USD stages broad comeback, especially against commodity dollars

USDCAD hits new more than 11year high

CAD and NOK dented by Opec's failure to agree on any production curtailment

EURUSD consolidates back toward first support in the 1.0800 area

Key developments in FX today:

The US dollar staged a relatively broad comeback today after looking very weak on Friday, with USDCAD pulling to a new 11-plus-years high and AUDUSD and NZDUSD the most interesting of strong USD statements, as the commodity dollars were the weakest performers.

CAD and NOK were very weak broadly on lower oil prices after Opec failed to reach agreement on any action to curtail production.

Elsewhere, the euro spike from last Thursday consolidated further, with EURUSD back toward the 1.0800 area of first support and EURGBP shying away from the key resistance area above 0.7200. The equivalent EURJPY area is the 134.00/50 zone around the 200-day moving average.

The focus later this week will be on central bank meetings on Thursday, including the Reserve Bank of New Zealand, which could see NZDUSD challenging the key local support area around 0.6600 again if the bank is sufficiently dovish, and the Swiss National Bank, which may need to respond to the ECB's easing measures to keep EURCHF in the higher range.

The Bank of England could bring fewer developments, but could spark volatility in the main GBP crosses. GBPUSD seems to have popped higher on last week's EURUSD tsunami rather than on any fresh relative developments.

USDCAD

USDCAD burst to a new more than 11-year high today and could see further upside if the USD remains resilient and especially if oil prices trade significantly lower. Support now moves up to the 1.3400/50 zone, and the next target area looks like at least 1.3650 and possibly 1.3750.

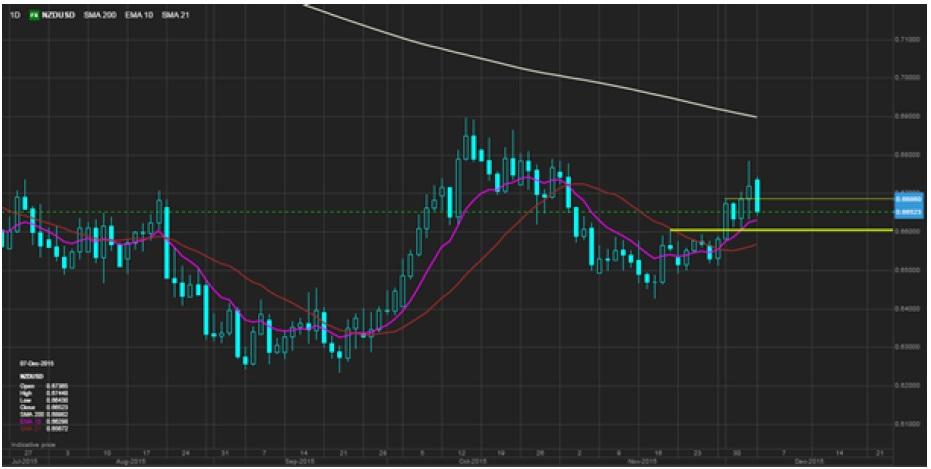

NZDUSD

The kiwi squeezed sharply higher through local resistance late Friday, a move that in 20-20 hindsight looks to have been stop-loss-driven. Today's reversal suggests the direction for the pair is far from settled, and a sufficiently dovish surprise from the RBNZ (merely cutting as the majority expect, together with reasonably dovish guidance) could see the pair push down through the 0.6600 area, which could finally open up for a test of the 0.6250 area lows again.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The Fed’s Bostic, Barr, Waller, Jefferson, and Mester are set to speak on Monday.

EUR/USD: Could FOMC Minutes provide fresh clues?

The EUR/USD pair advanced for a fourth consecutive week, comfortably trading around 1.0860 ahead of the close. Progress had been shallow, as the pair is up roughly 250 pips from the year low of 1.0600 posted mid-April.

Gold looks to extend uptrend once it confirms $2,400 as support

Gold price continued to push higher last week and rose above $2,400 on Friday, gaining nearly 2% for the week. Investors will continue to scrutinize comments from Fed officials this week and look for fresh hints on the timing of the policy pivot in the minutes of the April 30-May 1 meeting.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.