GBP/USD tilts higher after hawkish BOE interest rate decision

US stock futures tilted higher after relatively strong quarterly results. The Dow Jones rose by 100 points while the S&P 500 and Nasdaq 100 index rose by 12 and 40 points, respectively. Apollo Global Management earnings more than doubled in the second quarter as the company sold more assets. Similarly, Uber revenue jumped in the second quarter while the New York Times reported 8 million members. Other stocks that have reported strong results this week are firms like CVS and Western Union. Other firms that are set to publish their results today are Ball Corporation, Kellogg, Spire Inc, Viasat, and Papa Johns.

The FTSE 100 index was little changed even after the strong quarterly results. The index was trading at 7,123 pounds, where it has been in the past few days. The top movers in the index were Rolls-Royce and WPP. The Rolls-Royce Holdings stock rose by more than 2% after the company reported a profit of more than 300 million pounds. WPP, the world’s biggest advertising agency, also reported strong results as the advertising industry rebounded. Other FTSE 100 firms that have reported strong results recently are Lloyds Bank and BP.

The GBPUSD pair tilted upwards after the latest Bank of England (BOE) decision. The bank decided to leave interest rates unchanged at 0.10%. It also decided to leave its quantitative easing policy unchanged in a bid to support the recovery. This was the first meeting without Andrew Haldane, the former hawkish official. The decision came at a time when the UK is seeing more Covid cases and higher inflation. In July, the country’s headline CPI jumped by 2.5%, which was higher than the target of 2.0%.

EUR/USD

The EURUSD pair was little changed today as traders waited for the latest US trade numbers and non-farm payrolls (NFP). The pair is trading at 1.1840, where it has been in the past few days. The price is slightly higher than last week’s low of 1.1753. It has also moved slightly above the 25-day moving averages while the MACD and Relative Strength Index (RSI) have formed a bearish divergence pattern. Therefore, the pair will likely remain in this range as traders wait for the US non-farm payrolls data.

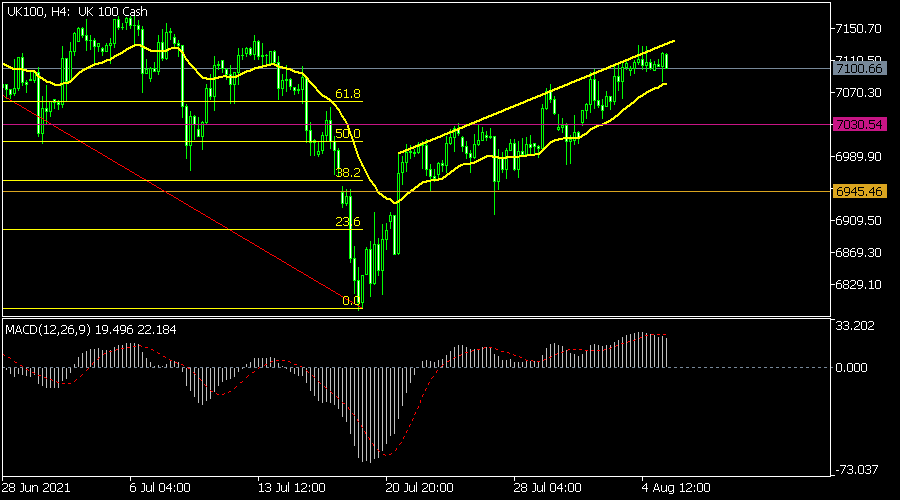

UK100

The FTSE 100 index was in a tight range after strong Rolls-Royce, WPP, and Taylor Wimpey results. The index is trading at £7,105, which was lower than this week’s high of £7,128. On the four-hour chart, the price was above the 25-day moving average and slightly above the 61.8% Fibonacci retracement level. The signal line of the MACD was above the neutral line. Therefore, the pair will likely maintain the bullish trend as bulls target the next key resistance at £7,160.

GBP/USD

The GBPUSD pair rose after the Bank of England decision. The pair rose to a high of 1.3925, which was substantially higher than July’s low of 1.3570. On the four-hour chart, the pair is above the 25-day and 15-day moving averages. It has also formed an inverse head and shoulders pattern, which is a bullish sign. It also moved above the 50% retracement level. Therefore, the pair will likely keep rising, with the next reference level being at 1.4050.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.