- GBP/USD caught some fresh bids and rallied to nearly three-year tops on Thursday.

- The upbeat market mood undermined the safe-haven USD and remained supportive.

- Indications that lockdown in the UK will be extended prompted some selling on Friday.

- Investors now look forward to UK Retail Sales and PMI prints for some trading impetus.

A combination of factors assisted the GBP/USD pair to gain strong positive traction on Thursday and rally to the highest level since May 2018, around mid-1.3700s. The prevalent risk-on environment continued weighing on the safe-haven US dollar, while the British pound benefitted from the rapid vaccination campaign and a gradual decrease in COVID-19 cases in the UK. The global risk sentiment remained well supported the optimism over COVID-19 vaccine rollouts and expectations for a massive US fiscal stimulus, which lifted hopes for a strong economic recovery.

The USD remained depressed and failed to gain any respite following the release of better-than-expected US macro data. In fact, the US Initial Weekly Jobless Claims fell to 900K last week as against 910K expected. Separately, the Philly Fed Manufacturing Index also surpassed consensus estimates and jumped to 26.5 from 9.1 previous. Adding to this, the US housing market data – Building Permits and Housing Starts – also came in better than market expectations, albeit did little to impress the USD bulls or hinder the pair's intraday positive momentum.

Meanwhile, a modest pickup in the US Treasury bond yields extended some support to the greenback. Apart from this, indications that lockdown restrictions will be extended in the UK kept a lid on any further gains for the major, rather prompted some selling during the Asian session on Friday. The pair, for now, seems to have snapped three consecutive days of the winning streak as market participants now look forward to the UK monthly Retail Sales figures for a fresh impetus. The UK economic docket also features the release of the flash PMI prints for January.

The gauge for the manufacturing sector is expected to drop to 54 during the reported month from 57.5 previous. Meanwhile, activity in the crucial services industry is expected to drop further into the contraction territory, which could fuel worries about the UK economic growth at the start of 2021 and prove negative for the British pound. Apart from this, developments surrounding the coronavirus saga will also remain in focus for the GBP traders. This, along with the broader market risk sentiment, might influence the USD price dynamics and produce some trading opportunities.

Short-term technical outlook

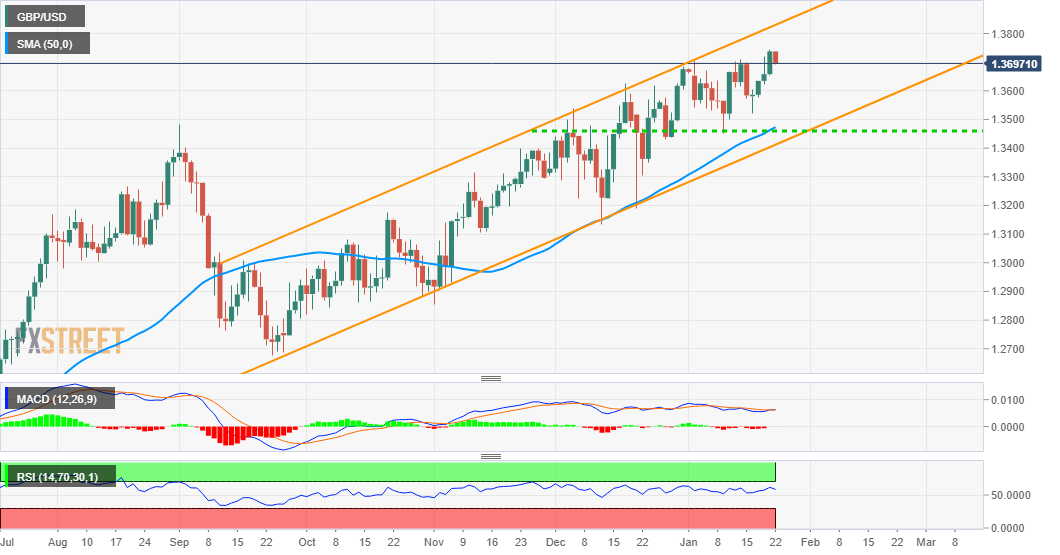

From a technical perspective, the overnight sustained move beyond the 1.3700 mark favours bullish traders and supports prospects for additional gains. The positive outlook is further reinforced by the fact that the recent strong move up over the past four months or so has been along an upwards sloping channel. This points to a well-established near-term bullish trend and hence, any meaningful pullback might still be seen as a buying opportunity.

From current levels, the 1.3665 horizontal level is likely to protect the immediate downside. This is followed by support near the 1.3620 region and the 1.3600 round-figure mark. A sustained break below might prompt some technical selling and turn the pair vulnerable to correct further towards testing the key 1.3500 psychological mark. Any further decline is more likely to find decent support and remain limited near the trend-channel support, currently around mid-1.3400s.

On the flip side, the overnight swing highs, near the 1.3745 region, now seems to act as immediate resistance. Some follow-through buying has the potential to assist bulls to aim to reclaim the 1.3800 round-figure mark. The momentum could get extended further and has the potential to push the pair towards the top boundary of the mentioned channel. The mentioned barrier is pegged near the 1.3835-40 region, which if cleared decisively will be seen as a fresh trigger for bullish traders.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.