Yesterday’s Trading:

On Monday trades in Europe finished around the level that the Asian session opened at. During the first half of the day the euro weakened against the dollar to 1.1371 due to a sharp fall in the euro/pound cross. There was no news to strengthen the pound. The dealers reckon that the demand for pounds was caused by one big order. Maybe.

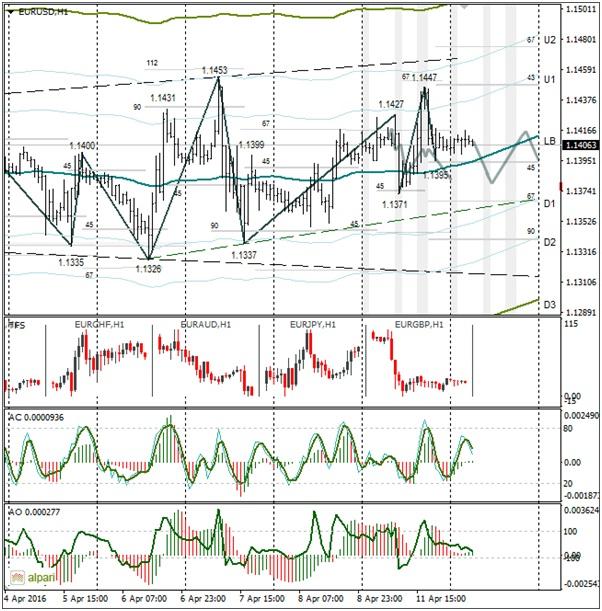

In the second half of the day the euro strengthened due to the general weakness of the dollar which, in my opinion, was caused by oil price movements. Before the meeting in Doha, Brent rose to $43.03. Following the rise in oil price, the Canadian dollar rose. The euro/dollar restored to 1.1447 and closed the day at 1.1405.

Market Expectations:

The euro/dollar is continuing to trade in a seven-day range of 1.1326-1.1453. The euro/pound is readying to fall to 0.7963. Consequently, in the first half of the day we could see a repeat of yesterday.

Germany is publishing its definitive March CPI and the US is releasing import/export prices today. This evening Fed representatives Williams and Lacker are set to speak. In my forecast I’ve gone for a sideways in a 1.1365-1.1420 range.

Day’s News:

-

11:30, UK CPI, RPI and PMI for March;

-

15:30, US import prices for March;

-

16:00 FOMC’s Harker to speak;

-

21:00, US federal budget balance for March;

-

22:00, FOMC’s Williams to speak;

-

23:30, FOMC’s Lacker to speak;

-

23:35, API’s weekly oil reserve report.

Technical Analysis:

We see a 17-hour correction in a narrow range on the euro/pound. If the euro can’t manage to strengthen against the pound, ready yourselves for a break in 0.7994. The closest support runs through 0.7665. A fall in the cross will cause a fall in the euro/dollar. However, since oil isn’t losing value, in the second half of the day the euro could get back all of its losses from the first half of the day. We want to see a close of the day near the LB at 1.1395.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.