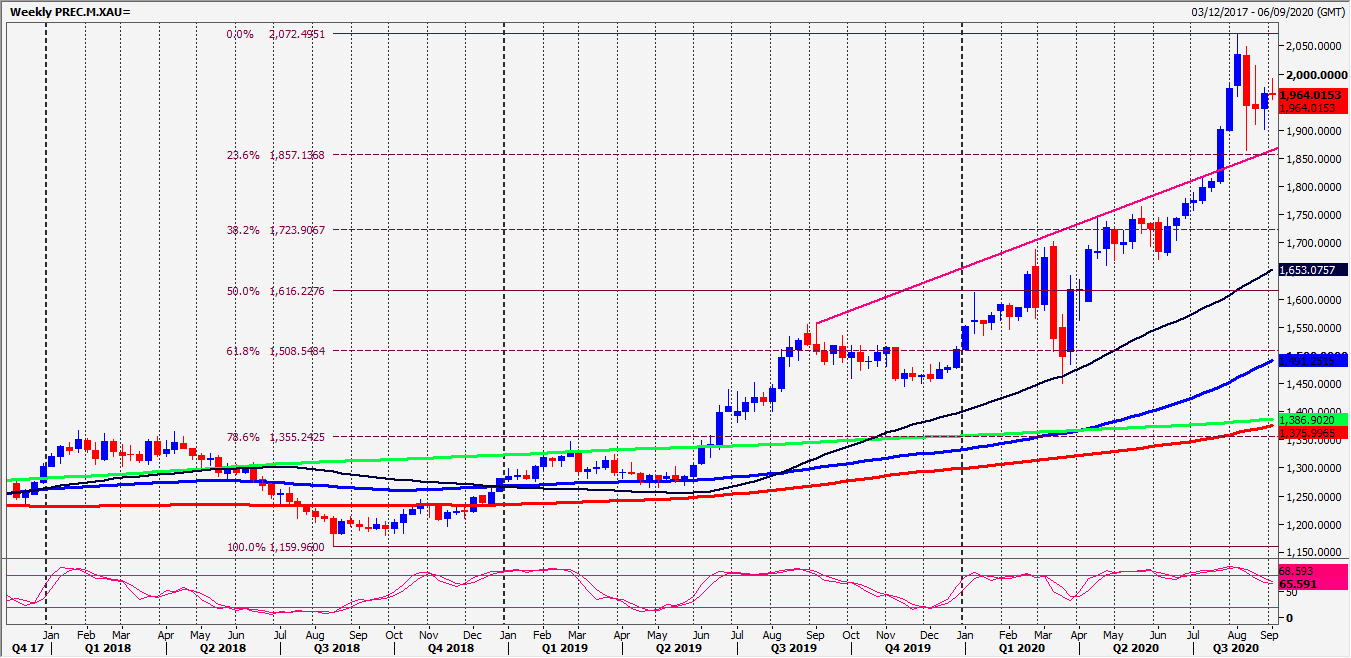

Gold

Gold Spot initially topped exactly at the selling opportunity at 1970/75 for the 3rd or 4th time. This levels has offered great profits over the past week. However I did warn that this was more likely to break vent yesterday...and exactly as predicted we broke higher through 1980 for a clear buy signal.

However gains could not be sustained & we now appear to be forming a triangle consolidation pattern.

Silver Spot also moving higher of course beating last week's high at 2785/90 & 2 week highs at 2840/44 but has collapsed from 2888 leaving a short term bull trap. This also signals further sideways trading.

It is too risky at this stage to run longer term bull positions until we get a clear buy signal.

Daily Analysis

Gold likely to continue to trade sideways in the days ahead. The best support for today is at 1951/1947. Try longs with stops below 1942. A break lower is a short term sell signal targeting 1937, 1931, perhaps as far as 1 month trend line support at 1924/22. Try longs with stops below 1918.

There's very minor support at 1960 & if we bounce from here this morning we meet strong resistance at 1970/75. Shorts need stops above 1980. A break higher tests 2 week trend line resistance at 1989/91. (This is the upper trend line of the triangle). Bulls need a break above here for a buy signal targeting 1999/2001, perhaps as far as 2 week highs at 2012/14.

Silver meets minor support at 2780/75 but below here meets the best buying opportunity for today at 2725/15. Try longs with stops below 2705.

Holding minor support at 2780/75 targets 2810, perhaps as far as 2830. If we continue higher look for 2845/50, before resistance at yesterday's high of 2883/88.

Chart

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.