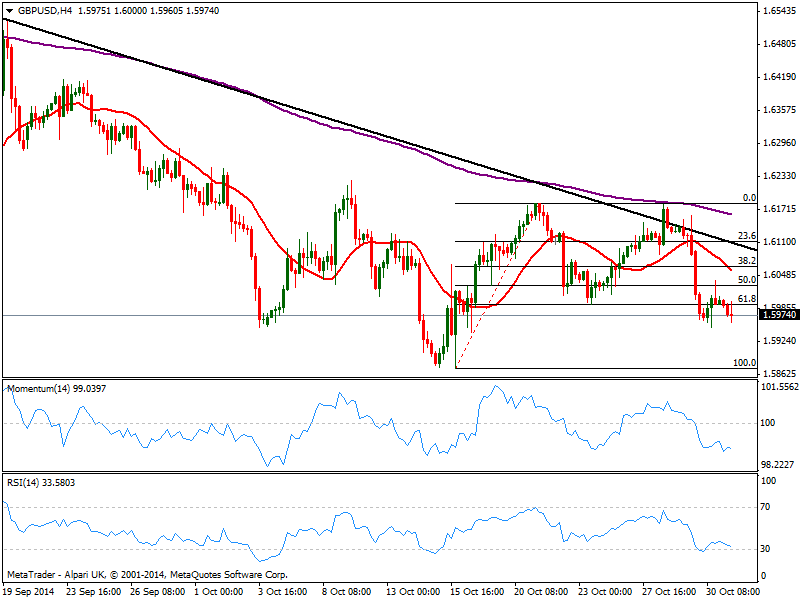

The technical picture remains quite bearish, as mentioned spike up to 1.6038 was rejected by a key Fibonacci resistance, the 50% retracement of the 1.5874/1.6184 rally; even further, the pair has extended its decline below the 61.8% retracement of the same rally at 1.5995, level that capped the upside all of this Friday. In the 4 hours chart, indicators turned back south well into negative territory and after correcting oversold readings, while 20 SMA extended its bearish slope above current price.

A downward acceleration below 1.5950, should lead to a quick slide towards the 1.5910 price zone, while once below this last, October low of 1.5874 comes as next bearish target. Up to 1.6030/40 Fibonacci area, sellers will maintain the lead: it will take a firmer advance beyond it to confirm a reversal in the pair, quite unlikely, yet short term pointing then to 1.6060/80 price zone.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.