Trading opportunities for currency pair: the monthly candle has closed the previous two months and will be closing down. The target is 1.4560. Due to the general strengthening of USD and according to the cycle, the pound/dollar’s fall could last until the beginning of March 2016. Since the scenario is a weekly one, it could become invalid if the weekly candle closes above 1.5340.

As things are at the moment:

The pound/dollar closed at 1.5030 against 1.5046. The pound strengthened to 1.5335 as part of an upward correction and then returned to where it was. The support remained unbroken with the weekly indicators showing a further fall for the GBP.

Weekly GBP/USD

After the broken trend line (dotted line), the pound couldn’t manage to win back its losses. The price returned to the support. All of the indicators (CCI, AC, and AO) are showing a further fall for the pound sterling. Just as before, I’m still waiting for the support to be broken. The first target is 1.4950 and after that the road to 1.4565 will open up.

We can expect a sharp fall of the GBP/USD if there is an upward inversion of the euro/pound cross. Don’t expect this inversion to come before 3rd December (ECB meeting).

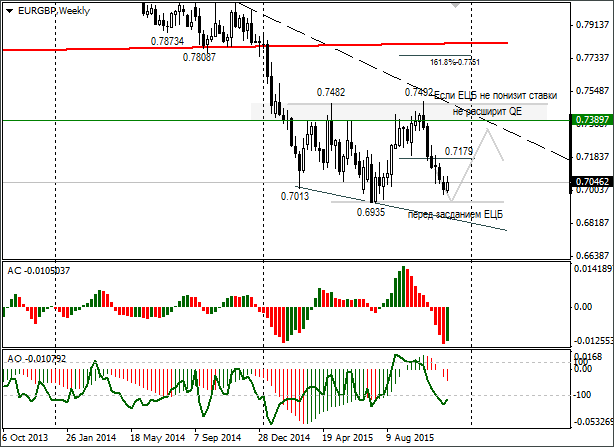

Weekly EUR/GBP

The price already takes account for a further relaxation of monetary policy. If the ECB disappoints the market, the euro/pound will flip downside up. After the ECB has convened, traders will be focussing their attention on Friday’s US labour market report and the FOMC meeting. Here I think we’ll see a double bottom. This pattern could be realized even if the ECB relaxed its monetary policy further.

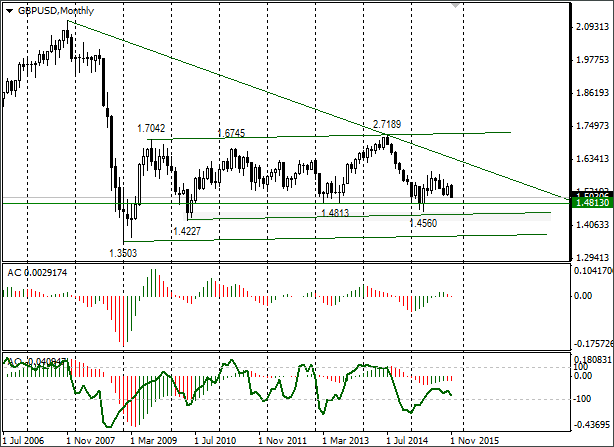

Monthly GBP/USD

The monthly candle will close on Tuesday. I’ve put this graph in the review to show you the full picture for the GBP/USD. It’s unlikely that anything will change over the course of Monday. For now, November has closed two previous candles and this is a bear signal.

If we put a line through the 1.7042 and 2.7189 maximums and then attach a parallel line to the 1.4227 minimum, we get a support at 1.4430. I took the target from April 2015’s minimum.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.