GBP/USD Price Annual Forecast: Will politics and policy spoil the Pound Sterling party in 2024?

- GBP/USD sustained its turnaround from a four-decade low in 2023.

- The divergent Fed-BoE policy outlooks could keep the US Dollar undermined.

- Pound Sterling could face headwinds from UK election uncertainty and economic woes.

- The monthly chart portrays GBP/USD as a good ‘buy-the-dip’ trade for 2024.

Setting out to analyze the GBP/USD price outlook for 2024, there are plenty of unknowns and looming uncertainties that make it difficult to convincingly predict the course of the Pound Sterling against the US Dollar (USD) in the year ahead. On both sides of the Atlantic, increased odds of a recession, a dovish pivot in the monetary policies and general elections are foreseen as the key factors driving the GBP/USD price action next year, barring any unprecedented geopolitical risks.

GBP/USD witnessed a rollercoaster ride in 2023 but the Pound Sterling managed to preserve the recovery gains seen in the first half of the year to a 15-month high of 1.3142. Meanwhile, the US Dollar failed to sustain the turnaround, helping GBP/USD gain over 5.0% on the year. However, it remains to be seen whether the British Pound will maintain its upswing against the Greenback, as we head into 2024.

And to gauge the path forward for GBP/USD, it’s critical to be cognizant of the 2023 backstory; the key catalysts that led to the extension of the pair’s recovery from a 37-year low of 1.0339 set in September 2022.

What helped the Pound Sterling to stay afloat in 2023?

Amidst calls for an imminent recession, double-digit inflation numbers and the Bank of England’s (BoE) tightening spree in the first half of the year, GBP/USD survived it all and snapped the previous year’s decline. The tide turned in favor of the Pound Sterling in the second half of the year, as the monetary policy divergence between the US Federal Reserve (Fed) and BoE returned to the fore amid speculations of a policy pivot in 2024 and easing inflationary pressures.

1. Inflation: A bigger problem for the UK

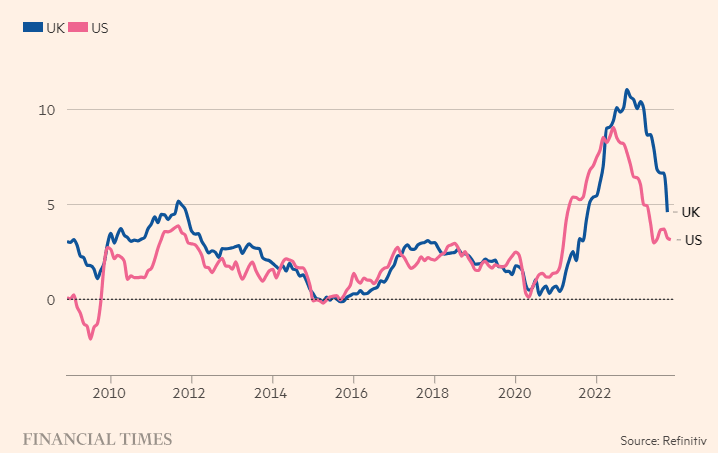

UK inflation proved more persistent than other major economies, including the US, with the headline annual Consumer Price Index (CPI) rate at 10.1% in January, extending its double-digit stint at the beginning of the year.

The Bank of England (BoE) remained increasingly confident that falling energy prices and a more resilient economy would cause inflation to fall more rapidly in the upcoming months. Inflation did dip below 10.0% in the second quarter but continued to exceed consensus forecasts while the underlying core rate kept rising.

The apparent stickiness of UK inflation convinced markets that the BoE would have to raise rates as high as 6.50% in summer, as so-called second-round effects took hold. Such effects have historically seen higher energy and food prices seep into wages and drive up domestic inflation.

Britain saw a surprise slowing in its fast pace of price growth in the third quarter, although it stayed more than double the BoE’s 2.0% target. Throughout the year, the Bank kept a close watch on Britain's job market as it remained worried that labor shortages would keep wage growth high and make it hard to get inflation all the way back to its 2% target.

In welcome news for the BoE, British wage inflation slowed by the most in almost two years in Q3 – further evidence of a cooling of the inflationary heat in the labor market. Earnings excluding bonuses were 7.3% higher in the quarter to October than a year earlier, down from a growth rate of 7.8% in the three months to September.

