s trade so far, XAU bears took a breather after a five-day losing streak as gold traders appear cautious and have turned on the side-lines ahead of tomorrow’s highlight – the US non-farm payrolls data which might have major impact on the Fed’s interest rate outlook. The prices continue to mire near fresh two-week lows struck at 1111.07 in the European morning and look to pose a minor rebound on the US jobless claims and manufacturing data, which are expected to come in weaker than the previous reading.

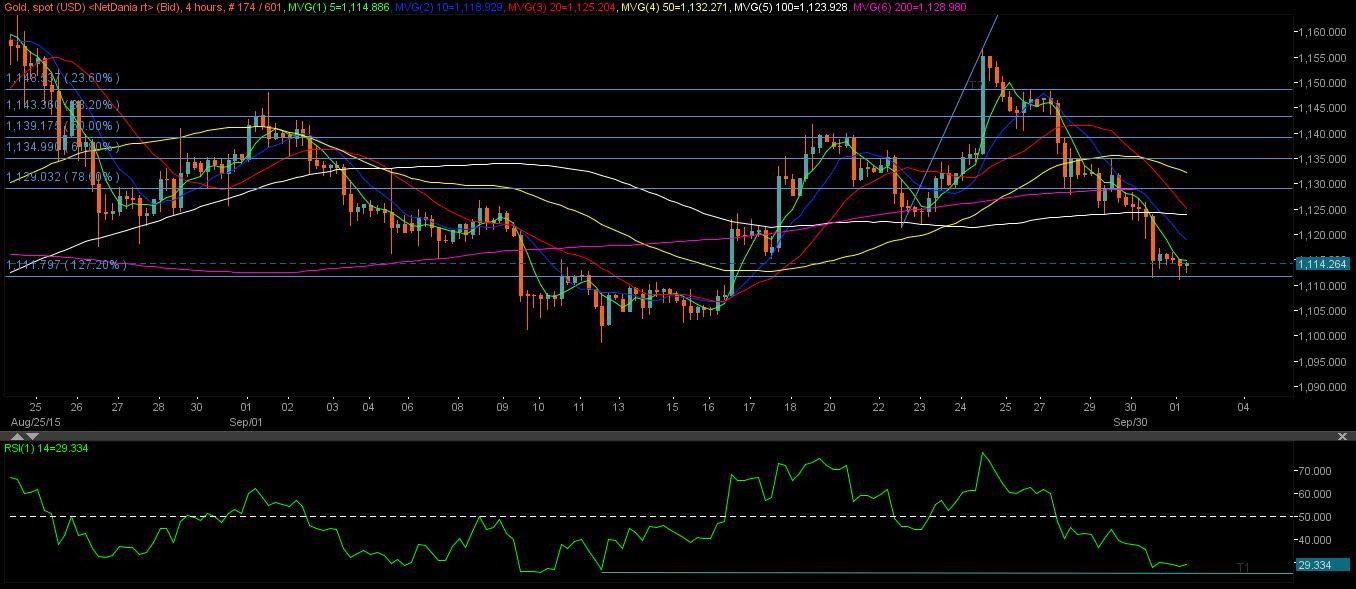

Technicals – below estimates US data could aid the recovery

On 4 hour charts, the prices seem to have bounced-off a major support at the Fib 127.20% retracement of last week’s rally, located above 1111 and now attempt a tepid-recovery towards the daily highs posted at 1116.39. A break above the last, the prices could climb further for a test of the hourly 10-MA at 1118.90 and the hourly 100-MA placed at 1123.92. This case will hold true if the US datasets miss estimates. While the downside seems limited to the above mentioned Fib support. However, in case the prices breach the last, selling pressure is likely to intensify drowning the pair towards 1100 – psychological levels. The RSI has rebounded higher near 30, also pointing to further upside in the session ahead.

On daily charts, the daily RSI has turned flatter around 44 and also indicate potential for a minor rebound towards the 50-DMA resistance located at 1118.90, beyond which a retest of the Fib 61.80% support-turned resistance (Sept rally) will come into the picture. A failure to break above the last, prices could once again fall back towards the afore-mentioned Fib 78.60% support. On breach of the last, a test of 1100 levels becomes imminent.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The markets remain unconvinced that the Fed will pivot earlier than previously expected.

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

Gold gains ground above $2,400, eyes on Fedspeak

Gold price gathers strength around $2,415 during the early Asian session on Monday. The softer US inflation data in April provides some support to the yellow metal. Meanwhile, the USD Index edges lower to 104.50, losing 0.03% on the day.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.