The year seems to have started in slow motion across the world, as UK GDP readings have just missed big: the economy grew 0.3% in the Q1 of 2015, below expectations of a 0.5% growth and previous 0.6%, being the worst reading since Q4 2012. The year-over-year reading ended up at 2.4%, well below previous 3.0%. The GBP/USD tumbled with the release to a daily low of 1.5174, but buyers immediately bought the dip, sending the pair back towards its daily high in the 1.5260 region.

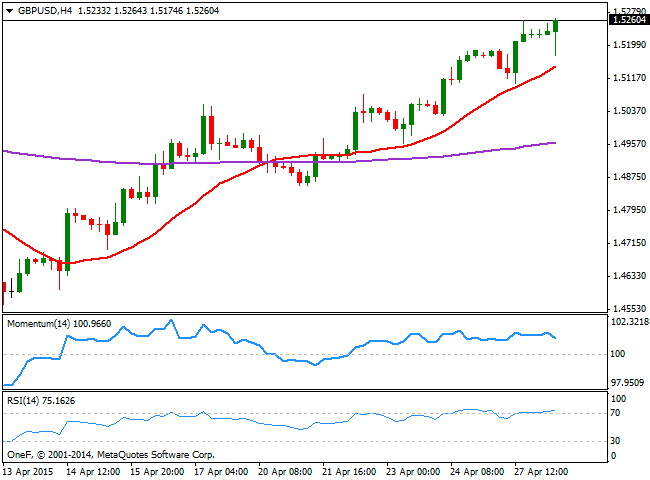

Sentiment is leading the way rather than technical readings, as market expects now some progress in Greek negotiations with its creditors. Technically, the pair remains near its daily high, with a strongly bullish 20 SMA well below the current price, and the RSI indicator maintaining its bullish slope, despite being in overbought territory. The Momentum indicator lacks directional strength at the time being, but remains in positive territory, all of which suggest the pair may reach the 1.5300/10 region, should the price break above the daily high. The immediate support stands at 1.5220, followed by the mentioned daily low in the 1.5170 price zone, where buying interest is expected to resume.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.