- GBP/USD saw a technical rebound, snapping three straight weekly declines.

- UK political uncertainty overshadowed aggressive BOE tightening bets.

- US dollar corrected ahead of the Fed verdict; 21 DMA holds the key for cable.

The long-due US dollar correction and increasing odds of a 50 bps BOE rate hike in August brewed a perfect mix for the much-needed recovery in GBP/USD from over two-year lows. Although uncertainty surrounding the UK political scenario and the critical 21-Daily Moving Average (DMA) capped the rebound in the currency pair. Bulls took a breather also ahead of the all-important Fed interest rate decision, US advance GDP and inflation data.

GBP/USD: What happened last week?

The Fed’s ‘blackout’ period carved out a perfect opportunity for GBP/USD to attempt a comeback after being dumped to the lowest level since March 2020 at 1.1760 a week ago. Easing bets of a 100 bps rate hike, in the face of less hawkish commentary from the Fed policymakers and softening University of Michigan's Consumer (UoM) Sentiment inflation expectations sub-component, triggered a broad correction in the US dollar from two-decade highs. The probability of a 100 bps Fed rate hike in July dropped below 30% after reaching 90% on hot US inflation data.

Along with the dollar pullback, a chart-driven technical rebound was the main catalyst behind cable’s upturn. Meanwhile, upbeat UK employment data and hotter inflation boosted the chance of a 50 bps BOE rate hike on August 4 to 86%. The UK Consumer Prices Index (CPI) 12-month rate came in at 9.4% in June when compared to 9.1% seen in May while beating estimates of a 9.3% print, the UK Office for National Statistics (ONS) reported on Wednesday. The UK’s official jobless rate stood at 3.8% in May vs. the previous 3.8% and 3.8% expected while the number of people claiming jobless benefits fell by 20K in June. This offered another tailwind to the pair’s recovery, as it reached the highest level in over a week near 1.2050.

The pound was also underpinned by BOE Governor Andrew Bailey’s comments, as he said on Tuesday that a half percentage point rate hike will be on the table at the August policy meeting. On the other side, weak US housing data added to the greenback’s pain, boding well for cable.

However, anxiety over the ongoing political uncertainty in the UK and the return of recession fears checked the upside in the spot. After the parliamentary voting and some rounds of debate, the candidates running for the UK leadership race have narrowed down to former Finance Minister Rishi Sunak and Foreign Minister Liz Truss. Sunak and Truss enter the runoff with support at 38% and 32%, respectively. It is very critical now more than ever that the new prime minister not only will be taking over but also rebuilds credibility and trust in the office after Boris Johnson’s debacle and in light of the mass resignations.

In the second half of the week, the ECB’s 50 bps rate hike announcement drove the EUR/GBP pair sharply higher, with an initial reaction. In response to the cross-driven weakness, the pound extended the U-turn from higher levels and fell briefly below 1.1900 against the US dollar. However, bulls jumped back into the game as the ECB failed to impress the market and instead revived recession fears. Disappointing US jobless claims and regional manufacturing index also accentuated global slowdown woes, keeping GBP bulls on the defensive while the safe-haven dollar somewhat buoyed.

The end of the week is not very looking very good for GBP buyers, as the mixed UK Retail Sales release failed to rescue them. The UK retail sales arrived at -0.1% over the month in June vs. -0.3% expected and -0.8% previous. On an annualized basis, the UK retail sales plunged 5.8% in June versus -5.3% expected and -4.7% prior. Meanwhile, the UK Manufacturing PMI dropped to 52.2 in July, beating estimates of 52.0. The Services PMI in the UK eased to 53.3 in July vs. expectations of 53.0. Nevertheless, the USD came under selling pressure in the second half of the day and helped GBP/USD post modest daily gains. The data from the US showed that the economic activity in the private sector contracted in early July with the US Composite PMI falling below 50 for the first time since June 2020.

