GBP/USD Forecast: UK reopenings likely to continue

GBP/USD Current price: 1.4097

- UK PM Johnson thinks they would not need to delay reopenings.

- The UK will publish employment-related data next Tuesday.

- GBP/USD recovered its bullish potential, additional momentum needed.

The GBP/USD pair closed with substantial gains for a second consecutive week, just below the 1.4100 threshold, advancing on Friday on the broad dollar’s weakness. Dismal US data released on Friday worked in favor of Wall Street, as investors were concerned that economic progress in the country would result in a tighter monetary policy. Meanwhile, in the UK concerns gyrate about the increased number of coronavirus cases from the Indian strain.

Prime Minister Boris Johnson hit the wires on Friday and said that the government does not believe it would need to delay reopening, as there’s no evidence of stress in the health system. Nevertheless, he noted that there are some important unknowns and that they will remain vigilant. Over the weekend, the leaders of Ireland and PM Johnson met to discuss a smooth trade relationship with Northern Ireland. The UK macroeconomic calendar has nothing to offer until next Tuesday when it will publish employment-related figures.

GBP/USD short-term technical outlook

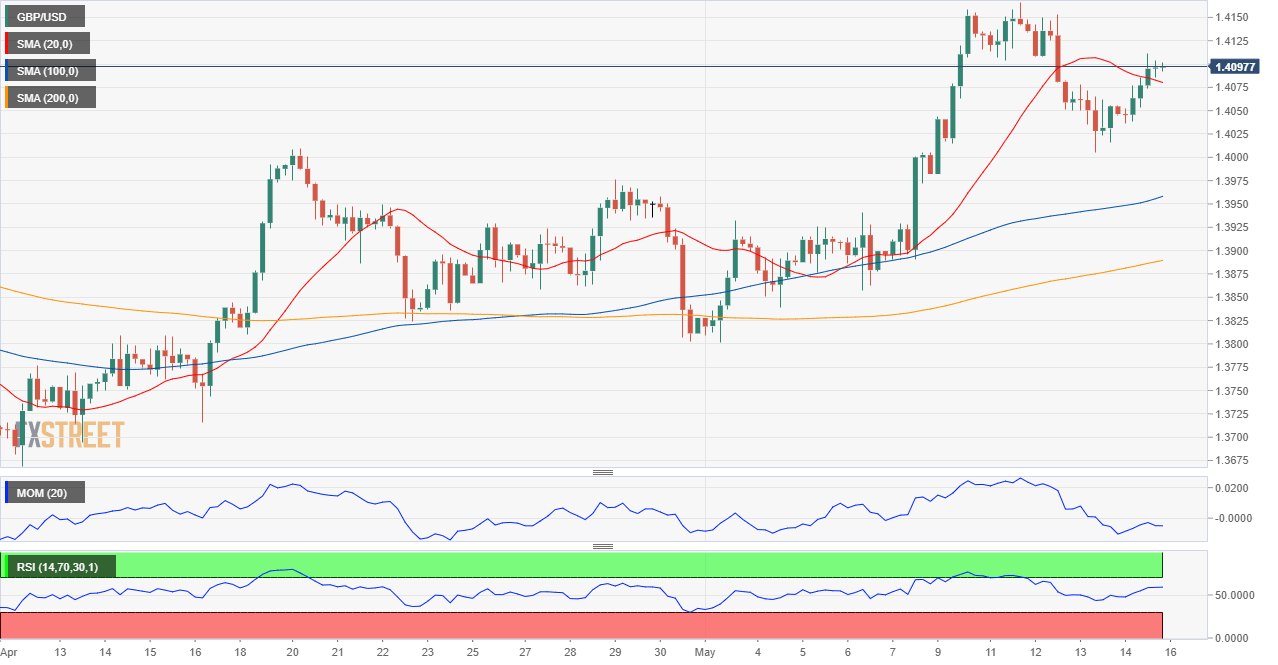

From a technical perspective, the GBP/USD pair has room to continue advancing. The daily chart shows that technical indicators are resuming their advances after consolidating within positive levels, as the pair develops above bullish moving averages. In the near-term, and according to the 4-hour chart, the bullish potential remains limited. The pair settled a few pips above a mildly bearish 20 SMA, while technical indicators lack directional strength, the Momentum below its midline and the RSI at around 58. Bulls will likely become more courageous on a break above 1.4120, the immediate resistance level.

Support levels: 1.4050 1.4000 1.3955

Resistance levels: 1.4120 1.4170 1.4230

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.