GBP/USD Forecast: Pound Sterling turns fragile ahead of BoE policy announcements

- GBP/USD fell nearly 0.5% and snapped a four-day winning streak on Tuesday.

- The near-term technical outlook points to a buildup of bearish momentum.

- Investors could refrain from betting on a Pound Sterling recovery ahead of the BoE's policy announcements.

GBP/USD came under heavy bearish pressure and lost nearly 0.5% on Tuesday. The pair continues to edge lower early Wednesday and was last seen trading below 1.2500.

The US Dollar (USD) benefited from the cautious market mood on Tuesday and weighed on GBP/USD. Additionally, hawkish comments from Minneapolis Federal Reserve President Neel Kashkari helped the USD edge higher and caused the pair to extend its slide.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.15% | -0.44% | -1.41% | -0.60% | -0.46% | -0.28% | -0.43% | |

| EUR | 0.15% | -0.20% | -1.13% | -0.39% | -0.09% | -0.05% | -0.18% | |

| GBP | 0.44% | 0.20% | -0.97% | -0.18% | 0.09% | 0.14% | 0.03% | |

| JPY | 1.41% | 1.13% | 0.97% | 0.80% | 0.96% | 1.15% | 0.96% | |

| CAD | 0.60% | 0.39% | 0.18% | -0.80% | 0.04% | 0.33% | 0.24% | |

| AUD | 0.46% | 0.09% | -0.09% | -0.96% | -0.04% | 0.02% | -0.03% | |

| NZD | 0.28% | 0.05% | -0.14% | -1.15% | -0.33% | -0.02% | -0.09% | |

| CHF | 0.43% | 0.18% | -0.03% | -0.96% | -0.24% | 0.03% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Kashkari noted that the housing market was proving more resilient to tight monetary policy than it has been in the past and said that inflation moving sideways was raising questions about how restrictive the policy was. Regarding the rate outlook, he acknowledged that the most likely scenario was for rates to remain unchanged for an extended period of time but did not rule out further tightening if inflation were to become embedded.

The US economic docket will not feature any high-tier data releases but Federal Reserve (Fed) Vice Chair of the Board of Governors Phillip Jefferson, Boston Fed President Susan Collins and Governor Lisa Cook will be delivering speeches later in the American session.

Markets are currently seeing a 35% chance that the Fed will leave the policy rate unchanged. In case Fed policymakers adopt a hawkish tone and dismiss the softness seen in the April jobs report, the USD could gather strength.

On Thursday, the Bank of England (BoE) will announce monetary policy decisions. Even if the USD struggles to build on Tuesday's gains, GBP/USD could have a hard time staging a decisive rebound, with investors refraining from taking large positions ahead of the BoE event.

GBP/USD Technical Analysis

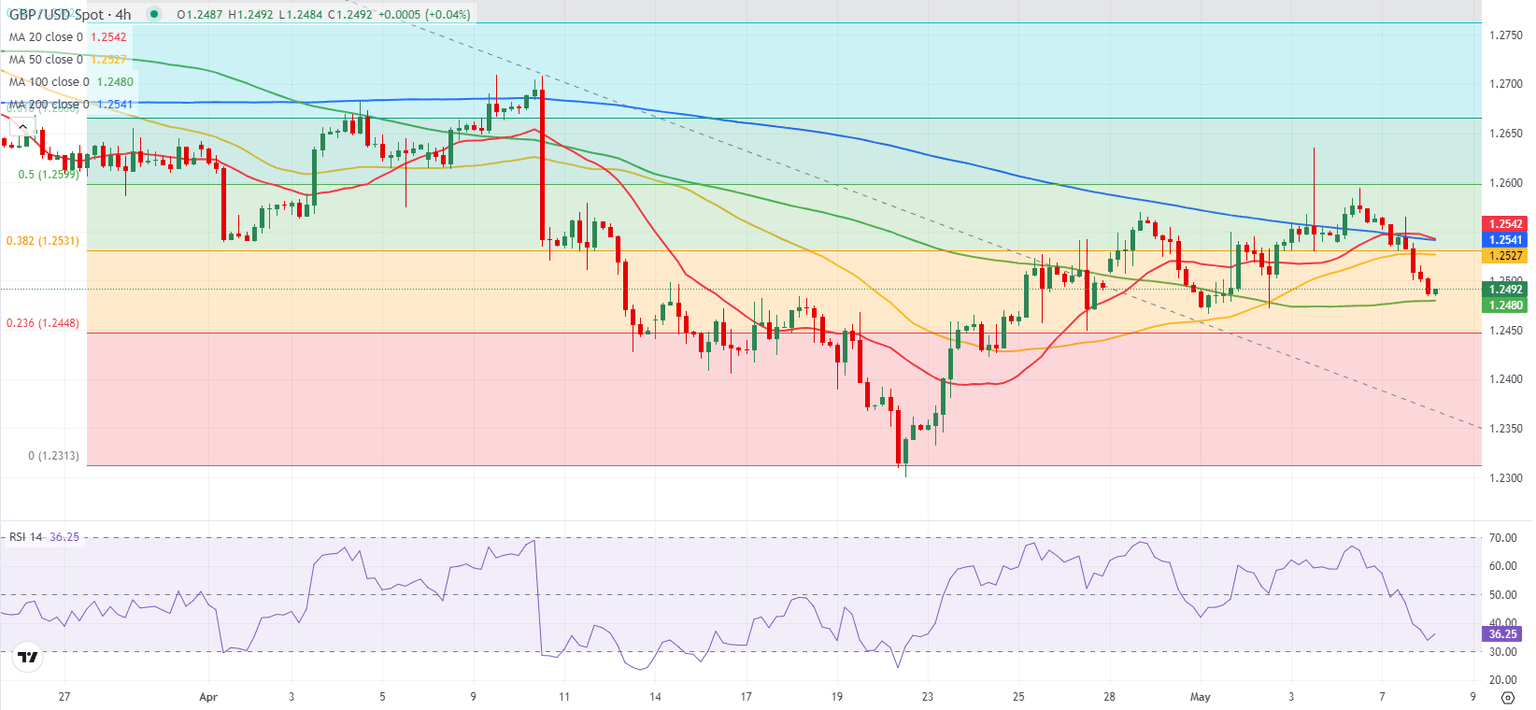

GBP/USD closed well below the 200-day Simple Moving Average (SMA), which is currently located at 1.2550, after failing to clear this level earlier in the week. Additionally, the Relative Strength Index (RSI) indicator on the 4-hour chart dropped below 40, reflecting the bearish tilt in the near-term technical outlook.

On the downside, the 200-period SMA on the 4-hour chart aligns as immediate resistance at 1.2480 before 1.2450 (Fibonacci 23.6% retracement of the latest downtrend) and 1.2400 (static level, psychological level).

Immediate resistance is located at 1.2500 (static level, psychological level) before 1.2530 (Fibonacci 38.2% retracement) and 1.2550 (200-day SMA).

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.