GBP/USD Forecast: London lockdown fears, channel loss and other factors point lower

- GBP/USD has been extending its falls from the highs amid coronavirus concerns.

- US-UK trade talks, PMIs, and Brexit are all in play.

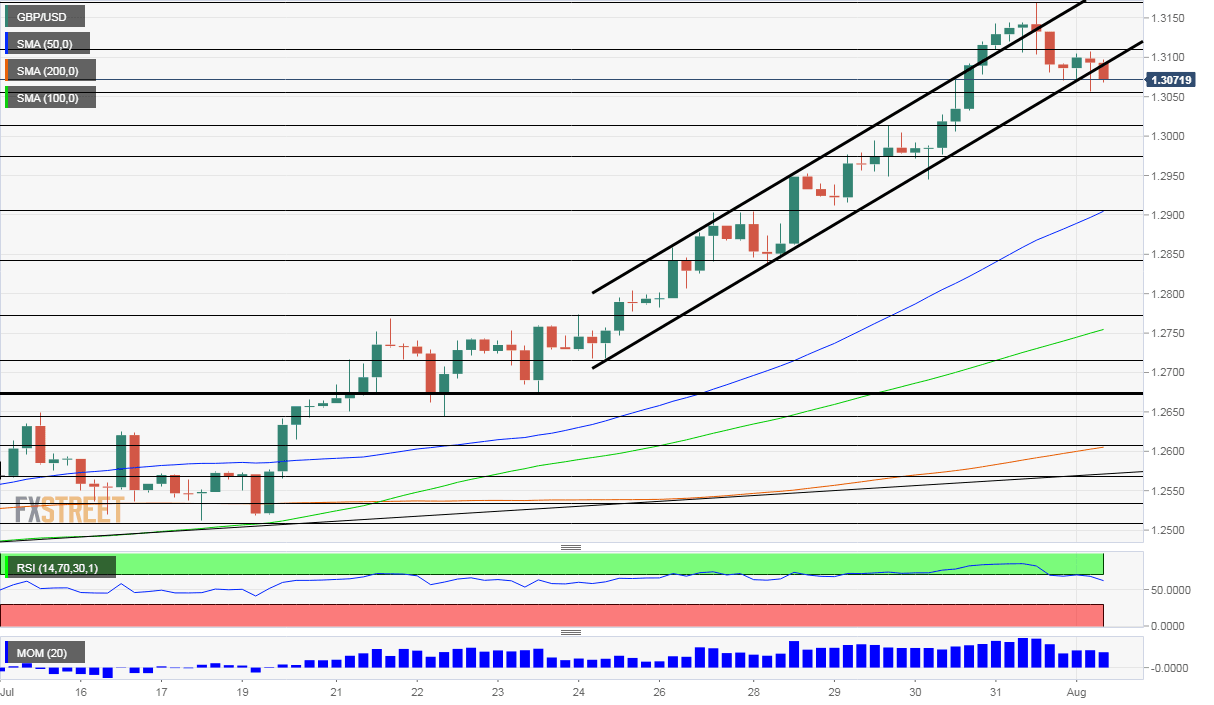

- Monday's four-hour chart is showing a drop below the uptrend channel.

It is only a worst-case scenario – the words of British officials, trying to calm fears of a strict siege on London. Nevertheless, the UK's coronavirus situation seems to be going in the wrong direction – a "major incident" has been declared in Manchester after new restrictions were imposed late last week. Moreover, the government is working on plans to prevent a broad nationwide lockdown – the mere floating of the idea is a negative sign.

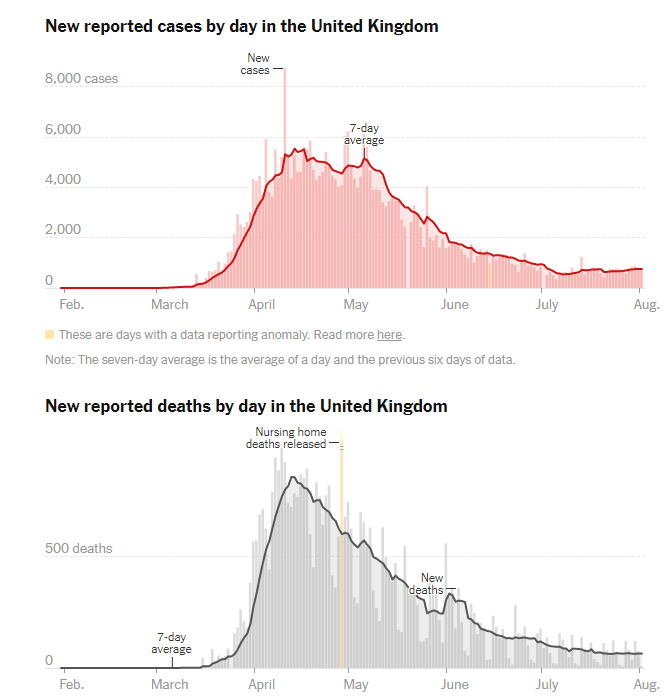

It is essential to stress that while certain areas are seeing an increase, broad UK figures remain under control, at least for now. Nevertheless, Britain was hit hard by COVID-19 – including Prime Minister Boris Johnson's near-death experience – and may, therefore, act more cautiously, even if that weighs on the economy.

Source: New York Times.

Liz Truss, UK Secretary of State for International Trade is in America for talks with US Trade Representative Robert Lighthizer to try to negotiate a post-Brexit trade deal. Despite the "special relationship," negotiations have yet to yield any progress and expectations for an accord before the US elections are low. Further reports of a delay may weigh on the pound while an unlikely breakthrough could boost it.

GBP/USD may benefit from the weakness of the dollar, potentially stemming from disappointing data. The ISM Manufacturing Purchasing Managers' Index is set to remain in growth territory despite the surge in coronavirus cases. The industrial sector suffered less than the services one, but high estimates may lead to disappointment. The publication serves as the first hint toward Friday's Non-Farm Payrolls.

See US Manufacturing PMI July Preview: Confirmation of decline?

Another source of grievance for greenback bulls may come from deadlocked talks in Washington between Republicans and Democrats. Special federal programs, including the all-important unemployment benefits, expired on Friday and without them, consumption could fall. Investors remain optimistic expecting politicians to splash the cash in an election year.

US COVID-19 figures remain high on the agenda as well. While deaths are on the rise, cases are falling – and may extend their decline due to the "weekend effect."

Later in the week, the Bank of England's rate decision and quarterly report are eyed.

See BOE Preview: Three things that will move the pound on “Super Thursday”

Overall, while both the dollar and pound have reasons to struggle, the pound seems more vulnerable.

GBP/USD Technical Analysis

Pound/dollar has dropped out of the uptrend channel that had accompanied it for over a week. Is it a bearish sign? Other indicators remain bullish – the Relative Strength Index on the four-hour chart dropped below 70, exiting overbought conditions, while momentum remains positive.

Support awaits at the daily low of 1.3050, followed by 1.2970, a stepping stone on the way up. The next level to watch is 1.2910, which also held cable down last week and it is where the 50 Simple Moving Average hits the price.

Resistance is at the daily high of 1.3110, followed by the recent peak of 1.3170. The next lines to watch are 1.32 and 1.3270.

More Where next for the dollar, stocks and the US economy after downbeat data and the Fed

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.