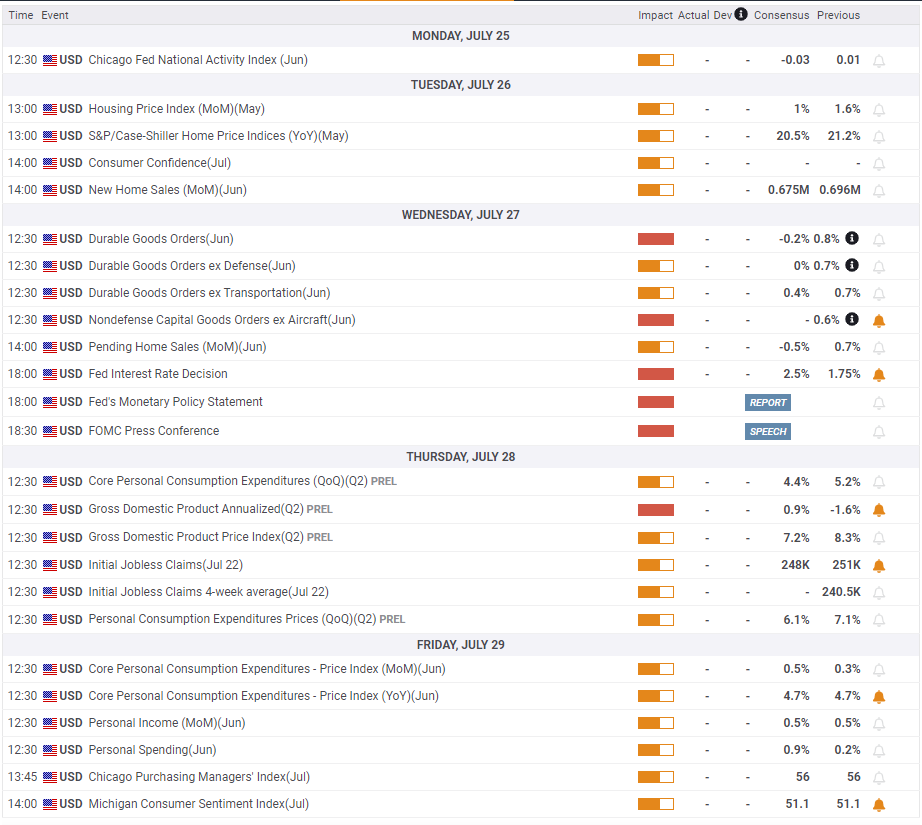

Week ahead: Fed, US GDP and inflation

The week ahead is dominated by US event risks, with the Fed policy decision the most crucial. A 75 bps rate hike is fully baked in for the July meeting due Wednesday but Powell’s nod for another 75 bps lift-off in September will reinforce the US-UK monetary policy divergence, which could bring back the dollar bulls. Ahead of the Fed event, the US Durable Goods Orders will be also eyed on Wednesday.

The US will release the advance Q2 GDP data and Core PCE Price Index on Thursday and Friday respectively. The data will shed more light on the health of the US economy, which could have significant impact of the market’s pricing of the Fed’s policy path. America recorded a 1.6% contraction in the first quarter of this year. Despite negative growth, Fed Chair Jerome Powell remains confident of the economic outlook while sticking to his pledge to fight inflation.

The UK calendar is data-scanty, with no first-tier macro news on the cards. Therefore, the political developments in Britain will remain the most relevant for GBP traders. At the end of the week, GBP traders could turn cautious, as they look forward to the August 4 BOE policy meeting before placing any directional bets on the sterling.

GBP/USD: Technical Analysis

In order to regather bullish momentum, GBP/USD needs to hold above 21 DMA, which is currently located around 1.2030, and start using it as support. Additionally, the Relative Strength Index (RSI) indicator on the daily chart is yet to confirm a bullish shift as it stays below 50.

On the upside, next significant resistance seems to have formed at 1.2200 (Fibonacci 23.6% retracement of the latest downtrend, 50-day SMA) ahead of 1.2300 (static level) and 1.2500 (Fibonacci 38.2% retracement).

Supports are located at 1.1900 (psychological level, static level), 1.1800 (the end-point of the downtrend) and 1.1760 (July 14 low).

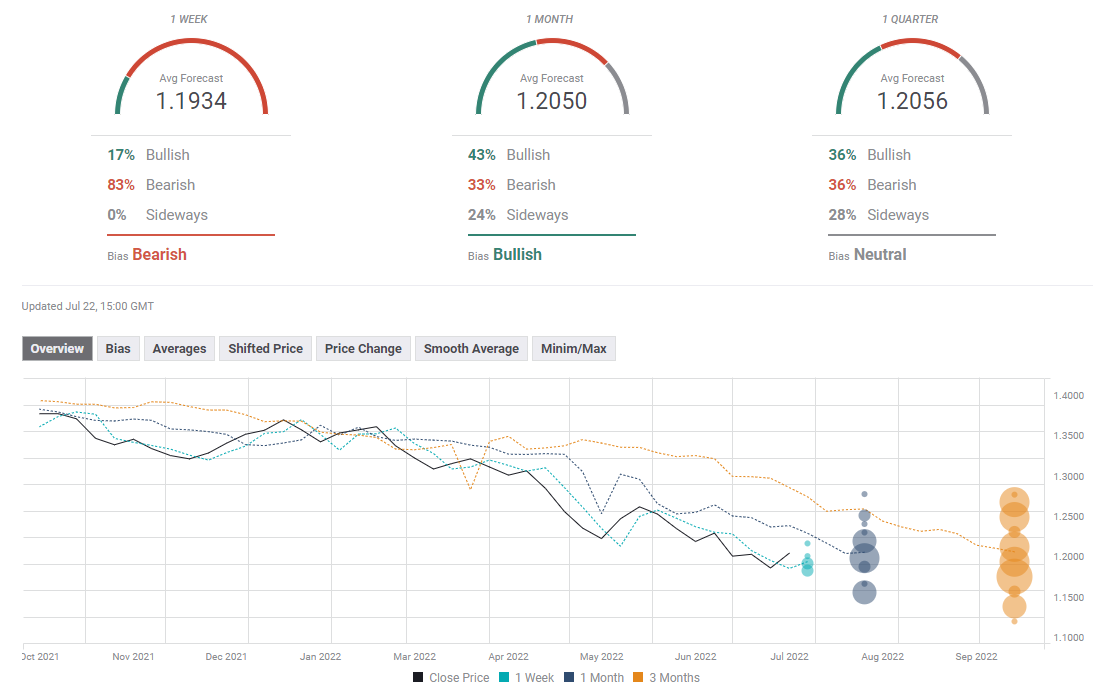

GBP/USD: Forecast poll

FXStreet Forecast Poll shows that the near-term outlook remains bearish. The one-month outlook, however, paints a mixed picture with an average target of 1.2050.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.