Market players have dashed into the new trading week, adopting a risk-on attitude after November's strong NFP report and progress in the US tax reform initiatives, boosted risk sentiment.

Most Asian Indexes ventured higher during trading on Monday, thanks to a return of risk appetite following the better-than-expected Chinese trade figures on Friday. In Europe, shares were buoyed by news of a breakthrough in Brexit negotiations and this market positivity could find its way back into Wall Street in the afternoon. With positive economic data from the US and China boosting investor optimism over the global economy, equity bulls could remain in the vicinity this week.

Dollar lower ahead of Fed

The Greenback struggled to maintain gains against a basket of currencies on Monday, as investors continued to digest and evaluate November's US jobs data.

Although US Non-farm payrolls blasted through market expectations by rising 228,000 last month and unemployment remained at a 17-year low, wage growth figures printed below forecasts by rising 2.5% for the year. With sluggish inflation and slow wage growth fuelling uncertainty over the Federal Reserve's policy outlook beyond 2017, the Dollar has found itself under pressure. There is a possibility of the Greenback turning volatile this week as bulls and bears enter a fierce tug of war. While optimism over US tax reforms is likely to continue supporting bulls, uncertainty over the Fed outlook next year amid lacklustre wage growth, may attract bears.

From a technical standpoint, the Dollar Index edged lower during Monday's trading session with prices trading around 93.80 as of writing. An intraday breakdown below 93.80 may encourage a further decline towards 93.60, ahead of the Federal Open Market Committee (FOMC) statement on Wednesday.

Currency spotlight – GBPUSD

Sterling weakened against the Dollar on Monday, despite last week's breakthrough in Brexit negotiations opening the doors for future trade talks.

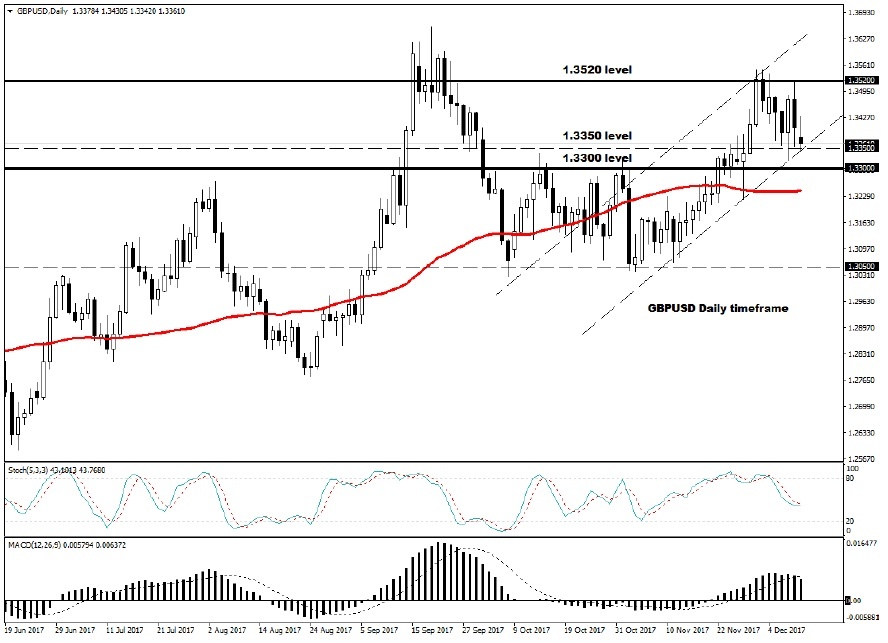

Although the United Kingdom and the European Union can now move on to the second phase of the talks, investors still remain somewhat anxious, and this is reflected in Sterling's price action. With the Pound still highly sensitive to the Brexit developments and headlines, this could be another interesting trading week for the currency. Taking a look at the technical picture, the GBPUSD is at risk of depreciating towards 1.3300 and even lower if 1.3350 is breached. Bears still have some degree of control on the daily charts, as long as prices can stay below the 1.3520 resistance level.

Bitcoin futures in the spotlight

Bitcoin was the hot topic across financial markets on Monday morning after making its debut onto the future markets in style.

The cryptocurrency exploded uncontrollably higher following the launch of futures by Chicago Board Options Exchange (CBOE), forcing the CBOE to halt trading twice in an effort to tame volatility. With the futures listing of Bitcoin, seen among some as another step towards legitimacy, this sentiment has the ability to bolster investor attraction - consequently supporting the upside. From a technical standpoint, Bitcoin staged a remarkable rebound from the $13000 regions last week with prices hovering around $16500 as of writing. A decisive breakout above $16700 may instil bulls with enough inspiration to challenge $17,000 and beyond.

It's remarkable how back in November $10000 seemed like a psychological end of year target. With the current gravity-defying bullish momentum, it may be no surprise if Bitcoin concludes 2017 on $20000.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.