GBP/USD Forecast: Ready for the next leg up? It depends on Brexit hopes overcoming Cummings' scandal

- GBP/USD has been retreating after surging on Tuesday, amid dollar strength.

- Brexit hopes, the scandal around Dominic Cummings, and Sino-American relations are in the mix.

- Wednesday's four-hour chart is painting a bullish picture with clear resistance.

Flying further up with free-roaming fish? While Brits are closely following the latest developments around Dominic Cummings – the special adviser at Downing Street who violated the lockdown – an EU concession around fisheries helped propel the pound higher.

Brussels is reportedly ready to relent on its "maximalist approach" on fishing rights. While the industry is minuscule, it carries substantial political weight. The EU's step may help make progress in talks about future relations, once the transition period ends.

Coming back to Cummings, Prime Minister Boris Johnson's special adviser remains at his post despite members of the Conservative Party calling for him to resign. Moreover, the PM's approval ratings are falling.

The issue is weighing on sterling as adherence to social distancing measures and defeating the disease depend on public trust in officials' instructions. If there is one rule for the elite and another for all the rest, people may disregard the rules and lengthen the impact of the pandemic, slowing the return to normal.

The topic of negative rates is refusing to return to the shadows. Andy Haldane, Chief Economist at the Bank of England, said that sub-zero rates are not that close. He previously seemed to warm to the idea. Officials seemed open to negative rates – sending sterling down – and may now want to convey a message that these are not imminent. The pound received some support from Haldane's comments.

On the other side of the pond, the Federal Reserve release its Beige Book late on Wednesday. Anecdotal evidence from the Fed's nine regions will likely show an ongoing slump, even as consumer confidence has stabilized.

US Consumer Confidence: From stability to improvement?

Sino-American tensions are intensifying with Washington moving toward decertifying Hong Kong as an autonomous region in response to China's proposed security law. Beijing's aims to tighten its grip over the city-state have sparked protests. The US and China are also at odds about technology but continue upholding the trade deal.

The safe-haven US dollar gained some ground amid these tensions, while stock markets remain upbeat. Efforts to develop a coronavirus vaccine continue at full speed, with more promising reports coming almost every day. However, Merck, a large pharmaceutical firm, warned that it may take a long time.

Overall, despite a light calendar, there are many moving parts. As long as the market mood remains upbeat, sterling has room to rise on Brexit hopes. The Cummings scandal is significant but may fade quickly.

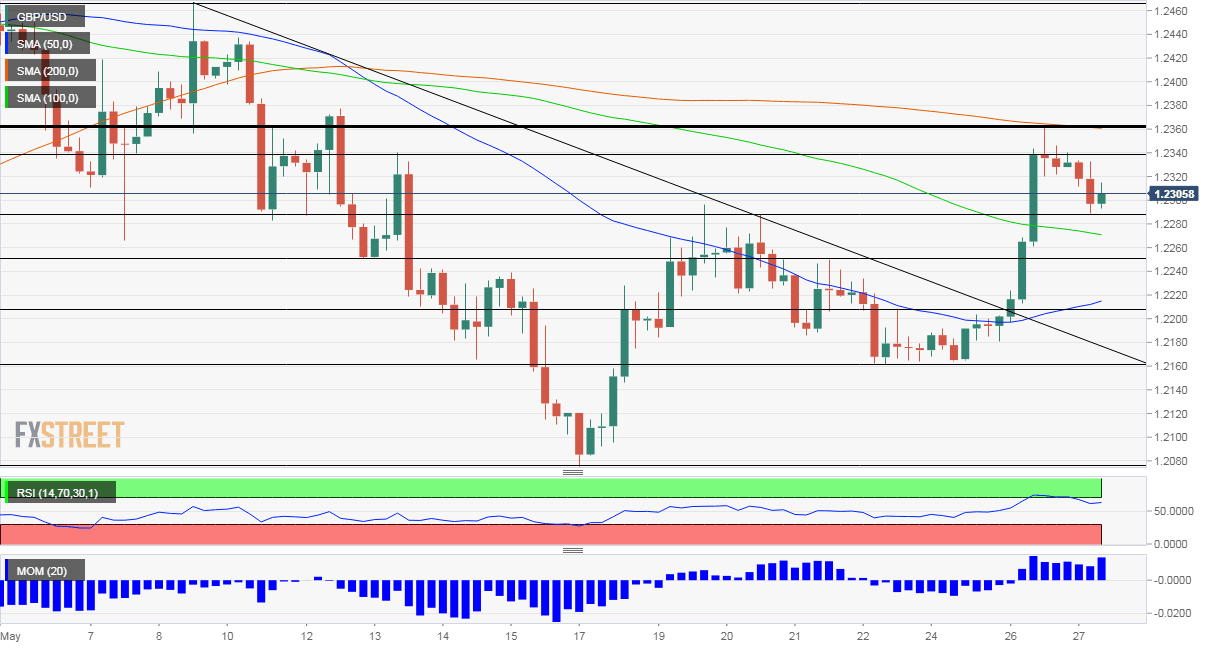

GBP/USD Technical Analysis

Pound/dollar continues enjoying upside momentum on the four-hour chart and the Relative Strength Index dropped below 70 – exiting overbought conditions. The recent rise sent sterling above the 100 Simple Moving Average and the most significant resistance is at 1.2360 – Tuesday's peak and where the 200 SMA hits the price.

Below 1.2360, cable is capped at 1.2340, a stepping stone on the way down from mid-May. Higher above, the next noteworthy line to watch is 1.2470, a swing high from early in the month.

Some support is at the daily low of 1.2285, followed by 1.2250, which held it down last week, and then by 1.2160.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.