- GBP/USD has advanced as the US Democratic lead weighs on the dollar.

- Surging UK coronavirus cases and a slow vaccination campaign may send sterling down.

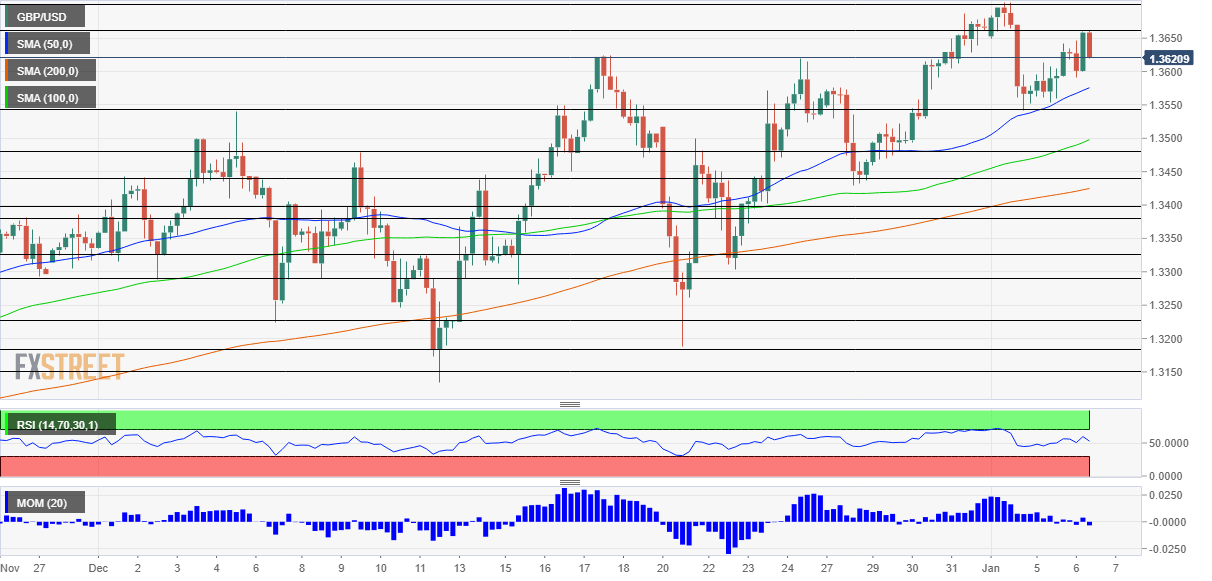

- Wednesday's four-hour chart is pointing to losses.

Georgia is on markets' minds – but the blue wave may wash away for sterling. The safe-haven dollar US dollar is on the back foot as investors cheer the prospects of Democrats controlling the US Senate.

Dem candidate Raphael Warnock won his race against GOP incumbent Kelly Loeffler. Her fellow Republican Senator is trailing Jon Ossof by around 0.3%, but the remaining votes are from Democratic-leaning counties. That would lead to a 50-50 tie in the Senate, which Vice-President-elect Kamala Harris would break. The prospects of a multi-trillion stimulus package mean the money would flow to the US and global economies and there is less need for safety – the US dollar.

See Georgia Elections Analysis: Markets to surf higher on imminent blue wave, USD to chop around