Annual % change in Consumer Price Index

Across the pond, notable progress was made on taming inflation by the US policymakers, as the annual CPI inflation extended its decline trend from 6.4% in January to a 3.1% figure recorded in November. The fall in energy prices emerged as a big downward contributor but the so-called ‘supercore’ services (services ex-energy and shelter) remained an underlying threat to the US Federal Reserve’s (Fed) reaching its price stability goal of 2.0%.

Meanwhile, the Core Personal Consumption Expenditures (PCE) Price Index, rose at an annual pace of 3.5%, easing considerably from a 4.9% increase seen in January. This is the Fed’s preferred inflation measure, as it is not distorted by base effects and provides a clear view of the underlying trend of consumer behavior by excluding volatile items.

2. Fed-BoE policy divergence

In their fight to tame raging inflation, both the Fed and the BoE extended their tightening cycle but a role reversal was witnessed in 2023. The Fed turned rather passive when compared to its aggressive rate-hike run seen in the previous year. In contrast, the BoE maintained its hawkish rhetoric, reiterating that "further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures."

The Fed has implemented 11 interest rate hikes since March 2022. The US central bank opted for a brief pause in June that was followed by another final lift-off after the July meeting. In total, the Fed increased rates by one percentage point during 2023, leaving the policy rates targeted in a range between 5.25%-5.50%, its highest level in more than 22 years. Concerns about the lag effects of the monetary policy on the economy, cooling inflation and loosening labor market conditions compelled the Fed to do away with its hawkish rhetoric, paving the way for rate cuts next year.

In contrast, the Bank of England ended a run of 14 straight hikes in September, having lifted the benchmark bank rate from 0.10% to a 15-year high of 5.25% between December 2021 and August 2023. At its June meeting, the British central bank surprised markets by raising rates by half a percentage point, justifying that there had been "significant" news suggesting Britain's persistently high inflation would take even longer to fall. The BoE announced a 25 bps rate hike in August before sticking to its stance of higher rates for “an extended period of time” for the rest of the year. The Bank implemented a total of 175 bps rate increases in 2023.

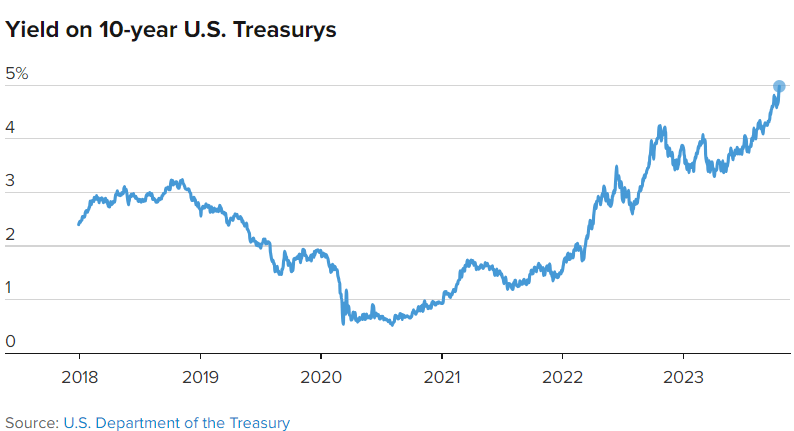

3. US bond market: The turmoil and recovery

Notwithstanding the Fed rate hikes, the US economy stood resilient and further fuelled the US Treasury bond yields’ upward trajectory to 16-year highs in October, with markets believing that a new era of higher interest rates was setting in. At the start of the final quarter, the US economic data continued to surprise on the upside, helping investors dial down 2024 rate cut expectations while adding to the risks of another rate hike. The benchmark 10-year Treasury yield briefly topped the 5.0% key level, appreciating roughly 4.15% this time last year and around 1.70% two years ago. All this helped fuel a bullish narrative for the Greenback at the end of the summer.

Markets also attributed the bond market rout to fears about the US government's growing debt pile and stickier-than-expected inflation, which probably stoked up demand for higher returns on longer-dated debt.

The turmoil in the US bond market supported the US Dollar recovery but the sustained decline in inflation combined resurfacing worries of a likely economic ‘soft landing’ next year brought back speculation surrounding Fed rate cuts as early as in the first quarter of 2024. Increased bets of a dovish Fed pivot led to a correction in the US Treasury bond yields, offering a much-needed reprieve to the US bonds while dragging the US Dollar lower toward the end of the year.

