GBP/USD Forecast: Negative rates and Brexit talks undermine Pound

GBP/USD Current price: 1.2173

- UK Retail Sales plunged in April amid the coronavirus-related lockdown.

- The BOE considering negative rates and no progress in Brexit talks hurt Sterling.

- GBP/USD at risk of falling further, heading towards 1.2000.

The GBP/USD pair has fallen for a third consecutive day on Friday, settling at around 1.2170. Demand for Sterling was undermined by UK Retail Sales, which fell in April by 18.1% MoM, much worse than the -16.0% expected. When compared to a year earlier, sales were down by 22.6%, also much worse than anticipated. The UK currency was also weighed by the BOE talking about negative rates, and Brexit-related concerns, as, despite no progress in talks with the EU, the kingdom refuses to extend the transition period beyond December this year. The UK won’t release relevant macroeconomic data this Monday as the UK celebrates the Spring Bank Holiday.

GBP/USD short-term technical outlook

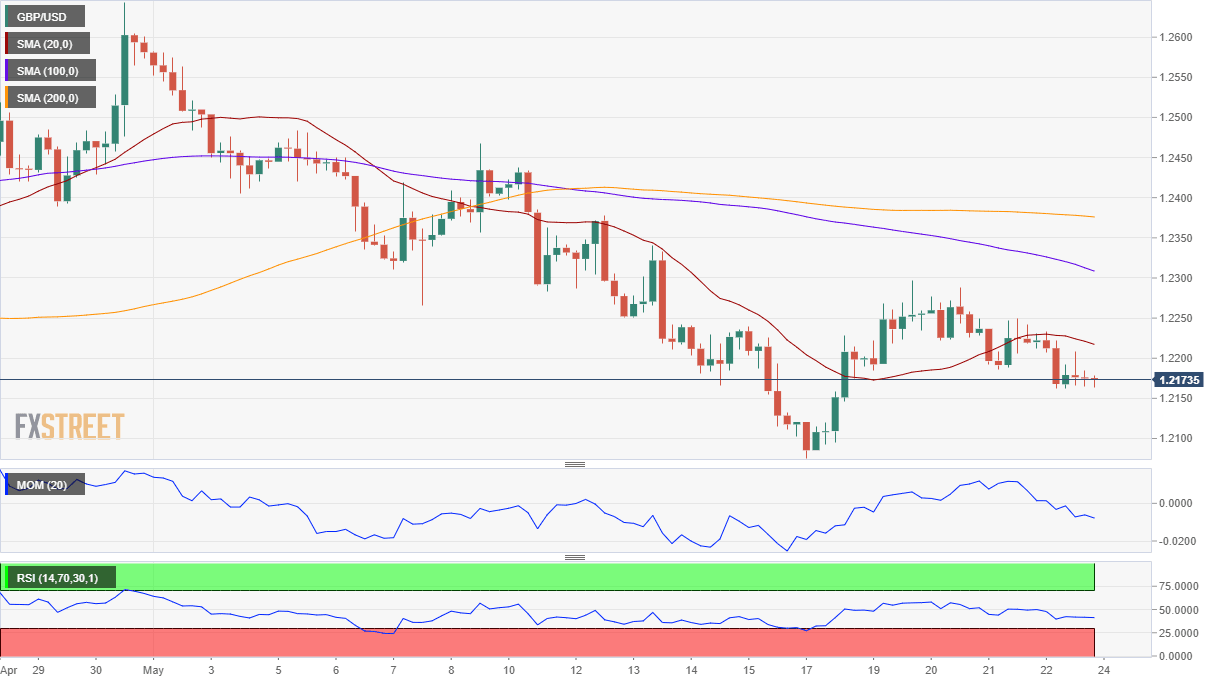

The GBP/USD pair is poised to extend its decline, according to technical readings in the daily chart, as the pair is developing below all of its moving averages, with the 20 SMA turning lower and providing dynamic resistance at around 1.2330. Technical indicators in the mentioned time-frame remain within negative levels, the RSI supporting further declines by heading firmly lower at around 40. In the shorter-term, and according to the 4-hour chart, the technical picture is quite alike, as the pair is developing below bearish 20 SMA, as technical indicators remain well into negative ground, with uneven bearish strength yet no signs of downward exhaustion.

Support levels: 1.2130 1.2085 1.2040

Resistance levels: 1.2205 1.2250 1.2290

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.