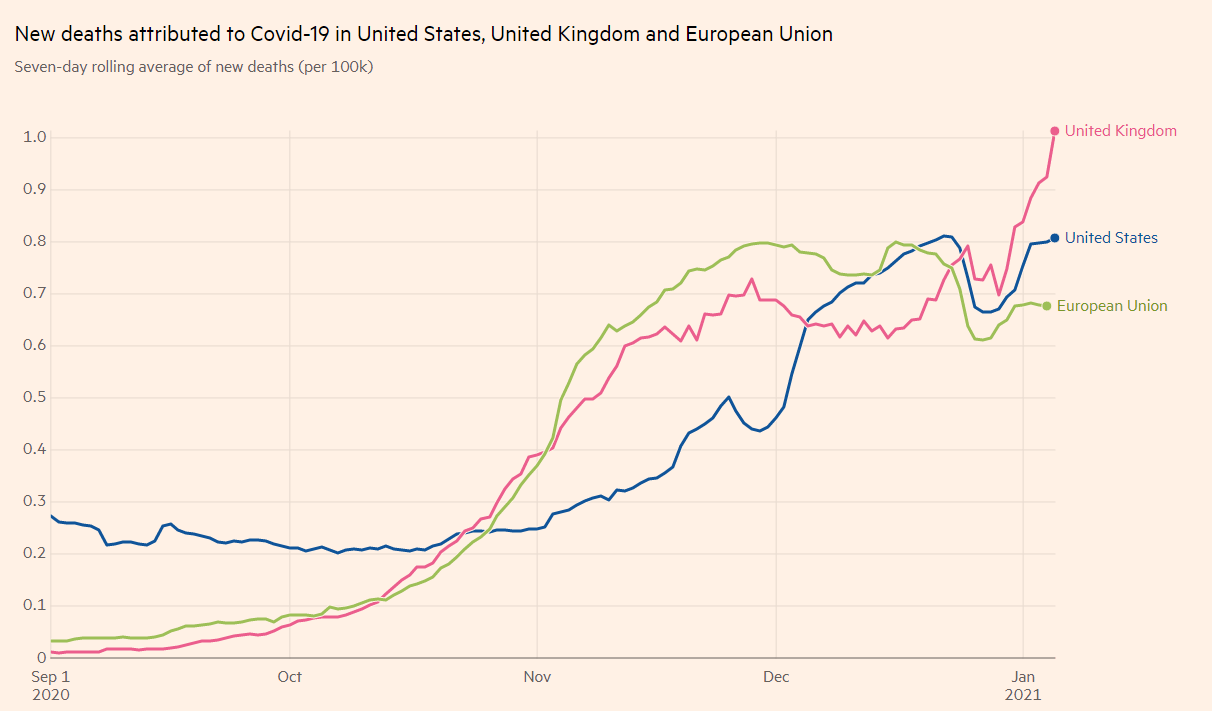

On the other hand, the situation in Britain is dire. COVID-19 hospitalizations have topped the peak seen in the spring and one out of every 50 people in England has had coronavirus recently. The worrying statistics come as the UK entered a severe lockdown – and markets find the recent injection by the Treasury as insufficient.

Moreover, vaccine distribution is advancing at a snail's pace. While Britain is ahead of European countries, it vaccinated only around 1.5% of its population and is unlikely to ramp up distribution in the next two weeks.

Estimates of an ongoing slow pace come despite the deployment of the University of Oxford/AstraZeneca jab – which benefits from mass production in Britain and requires only normal storage temperatures. The government aims to vaccinate 13 million people by mid-February and at the time of writing, only 1.3 million have received the first jab.

Unless covid cases fall and vaccinations accelerate, sterling may struggle to hold onto gains.

Source: FT

Another worrying development is that government officials cast doubt that the vaccines can beat the South African strain of the virus. Contrary to the British variant which probably succumbs to vaccines, the newer version is more complex. If these worries prove correct, it would be worrying for the entire world, potentially boosting the safe-haven dollar. Further data is awaited.

Apart from virus US political developments, the Federal Reserve's meeting minutes from December are awaited. The document may provide clues to future policy, especially additional bond-buying. The Fed could expand its scheme if the government introduces further stimulus.

ADP's employment report for December serves as a hint toward Friday's official Nonfarm Payrolls publication. While these reports have diverged in recent months, any print – and especially a negative one – could move markets.

All in all, cable's rise may hit roadblocks.

GBP/USD Technical Analysis

Momentum on the four-hour chart has flipped back to the downside, taking some of the air out the bullish picture. Pound/dollar continues trading above the 50, 100 and 200 Simple Moving Averages and the Relative Strength Index is balanced.

Some resistance awaits at 1.3660, the daily high, followed by 1.3705, the 2021 peak. The next levels to watch are 1.3730 and 1.3810.

Support is at 1.3545, the 2021 low. It is followed by 1.3480 and 1.3445.

More GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.