Introduction

A bumper US NFP print of 292k in comparison to 200k expected has led the market to envisage a more hawkish Federal Reserve in 2016, which has enticed a more risk-off environment with regards to the global economic outlook. Chinese inflation data released over the weekend proved largely in line with expectations but sentiment remains incredibly nervous, despite the lower USD/CNY fixing for the second business day in a row.

Asian Session

The Japanese enjoy their first holiday of the year today. The Hang Seng and Shanghai Composite Indices lost ground with the latter coming off by close to 5%. USD/CNY trades currently at 6.5843 currently.

Despite the holiday in Japan, there have been buyers of JPY evident with USD/JPY down at 117.13. The pair has reached a low of 116.70 overnight amidst safe-haven buying. Long term support can be seen at 115.58; the level for the pair at the time of the oil shock upon the Russian economy in December 2014.

Antipodean currencies have remained largely stagnant. ANZ job advertisement info. came in at -0.1% compared to 1.3% last. Australian stocks were hit in line with Asian bourses. AUD/USD and NZD/USD trade at .6968 and .6535 respectively whilst the AUD/NZD cross stands at 1.0662 right now.

The day ahead in Europe and NY

European equity futures are expected to open lower this morning. The Swiss Franc has gained 0.15% against G10 counterparties ahead of the release of retail sales out of Zurich at 08:15 GMT.

Scandinavia sees a fairly busy morning of data releases with Danish inflation and trade balance data printing at 08:00 GMT. USD/DKK trades at 6.8322 into the release whilst USD/NOK stands at 8.8944 in anticipation of Norwegian inflation data at 09:00 GMT.

EUR/USD and EUR/GBP are trading at 1.0919 and .7511 at the beginning of the week. European traders will look to Sentix Investor Confidence info. published at 09:30 GMT today.

Later in The States and Canada, housing data is released out of Toronto at 13:15 GMT. Both labour market conditions info. for The US and a business outlook survey for Canada will be released at 15:00 GMT and 15:30 GMT respectively. Later at 17:40 GMT, Dennis P. Lockhart of The Federal Reserve will speak.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.0919 | -0.02% | 1.097 | 1.0908 |

| USDJPY | 117.13 | 0.04% | 117.48 | 116.7 |

| GBPUSD | 1.4535 | 0.13% | 1.4559 | 1.4494 |

| AUDUSD | 0.6968 | 0.27% | 0.6983 | 0.6928 |

| NZDUSD | 0.6535 | -0.11% | 0.6568 | 0.6509 |

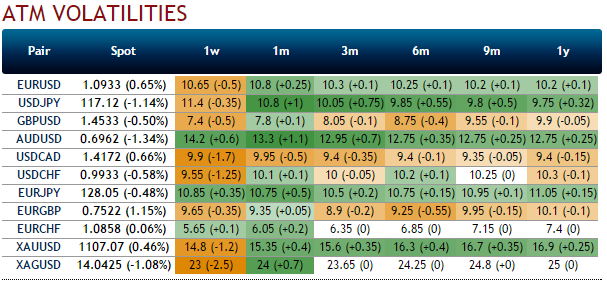

FXO

Overnight EUR/USD trades at volatility of approx. 17.0% which seems high without any notable data or events today or tomorrow. On Thursday, ahead of US employment figures, overnight EUR/USD strikes traded at approx. 19.0%.

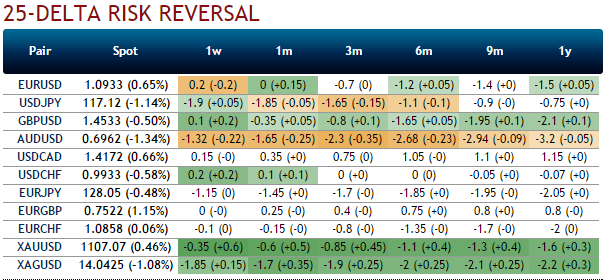

The largest sentiment change within the retail currency options space at Saxo Bank A/S comes regarding USD/CHF options. 42% of traders now favour the upside which is a move higher by 6% since this time on Friday.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.