The US Senate put an end to this year's third fiscal standoff in Congress by passing a stopgap spending bill, averting a government shutdown and alleviating the bond market pain.

GBP/USD: What to watch out for in 2024?

1. Fed and BoE interest rate cuts on the table

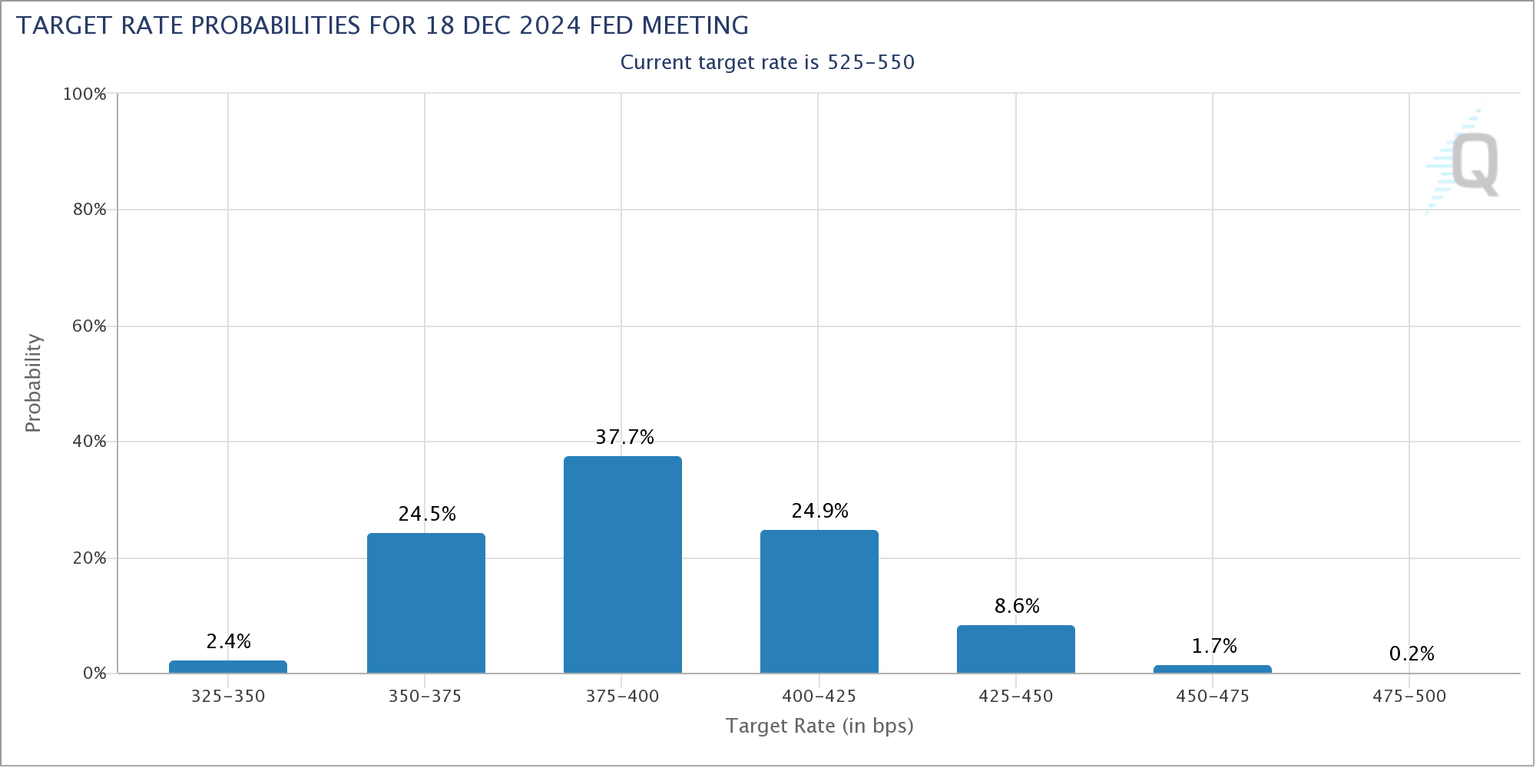

Speaking at the press conference after the December meeting, Federal Reserve Chair Jerome Powell said the historic tightening of monetary policy is likely over, with a discussion of cuts in borrowing costs coming “into view”. Powell’s comments affirmed the Fed’s dovish pivot and bumped up rate cut expectations.

