The British Pound turned out to be the best performing major currency on Wednesday, assisting the GBP/USD pair to decisively breakthrough the key 1.3000 psychological threshold and climb to its highest level since Nov. 8 amid growing market expectations of an extension of article 50 and receding risk of a no-deal Brexit. Ahead of next week’s vote on the UK PM Theresa May’s Brexit Plan B, a campaign to block no-deal Brexit gathers momentum on reports that the UK Labour Party will back an amendment, aimed at forcing a parliamentary vote on delaying Brexit if a deal isn't passed by Feb. 26.

An extension of Article 50 was seen as increasing chances of parliament to push for a second referendum and continued providing a strong boost to the Sterling. The pair rallied nearly 140-pips intraday to test the very important 200-day SMA for the first time since mid-May 2018 and was further supported by some renewed US Dollar selling pressure. Against the backdrop of unresolved US-China trade dispute, concerns over the US government shutdown and a sharp drop in the US 10-year Treasury bond yield exerted some fresh downward pressure on the greenback and kept pushing the pair higher through the US trading session.

The pair now seems to have entered a bullish consolidation phase and was seen oscillating in a narrow trading band, just south of the 1.3100 handle. There isn't any market-moving economic data due for release, either from the UK or the US, and hence, the incoming Brexit-related headlines might continue to influence sentiment surrounding the British Pound and infuse volatility around the GBP crosses.

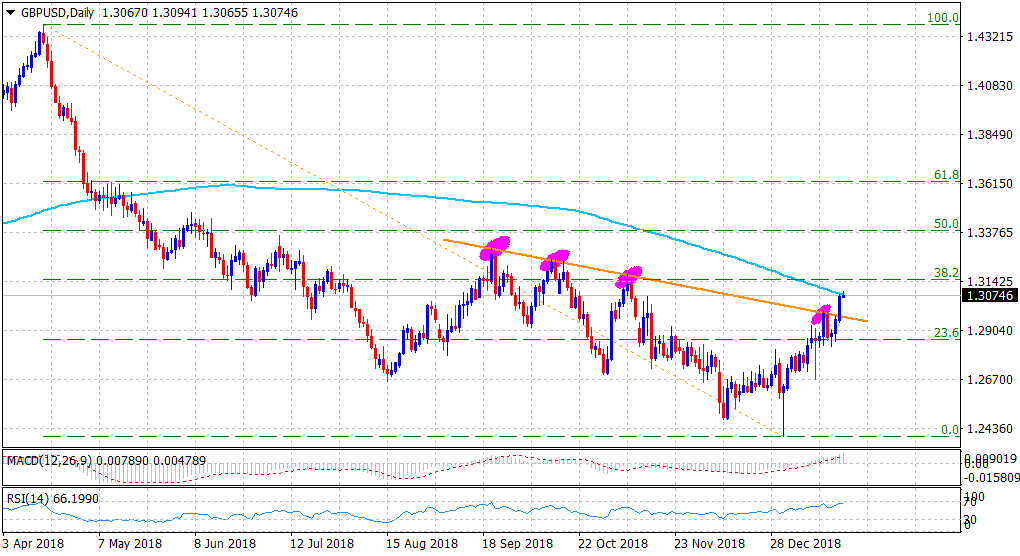

Looking at the technical picture, the overnight upsurge confirmed a near-term bullish breakthrough a four-month-old descending trend-line. A sustained move beyond the 1.3075-80 region (200-DMA) will further reinforce the constructive outlook and lift the pair further beyond the 1.3100 handle, towards a resistance marked by 38.2% Fibonacci retracement level of the 1.4377-1.2396 downfall, around the 1.3145-50 zone.

On the flip side, the 1.3030-25 region, closely followed by the 1.30 handle now seems to protect the immediate downside. Any subsequent slide might now be seen as a buying opportunity and hence, is likely to be limited by the descending trend-line resistance break-point, now turned support, currently near the 1.2960 area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.