Stocks mixed after Fed, as market cheers Shell and waits for Apple

The key event this week was the Fed meeting. It was less hawkish than expected, with a rate hike explicitly ruled out. The market reaction was mixed, a sharp drop lower in Treasury yields, which has extended into Thursday, a weakening of the dollar, especially vs. the yen and a higher gold price, although gold is slipping this morning. The focus will now shift to Apple results tonight and the Non-Farm Payrolls report for April that is scheduled for Friday.

Stocks in limbo after Fed meeting

European stocks are mixed on Thursday, as the stock market still can’t pinpoint when interest rates in the US will be cut. The FTSE 100 is bucking the global trend, but European stocks may have been knocked by the slightly weaker final readings of Eurozone manufacturing PMI.

Shell cuts costs to boost profits and investors like it

There have been a spate of earnings releases on Thursday. Shell was the highlight, rising by 1.5% so far on Thursday. It was the latest oil major to beat expectations, and net income was $1.5bn above expectations as stronger oil trading and chemicals results were a key driver of revenue last quarter, as the oil price rose nearly 20%. It has since fallen back, and Brent crude is lower by more than 5% in the past month, which may impact Q2 results. Net debt was lower, and capex dropped by $4.5bn, which has been cheered by investors. The company also remains committed to share buybacks, and the company has promised to buy back $3.5bn of shares for a third consecutive quarter.

All in all, this was a strong report from Shell. Although revenue was lower relative to Q4, it was still $72.4bn, although profit was higher and earnings per share rose by 56% compared to Q4 at $2.06, vs. $1.03. Investors love it when a company boosts its profitability, Shell has done this by reducing costs and expenditure, which has had a positive effect on the net income margin, which has surged in the past quarter. The market likes profitable businesses in this environment, and after slipping by 1.5% in the past week, this could be the trigger to see a sustained recovery in Shell’s stock price, which can help it to build on its 10% gain so far in 2024.

Can Apple recover from the slide in China sales?

Apple results are the focus when the market closes in the US on Thursday night. The Magnificent 7’s performance in Q1 has been mixed: Meta disappointed, Amazon and Google outperformed, and Tesla managed to shift the narrative around the troubled EV maker. We already know that sales of the iPhone, Apple’s flagship product, have fallen substantially in China in the first quarter, so the question is what this does to earnings. The market is expecting revenue of more than $90bn for the quarter, which is a 5% drop on the prior quarter, with net income of $23bn and adjusted earnings per share of $1.5. It is worth noting that analysts have revised down their expectations for Apple’ results in the past month. Although the bar has been lowered, it is also a sign that the market is bearish going into these results.

Will a passive AI strategy pay off for Apple?

The market will want to know how Apple’s top brass are dealing with the slowdown in China, and how iPhone sales are doing, after reports that it is also losing market share globally. Sales of Vision Pro, which went on sale in February, will also be closely watched to see if it can either make up for the shortfall in iPhone sales, or if it flops. Investors also want to get an update on Apple’s AI strategy. It is unique in the Magnificent 7 in that it has not pursued a strategy to develop AI in house, instead it has looked to tie ups, for example with Google, to implement into its products. The market will want an update on this passive AI strategy and whether it is paying off. On the plus side, Apple is unlikely to report the massive capex spend on AI that sent Meta’s shares plunging last week.

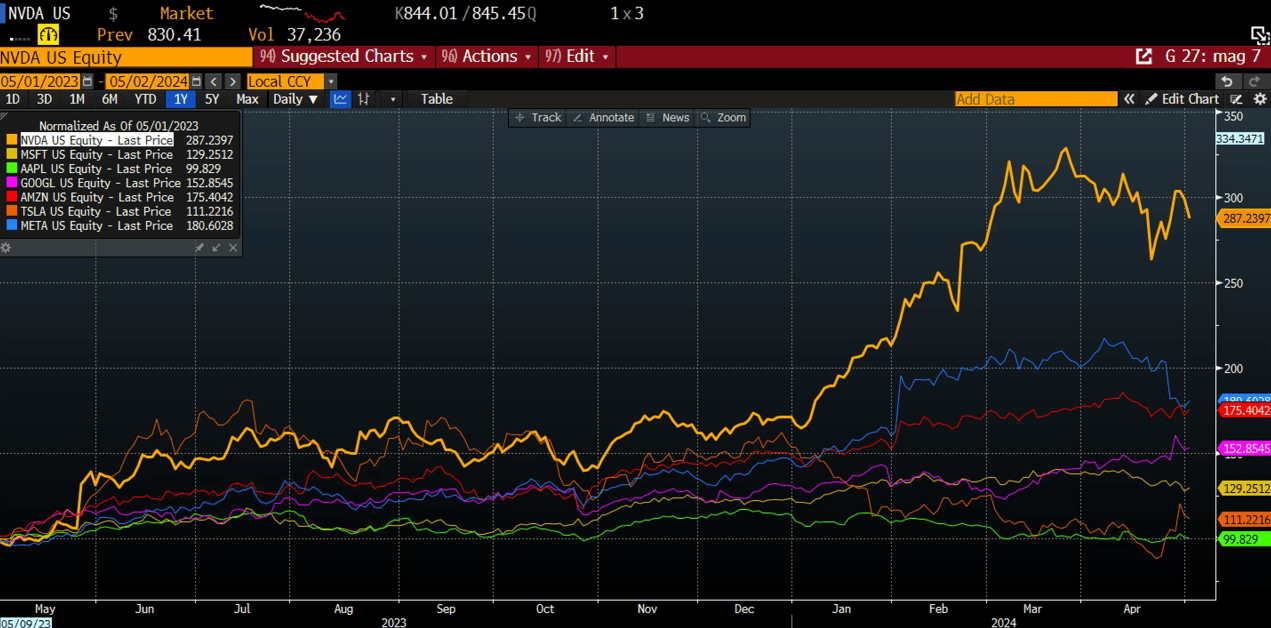

Apple is now lagging the rest of the Magnificent 7, as you can see below. Apple’s share price is expected to open higher today, along with the rest of the S&P 500. However, it is still lower by 10% YTD, and on a normalized basis, it has underperformed Tesla this month, as you can see in the chart below.

Source XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.