The Statement of Economic Projection (SEP), the so-called Dot Plot, showed that the Fed officials estimated 75 bps of rate cuts in 2024, with 2.4% inflation at the end of next year.

Markets are even more dovish, pricing in 150 bps of rate cuts for next year, twice as much as the Fed's median forecasts, the equivalent of six 25 bps cuts over the year. The probability of a March Fed rate cut, stands at around 75% while that for the May meeting is at 95%, according to CME Group’s FedWatch tool.

Source: CMEGroup

Meanwhile, the BoE policymakers continue to push back against expectations of rate cuts next year, with the December policy statement noting that “key indicators of UK inflation persistence remain elevated.”

However, deteriorating economic performance prompted money markets to begin pricing in four 25 bps rate cuts starting from the summer, anticipating the key rate to be slashed from 5.25% to as low as 4.25% by the end of 2024. The first cut is expected as early as June, to 5.0%.

Goldman Sachs said that it expects the Bank of England to announce its first rate cut in June compared to a previous expectation of a first cut in August. "We expect the MPC to cut at a 25 bps per meeting pace until policy rates reach 3.0% in June 2025," Goldman Sachs economists said.

2. US and UK economic outlooks

Markets believe that the Fed probably saw the need to pivot towards rate cuts earlier than previously expected, as the US economy is unlikely to achieve a soft landing. The soft language in the latest FOMC statement indicated that the Fed is increasingly worried about the economic prospects, and thus, has shifted gears to a dovish stance. The Fed policy statement acknowledges that “recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter.”

The US economy grew at a solid annualized pace of 5.2% in the third quarter, topping the initial 4.9% reading. Markets, however, believe that the economic resilience will not last, as the most aggressive series of rate increases in 40 years will eventually take its toll. Further, slowdown concerns in the Chinese and European economies combined with the negative impact of the Fed rate hikes on small banks could accentuate the US economic downturn.

On the UK side of the story, even though the Bank of England largely shrugged off a 0.3% contraction in Gross Domestic Product (GDP) for October, the prospect of a recession in the run-up to a 2024 national election remains high.

There were growing signs of stress in the economy as households and businesses remain under sustained pressure from higher borrowing costs. But the recent fiscal stimulus from the UK Finance Minister Jeremy Hunt, in his Autumn Statement, could lend some support to the economy while adding credence to BoE’s ‘higher for longer’ interest rate stance.

Hunt’s fiscal package is set to provide a £6.7 billion stimulus in 2023-24 and a £14.3 billion boost next year. Meanwhile, the Office for Budget Responsibility (OBR) projections showed a flatlining economy in the coming years with growth slowing to 0.6% in 2023. The growth estimates were seen as lackluster at 0.7% in 2024 before picking up to 1.4% in 2025.

The UK economy will continue to face headwinds in 2024 and could see a shallow recession toward the end of the year, as the lagged effect of 515 bps of rate increases begins to show.

3. US and UK national elections

A general election is expected next year in the US and the UK, which could fuel intense volatility around the GBP/USD pair. Amidst looming inflation and growth concerns, the political developments on both sides of the Atlantic are likely to be closely followed.

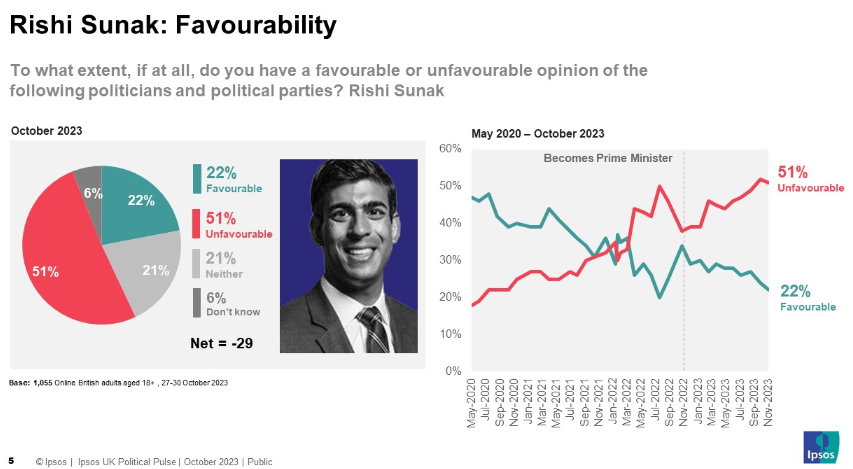

After 13 years of Conservative government, which has largely been blamed for failing the economy, UK Prime Minister Rishi Sunak is almost certain to call a general election in 2024. UK general elections have to be held no more than five years apart, so the next one must take place by January 28 2025.

