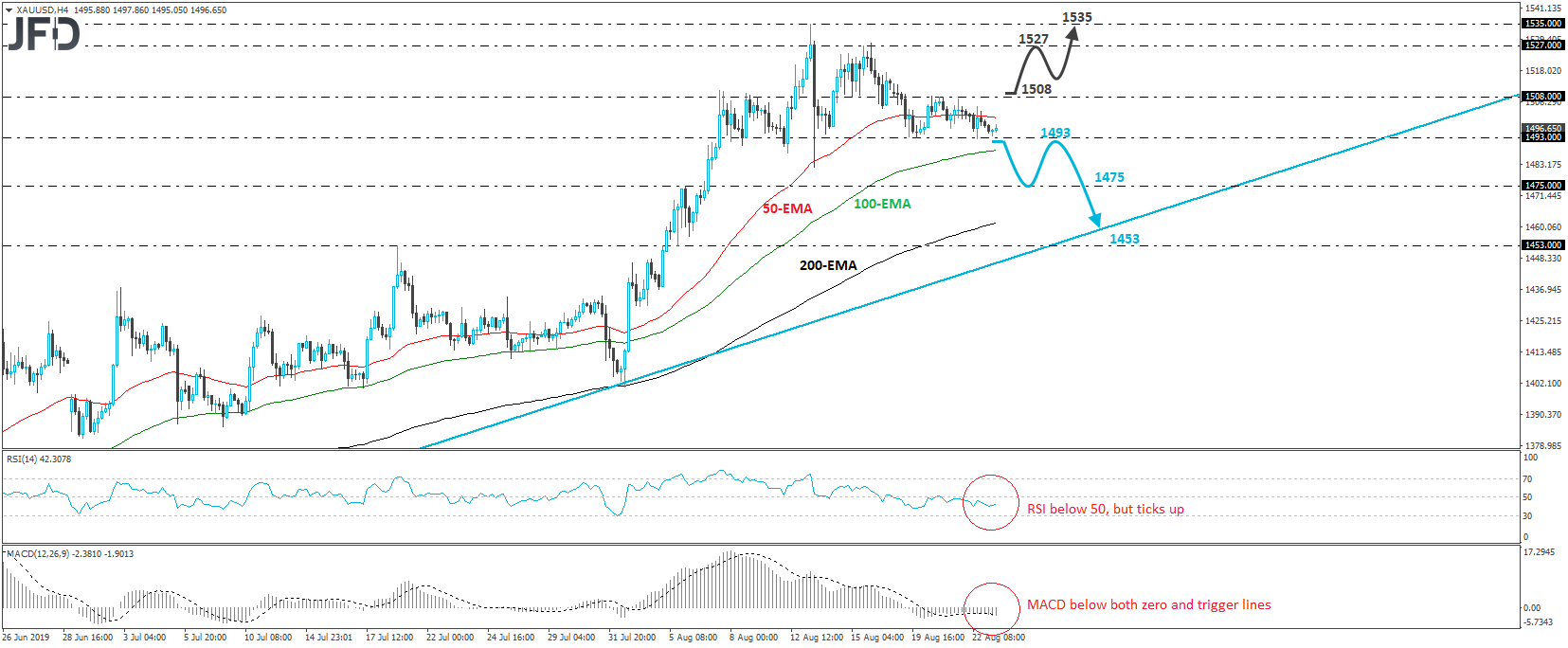

XAU/USD traded in a quiet mode today, staying slightly above the key support zone of 1493. The metal has been trading in a sideways manner between that barrier and the 1508 hurdle since Monday, and although it stays above the tentative upside support line drawn from the low of May 30th, since August 13th the bulls have been failing to create a higher high. Therefore, we would stay cautious that a corrective decline may be in the works for the short run.

A clear and decisive dip below 1493 may confirm the case for a corrective retreat and may initially pave the way towards the 1475 hurdle, which is marked as a support by the inside swing high of August 6th. If the bears do not give up near that barrier and drive the action below it, then we could see the correction extending towards the aforementioned upside line, or the 1453 area, defined by the inside swing peak of July 18th.

Taking a look at our short-term oscillators, we see that the RSI stands below 50, but has just ticked up, while the MACD lies below both its zero and trigger lines. Both indicators detect negative momentum, but the fact that the RSI ticked up suggests that a small bounce may be looming before a possible negative leg, perhaps for a test near the upper bound of the aforementioned small range, at 1508.

However, we would like to see a strong break above that zone before we abandon the case with regards to a corrective retreat. Such a break could signal that the bulls are interested in driving the metal higher again and may pave the way towards the 1527 area, near the highs of August 15th and 16th. If they are strong enough to overcome that obstacle as well, then we may see them challenging the peak of August 13th, at 1535, which is also the highest since April 2013.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.