With Jeremy Hunt's autumn statement tax cut, some Conservative MPs thought that the move suggested Downing Street wanted to be in a strong position to send voters to polling stations next May or June, rather than waiting for autumn as had previously been thought, per Sky News.

Following a series of record-breaking by-election defeats, disastrous events from 2020 to 2022 and with the Tories still lagging behind Labour in the polls, PM Rishi Sunak and his party are set for tumultuous times in the year ahead.

Source: Ipsos

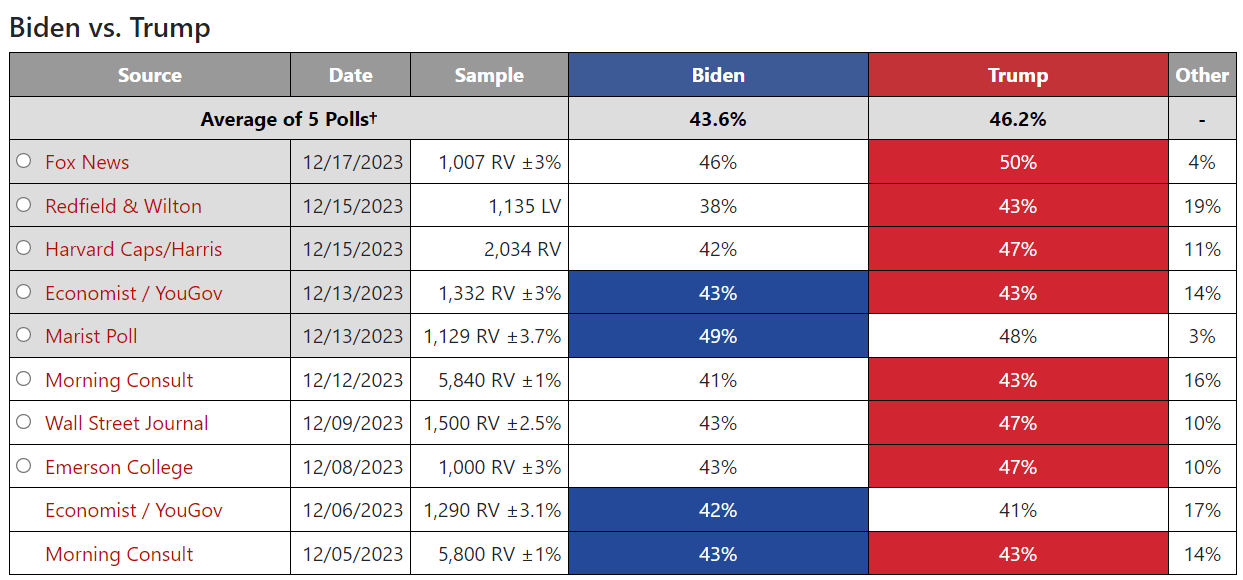

In the US, the Democratic and Republican primaries will kick off in January, with markets expecting a battle once again between the incumbent President Joe Biden and former President Donald Trump on November 5. A lack of confidence in Biden’s ability to handle various issues, including economic and immigration policy, has caused his approval ratings to reach a record low of 33%, according to a poll by Washington-based think tank Pew Research Center.

Most of the nationwide opinion polling for the 2024 presidential election shows former President Trump leading President Biden in key swing states that will likely decide the 2024 election.

Source: 270towin.com

GBP/USD: Technical outlook for 2024

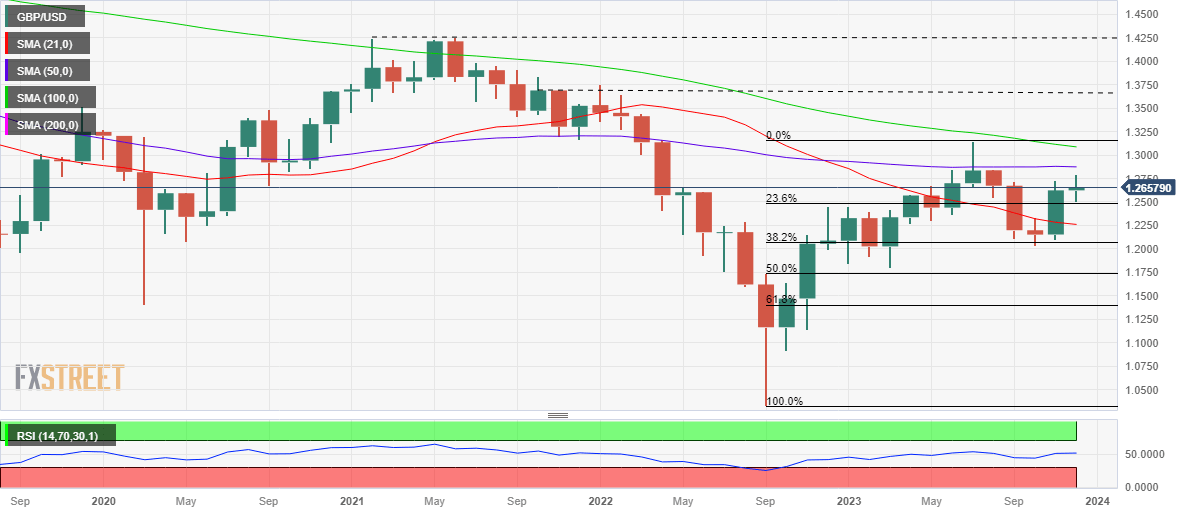

GBP/USD: One-month chart

Source: FXStreet

As observed on the monthly chart, GBP/USD entered a phase of consolidation after its recovery from near the 1.1800 neighborhood at the start of 2023 lost legs just shy of the 1.3150 psychological level in July.

The pair failed to find a foothold above the horizontal 50-month Simple Moving Average (SMA) at 1.2875 on a sustained basis, gyrating below the latter for the major part of the year.

On the contrary, the Pound Sterling continued to attract demand against the US Dollar at around 1.1800, where the 50% Fibonacci Retracement (Fibo) level of the entire upswing from the September 2022 low of 1.0339 to the yearly high of 1.3142, aligns.

Meanwhile, the Relative Strength Index (RSI) managed to reclaim the bullish territory in the last two months, justifying the latest rebound in the pair from near the 38.2% Fibo level of the same ascent, pegged at 1.2070.

At the same time, Pound Sterling recaptured the 21-month SMA at 1.2260 after a two-month hiatus, reinforcing the bullish interest in the major.

Against this backdrop, Pound Sterling buyers need to take out the two major resistance levels, the 50-month SMA and the 100-month SMA at 1.2875 and 1.3066 respectively, to extend the recovery toward the 1.3500 static resistance. The next target for bullish traders is seen at the powerful supply zone at around the 1.3700 level.

Should Pound Sterling bulls give into the bearish pressures at higher levels, immediate support is envisioned at the 21-month SMA of 1.2260, below which the 38.2% Fibo level at 1.2070 will be retested.

Further down, the 50.0% Fibo level near 1.1800 could challenge bullish commitments. Acceptance below the latter could trigger a fresh downtrend toward the 61.8% Fibo level at 1.1414.

To conclude, GBP/USD is likely to struggle on both sides of the trade, as it hangs around between a bunch of healthy support and resistance levels. However, any decline in the currency pair should be seen as a good buying opportunity, except for any unforeseen Black Swan event.

Pound Sterling price this year

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this year. Pound Sterling was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -1.79% | -4.61% | -1.33% | 1.32% | 8.04% | 2.03% | -6.59% | |

| EUR | 1.76% | -3.18% | 0.85% | 3.39% | 9.66% | 3.95% | -4.94% | |

| GBP | 4.38% | 3.07% | 3.89% | 6.36% | 12.43% | 6.27% | -1.90% | |

| CAD | 1.29% | -0.87% | -3.21% | 2.55% | 9.23% | 2.54% | -5.22% | |

| AUD | -1.31% | -3.48% | -6.76% | -2.63% | 6.51% | 0.60% | -7.99% | |

| JPY | -8.72% | -10.70% | -13.73% | -9.74% | -6.92% | -6.93% | -16.26% | |

| NZD | -2.07% | -3.92% | -6.78% | -3.43% | -0.57% | 5.95% | -9.30% | |

| CHF | 5.97% | 4.76% | 1.93% | 5.56% | 7.45% | 13.96% | 8.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.